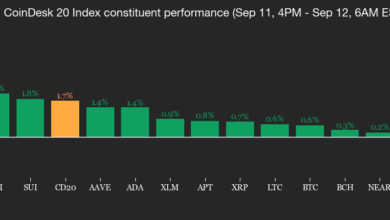

Key factors:

-

Bitcoin “shark” wallets have began shopping for the dip, including 65,000 BTC to their holdings in simply seven days.

-

Brief-term holders additionally cross a milestone, with the revenue ratio of cash shifting onchain flipping optimistic.

-

Lengthy-term holders have but to return to web accumulation.

Bitcoin (BTC) “conviction-driven” holders have purchased 65,000 BTC in simply seven days as value bounces from two-month lows.

New analysis from onchain analytics platform CryptoQuant launched Thursday reveals Bitcoin “sharks” shopping for the dip.

Bitcoin’s massive gamers rethink distribution

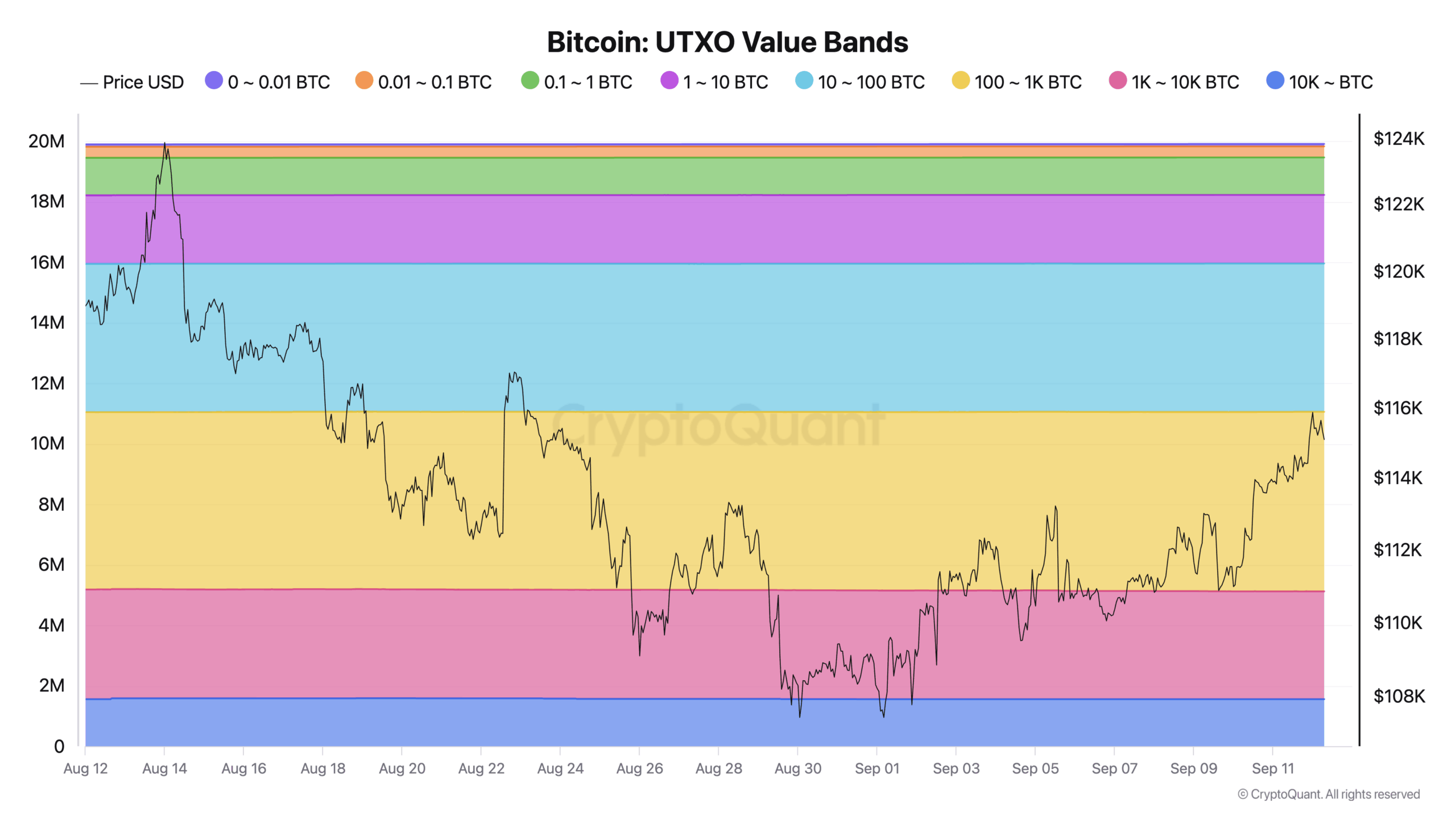

Bitcoin wallets with a steadiness between 100 BTC and 1,000 BTC have wasted no time bagging cash at decrease costs.

CryptoQuant information reveals that in a single week, these “sharks” added 65,000 BTC of web market publicity.

“Bitcoin’s current market motion highlights a pointy divide between short-term merchants and bigger, conviction-driven consumers. Addresses holding 100–1,000 BTC—often called ‘sharks’—have added 65,000 BTC in simply seven days, lifting their complete to a document 3.65 million BTC,” contributor XWIN Analysis Japan wrote in one among its Quicktake weblog posts.

“This shopping for has emerged at the same time as spot costs hovered close to $112,000, suggesting a rising disconnect between retail-driven volatility and deeper structural demand.”

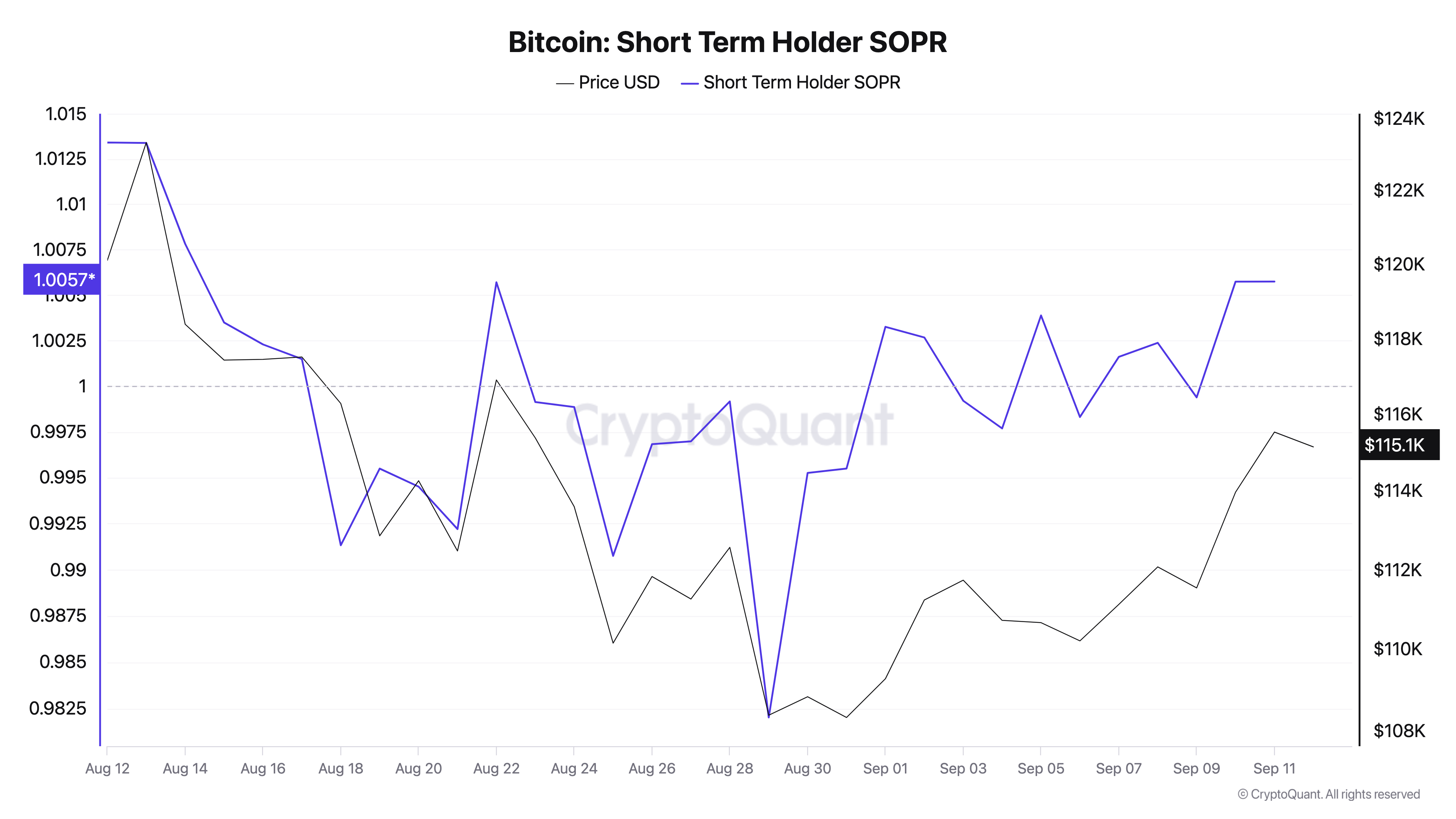

XWIN referred to knee-jerk reactions to BTC value volatility from the Bitcoin speculative dealer base, or short-term holders (STHs) — wallets hodling for six months or much less.

CryptoQuant information reveals the spent output revenue ratio (SOPR) of those traders solely simply starting to flip optimistic on Friday, after an almost month-long interval through which STH cash had been shifting onchain at a loss.

Predicting the subsequent “sturdy leg up” for BTC

XWIN noticed declining trade balances as proof of purchaser demand at present costs.

Associated: Bitcoin value can hit $160K in October as MACD golden cross returns

“Internet outflows—BTC withdrawn from exchanges—have dominated lately, signaling that traders are shifting cash into chilly storage somewhat than protecting them liquid for buying and selling,” it wrote.

Whereas extra BTC value corrections “stay potential” sooner or later, the market construction thus seems sturdy.

“Beneath floor volatility, the groundwork for Bitcoin’s subsequent sturdy leg upward seems to be forming,” XWIN concluded.

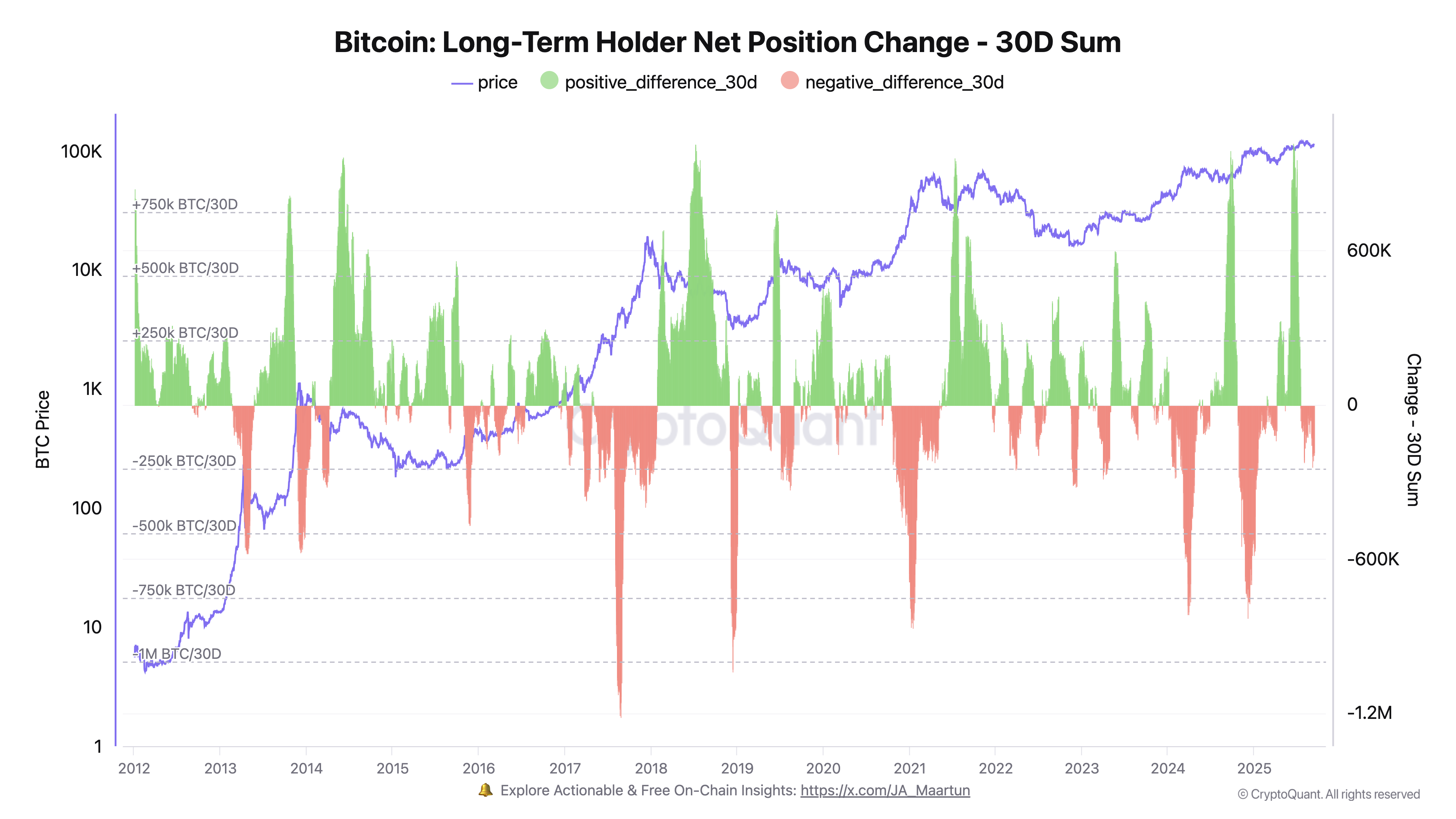

The scenario amongst some BTC investor cohorts is nonetheless precarious. As Cointelegraph reported, whales and long-term holders echoed the 2022 bear market with their promoting habits by August.

CryptoQuant reveals that LTH pockets balances have but to recuperate, with the rolling 30-day steadiness change nonetheless being destructive.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.