Key takeaways:

-

Michael Saylor reworked MicroStrategy from a enterprise intelligence agency into the world’s largest company Bitcoin holder.

-

Saylor’s conviction redefined company technique, turning volatility into alternative by way of long-term, dollar-cost averaging purchases.

-

His strategy set the usual for institutional Bitcoin adoption regardless of considerations over dilution and debt.

-

Saylor’s playbook highlights analysis, perseverance, threat management and long-term considering in Bitcoin investing.

Saylor’s Bitcoin awakening

In August 2020, Michael Saylor reworked from a know-how government into an emblem of company crypto adoption.

Saylor, lengthy often known as the co-founder and head of enterprise-software agency Technique (beforehand MicroStrategy), made his first daring transfer into cryptocurrencies by allocating $250 million of the corporate’s money to buy Bitcoin (BTC).

He cited a weakening greenback and long-term inflation dangers because the underlying causes behind this strategic transfer. By the way, it marked the most important acquisition of Bitcoin by a publicly traded firm at the moment and set a brand new precedent.

Inside months, Technique expanded its holdings: $175 million extra in September, $50 million in December and a $650-million convertible-note issuance, bringing Bitcoin holdings over $1 billion.

He acknowledged Bitcoin as “capital preservation,” evaluating it to “Manhattan in our on-line world,” a scarce, indestructible asset.

The transfer drew each reward and criticism. Skeptics known as it reckless, whereas supporters noticed it as a daring innovation at a time when few dared to place Bitcoin on an organization’s stability sheet. For Saylor, although, it wasn’t of venture. It was a calculated hedge in opposition to financial uncertainty and a sign that digital belongings would reshape capital technique.

Do you know? In 2013, Saylor tweeted that Bitcoin’s days had been numbered, predicting it will “go the best way of on-line playing.” That publish resurfaced in 2020, proper as he pivoted Technique into the largest Bitcoin holder amongst public firms. He has since referred to it because the “most expensive tweet in historical past.”

Saylor’s Bitcoin growth

From that preliminary entry level, Saylor doubled and tripled down on his perception in Bitcoin. He utilized structured finance instruments to scale holdings and form Technique right into a “Bitcoin treasury firm.”

It began throughout the July 2020 earnings calls when Saylor introduced his plan to discover different belongings, resembling Bitcoin and gold, as a substitute of holding money. He put the plan into movement with quarterly Bitcoin buys that quickly scaled holdings to tens of hundreds of cash at a good value foundation.

By early 2021, Saylor had borrowed over $2 billion to increase his Bitcoin place, an aggressive posture powered by conviction, not hypothesis. He articulated a imaginative and prescient of long-term possession by saying that Technique will maintain its Bitcoin funding for at the least 100 years.

Regardless of Bitcoin’s excessive volatility, hovering to $64,000 from $11,000 in 2021 after which plunging to close $16,000 by the tip of 2022, Saylor remained unwavering. In assist of the declare that Bitcoin is the apex of financial construction, his crew used dollar-cost averaging to make the most of value dips to extend holdings.

Saylor’s technique labored: His firm’s inventory surged, usually outperforming Bitcoin itself. By late 2024, Technique’s inventory had gained multiples of S&P 500 returns, and the enterprise turned seen much less as a software program agency and extra as a leveraged crypto proxy.

Saylor’s Bitcoin financing

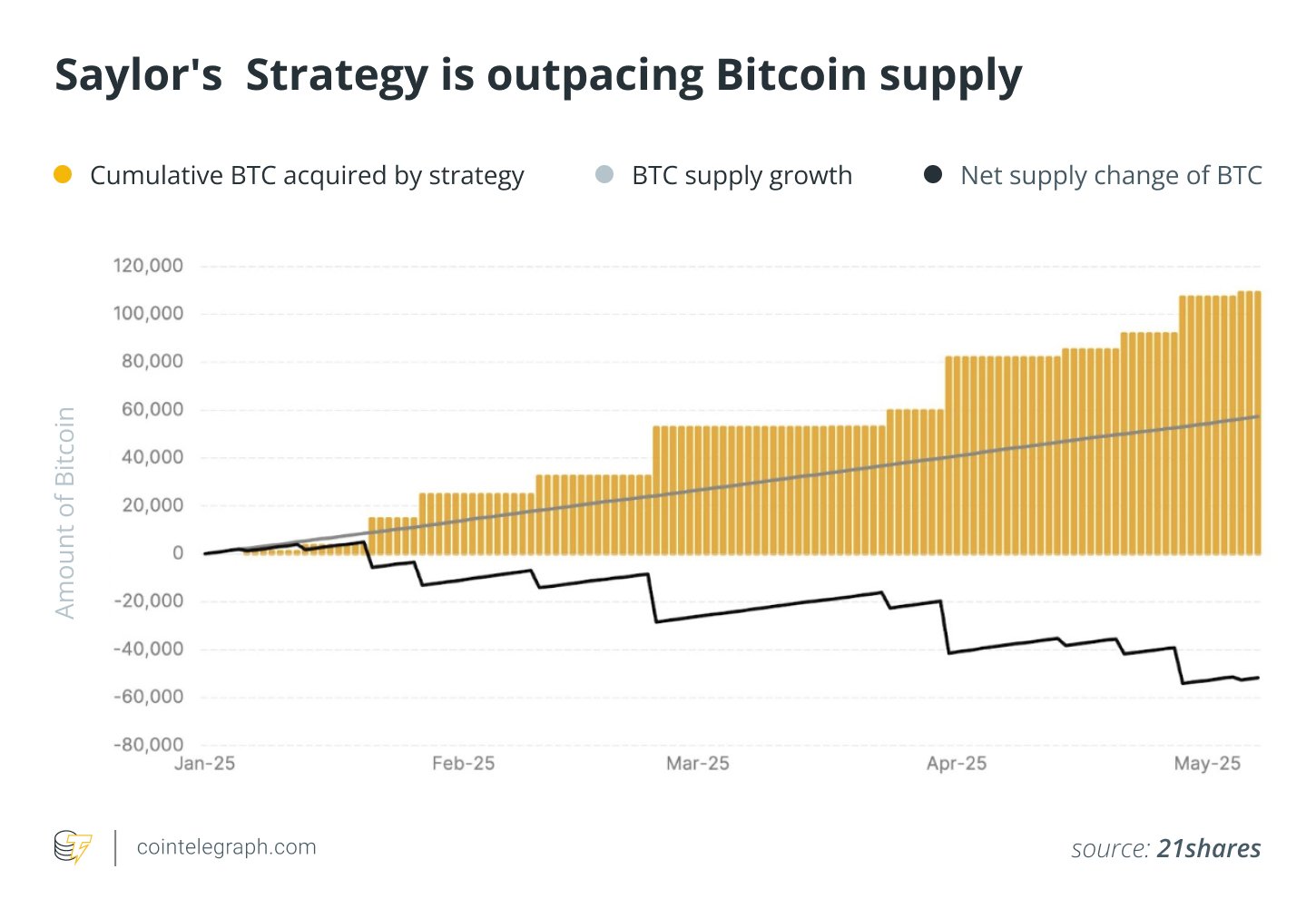

Saylor’s obsession advanced from a daring entry to dominating company demand for Bitcoin, shifting market dynamics by way of sheer scale. By early 2025, Technique held over 2% of Bitcoin’s complete fastened provide, roughly half one million BTC.

Yr-to-date, Technique acquired greater than 150,000 BTC at common costs close to $94,000, placing its holdings’ market worth above $50 billion.

These large allocations exert structural strain on Bitcoin’s finite provide, and companies now compete for scarce cash. Saylor set a benchmark that different companies started to observe. Within the first 5 months of 2025 alone, institutional and company Bitcoin purchases surpassed $25 billion.

This scale shifted Technique’s identification: Software program income was dwarfed by Bitcoin’s influence on valuation. The equity-raising technique, issuing inventory and debt to fund purchases, was scrutinized as a recursion: If Bitcoin fell, debt might pressure the corporate; if inventory was diluted an excessive amount of, investor confidence might wane.

In June 2025, Technique added 10,100 BTC by way of a $1.05-billion buy, having spent almost $42 billion on Bitcoin general. The corporate’s mannequin was now replicable, however not with out rising systemic threat.

Saylor’s transformation from tech CEO to crypto-treasury architect made him a polarizing determine and impressed imitators. His aggressive playbook reframed not simply Technique’s valuation however the broader institutional adoption narrative.

Do you know? Saylor disclosed that previous to changing firm belongings into Bitcoin, he had used his personal funds to purchase 17,732 BTC, which on the time was valued at virtually $175 million. This gave him sufficient conviction to push for Technique’s company allocation.

What’s subsequent for Saylor and Bitcoin?

Saylor has proven no indicators of slowing down. Technique continues to double down on Bitcoin, even financing new purchases by way of convertible debt and different artistic devices. With halving cycles tightening provide and institutional curiosity accelerating, Saylor positions Bitcoin not simply as a retailer of worth however as a company treasury customary.

Wanting forward, the principle questions are whether or not extra companies will observe Technique’s instance, how company adoption can be influenced by regulatory frameworks and whether or not Bitcoin’s perform can be restricted to stability sheets or lengthen to different areas of the monetary system. If Saylor’s idea is right, he won’t solely be often known as a daring CEO but additionally as one of many key gamers who revolutionized enterprise financing in relation to Bitcoin.

What are you able to study from Saylor’s Bitcoin obsession?

Saylor’s journey is exclusive, however there are sensible classes anybody exploring Bitcoin can take from his strategy:

-

Do your analysis earlier than committing: Earlier than investing, Saylor studied the basics of Bitcoin for months. For novices, this implies avoiding hype and starting with respected sources, white papers and competent evaluation.

-

Suppose long run: Saylor has no intention of constructing a fast revenue. For people, this interprets into solely investing what you’ll be able to maintain by way of volatility quite than attempting to time the market.

-

Threat administration issues: Technique took a hazardous however audacious step by borrowing cash to buy Bitcoin. Retail buyers should train higher warning, chorus from taking over extreme debt and preserve cryptocurrency as a portion of a bigger portfolio.

-

Have conviction, however keep versatile: All through the years, Saylor methodically deliberate his purchases, however he additionally doubled down on Bitcoin even throughout downturns. For inexperienced persons, dollar-cost averaging could change into a helpful technique.

-

Separate private perception from firm technique: Not everybody has a company to again Bitcoin bets. Saylor blended private holdings and Technique’s treasury. For people, it’s higher to obviously separate private financial savings from speculative investments.

Even when you don’t have Saylor’s fortune, you’ll be able to nonetheless use a few of his methods to raised navigate Bitcoin, resembling doing your personal analysis and being affected person and disciplined.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.