Bitcoin treasury corporations are in vogue, and Africa has its first buying and selling on the Johannesburg Inventory Trade. Whereas the launch of Africa Bitcoin Company guarantees to draw billions of South African rand from capital markets, its founders imagine Bitcoin’s influence on the continent stays in grassroots, retail adoption.

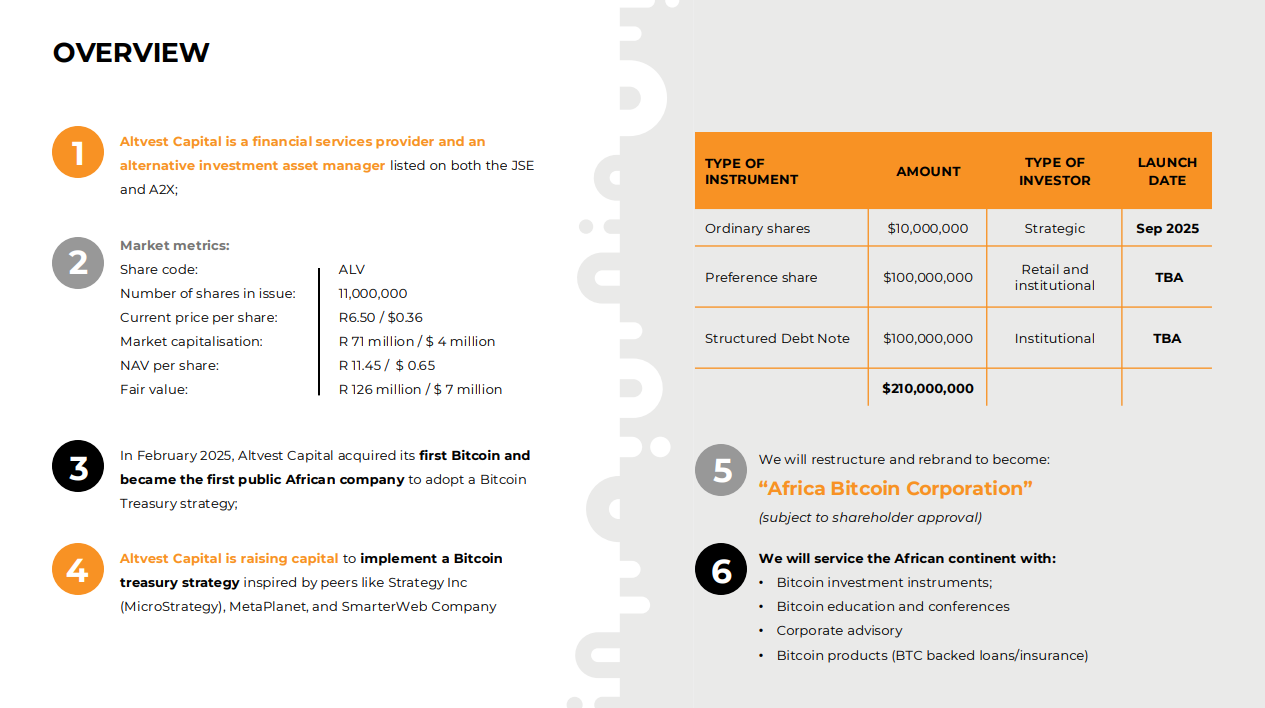

South Africa’s Altvest Capital grabbed headlines because it rebranded to Africa Bitcoin Company (ABC), the primary publicly-listed firm actively constructing a Bitcoin (BTC)-based treasury on the continent.

The corporate has a long-term purpose to boost $210 million to purchase Bitcoin utilizing preferential share choices and structured debt notes within the mould of the UK’s Smarter Net Firm. Altvest introduced its pivot into Bitcoin in February.

Talking completely on Cointelegraph’s Chain Response reside X broadcast, ABC’s chairman Stafford Masie and CEO Warren Wheatley unpacked the main points behind the inception of the corporate.

“In Africa, when monetary companies do not work, individuals die. We reside that actuality. So after we strategy Bitcoin, we strategy Bitcoin from an actual human necessity, life-saving perspective.”@staffordmasie outlined why Bitcoin is so highly effective for international locations grappling with… pic.twitter.com/E24Pek9DnU

— Gareth Jenkinson (@gazza_jenks) September 10, 2025

The listed monetary service enterprise traditionally targeted on serving to entrepreneurs and small companies entry capital by the JSE utilizing listed devices. Wheatley stated they aimed to sort out the “dysfunction” that exists in international capital markets, the place smaller gamers don’t have the identical means to draw funding or entry capital markets.

Associated: Metaplanet, Smarter Net add nearly $100M in Bitcoin to treasuries

How does Bitcoin match into that image? Wheatley stated it’s a “pure evolution,” describing Bitcoin because the “final different asset” that may impress the corporate’s steadiness sheet.

Masie added that holding Bitcoin would permit ABC to proceed investing and help small enterprises in South Africa to boost capital and construct their companies. This could entail providing Bitcoin-backed monetary companies, together with credit score, financial savings and structured merchandise.

“Within the context of all these Bitcoin corporations, we’re not a pure play. We have now an working enterprise that’s obtained immense alternatives. I feel this Bitcoin play provides it extra muscle relative to that,” Masie stated.

Bitcoin’s worth proposition solves African issues

The underlying precept for adopting a Bitcoin treasury reserve is immediately tied to the fact going through many growing international locations — devaluing native currencies and inflationary considerations.

Masie stated that Bitcoin holders in Europe, America and the Center East largely view BTC as a substitute funding asset. In distinction, Bitcoin is vastly beneficial as a medium of alternate and retailer of worth in growing international locations.

“In Africa, when monetary companies don’t work, individuals die. We reside that actuality. That’s who we’re. So after we strategy Bitcoin, we strategy Bitcoin from an actual, human necessity, life-saving perspective,” Masie stated.

“Debasement may be very actual for us. Individuals die due to that.”

From a South African perspective, political uncertainty, fraud and corruption are challenges that companies and people face day by day. As Masie defined, the rising prices of day by day requirements like meals, water and electrical energy are extra a symptom of financial dysfunction than political dysfunction.

“The cash is damaged, not the society. Your groceries usually are not getting costlier; the cash is getting weaker,” Masie stated.

Associated: UK Bitcoin treasury firm Smarter Net eyes acquisitions, FTSE 100

For ABC, the Bitcoin treasury play isn’t “simply a possibility from a pure monetary instrumentation perspective,” it’s a human story.

“If we are able to get this proper, we are able to remedy so many issues which can be very inherent to Bitcoin’s worth proposition. That’s why we are saying Bitcoin was made for us.”

Masie added that whereas Bitcoin permits people to protect financial worth much better than South Africa’s struggling Rand, the creation of the continent’s first publicly-listed Bitcoin treasury firm presents an enormous alternative for capital markets to achieve publicity to BTC.

“We wish to serve the person that just isn’t a cypherpunk, right through to the companies and stuck revenue markets wanting publicity to the asset class however struggling to get publicity to it.”

ABC introduced part 1 of its Bitcoin strategic reserve, elevating 11 million rand ($633,000) to this point. The corporate’s prospectus notes that its first part goals to boost $11 million in whole.

Journal: Bitcoin to see ‘another massive thrust’ to $150K, ETH stress builds: Commerce Secrets and techniques