Costs Prime 50-Day SMA, Greenback Index Regular, and Restricted Draw back for 10-12 months Treasury Yields

This can be a day by day evaluation by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin continues to realize floor, according to the inverse head-and-shoulders breakout from early this week, which opened the door for a rally to $120,000.

Costs have crossed above the 50-day easy transferring common (SMA), a widely-tracked momentum indicator. Moreover, the guppy a number of transferring common (GMMA) indicator is teasing a renewed bull cross. Taken collectively, these two developments could draw momentum chasers to the market, accelerating the worth rise.

That stated, there are no less than three causes to proceed being cautious. Let’s check out these individually.

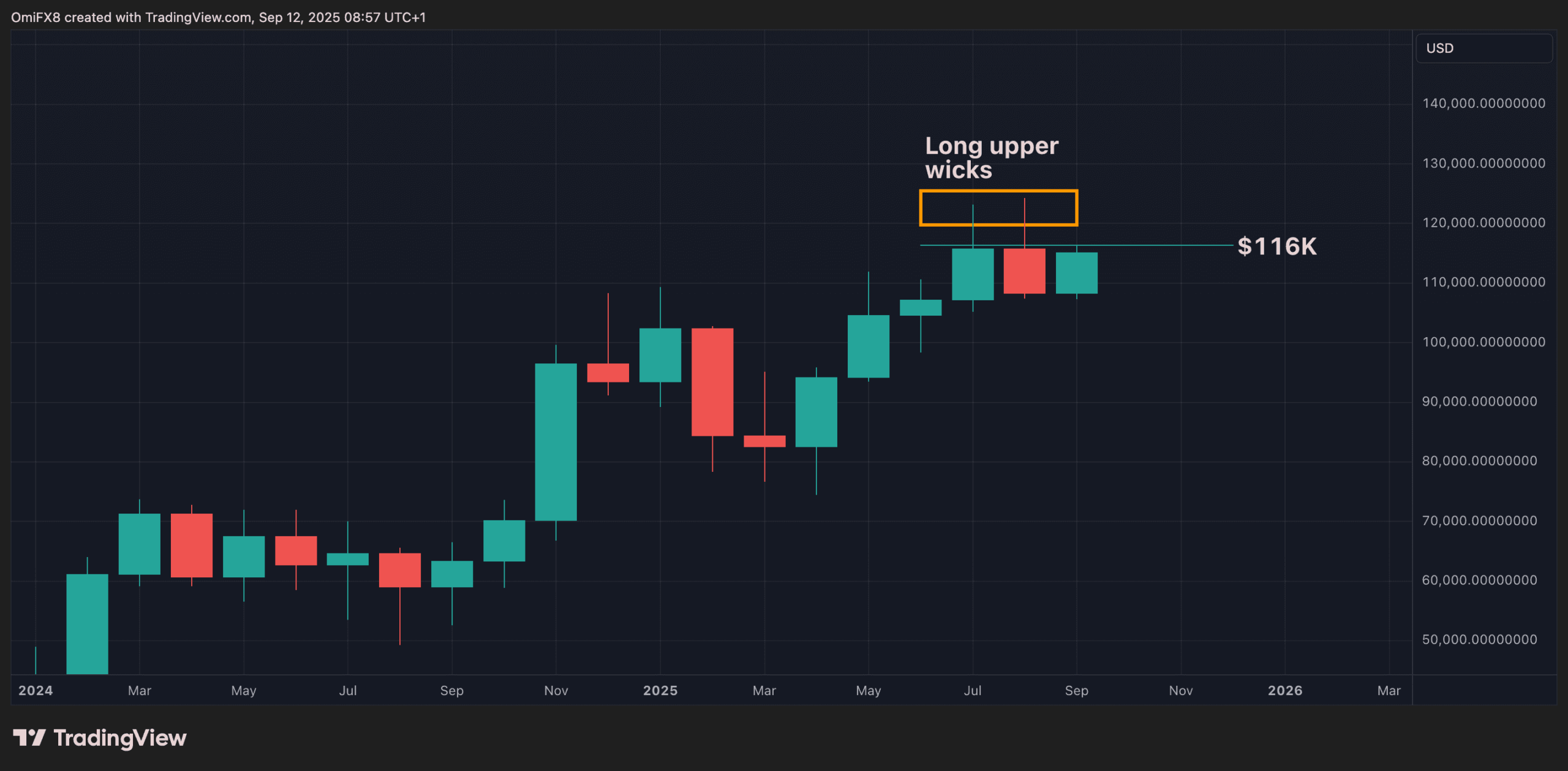

BTC nearing bull fatigue zone

BTC is closing on the bull fatigue zone above $115,000.

Whereas previous patterns don’t assure future outcomes, it’s notable that since July, bitcoin’s bull momentum has constantly weakened above the $115,000 degree, as mirrored by the lengthy higher wicks on the final two month-to-month candles.

These lengthy wicks point out that though bulls pushed costs to new file highs above $124,000, robust promoting stress pressured the worth again under $115,000, signaling a key resistance degree and potential hesitation amongst patrons.

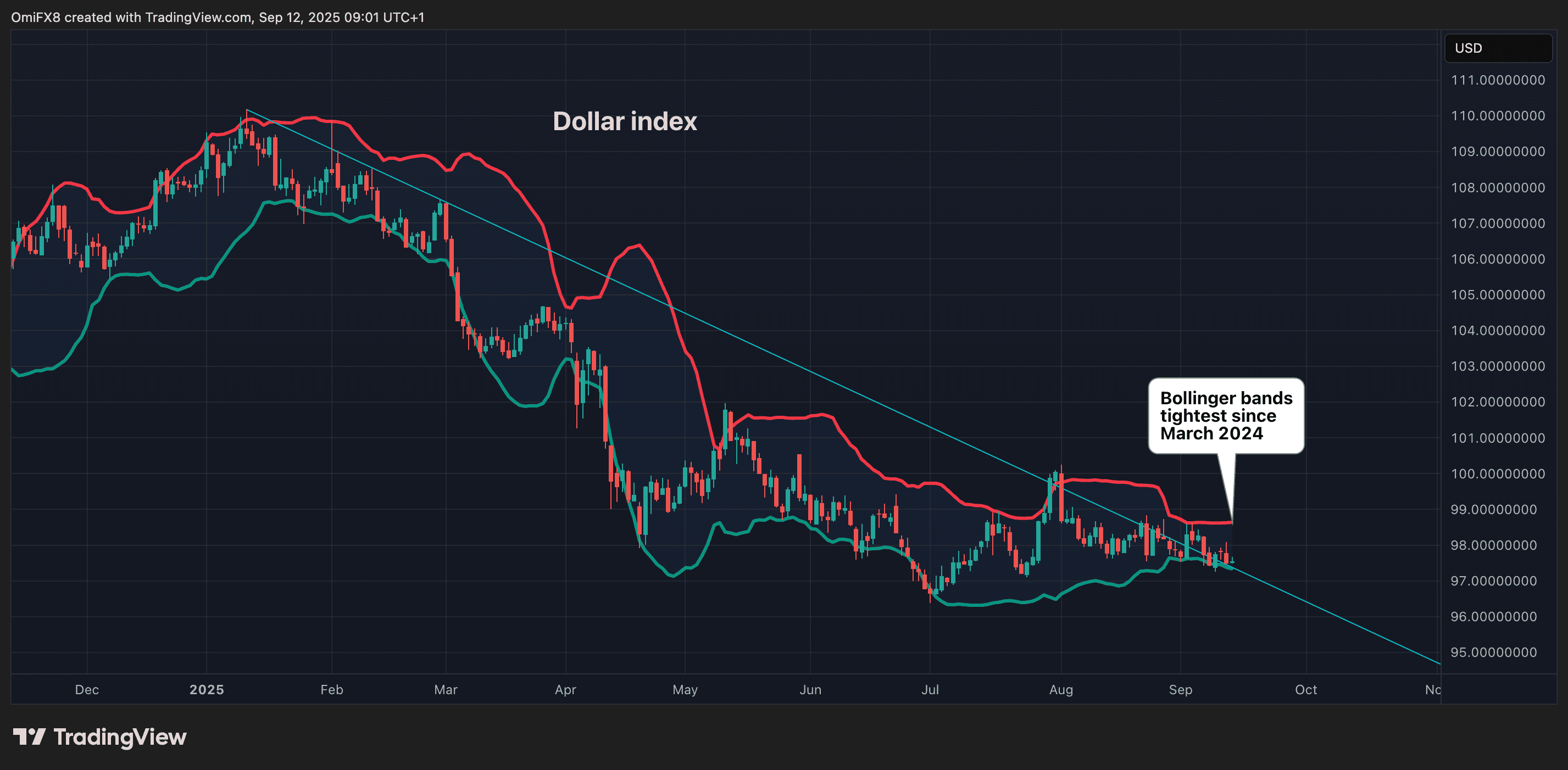

Has the greenback index priced Fed charge cuts?

With the U.S. labor market weakening at a speedy tempo, futures merchants have priced in 70 foundation factors (bps) of charge cuts by Dec. 31. That is nearly three 25-basis-point charge cuts, ranging from Sept. 17. Additional, merchants have priced in a complete of 125 bps of easing by July 2026, which might take the benchmark rate of interest down to three% to three.25% vary from the current 4.25-4.50 vary.

Market members seem assured that the central financial institution will look previous the sticky inflation, as highlighted by Thursday’s client worth index, and lower charges to help the labour market and financial development. These dovish expectations starkly distinction with these of the Fed’s friends, such because the European Central Financial institution (ECB), which seem to have moved on from charge cuts. In different phrases, the speed differential favors USD weak point.

But, the greenback index, which gauges the buck’s worth in opposition to main fiat currencies, continues to hover within the latest vary of 97.00 to 98.00. The index has dropped simply 0.20% to 97.55 this week regardless of the sharp rise within the Fed charge lower pricing.

This raises the query: Has the greenback already priced within the Fed charge cuts? In that case, it might get well from right here, capping beneficial properties within the dollar-denominated belongings like BTC and gold.

The chart exhibits that the greenback sell-off has run out of steam because the index hit a low of 96.37 on July 1.

As of writing, the Bollinger bands, or volatility bands positioned two commonplace deviations above and under the index’s 20-day SMA, had been at their tightest since March 2024. The so-called squeeze means a giant transfer in both course might occur quickly. A bullish one could not bode nicely for BTC.

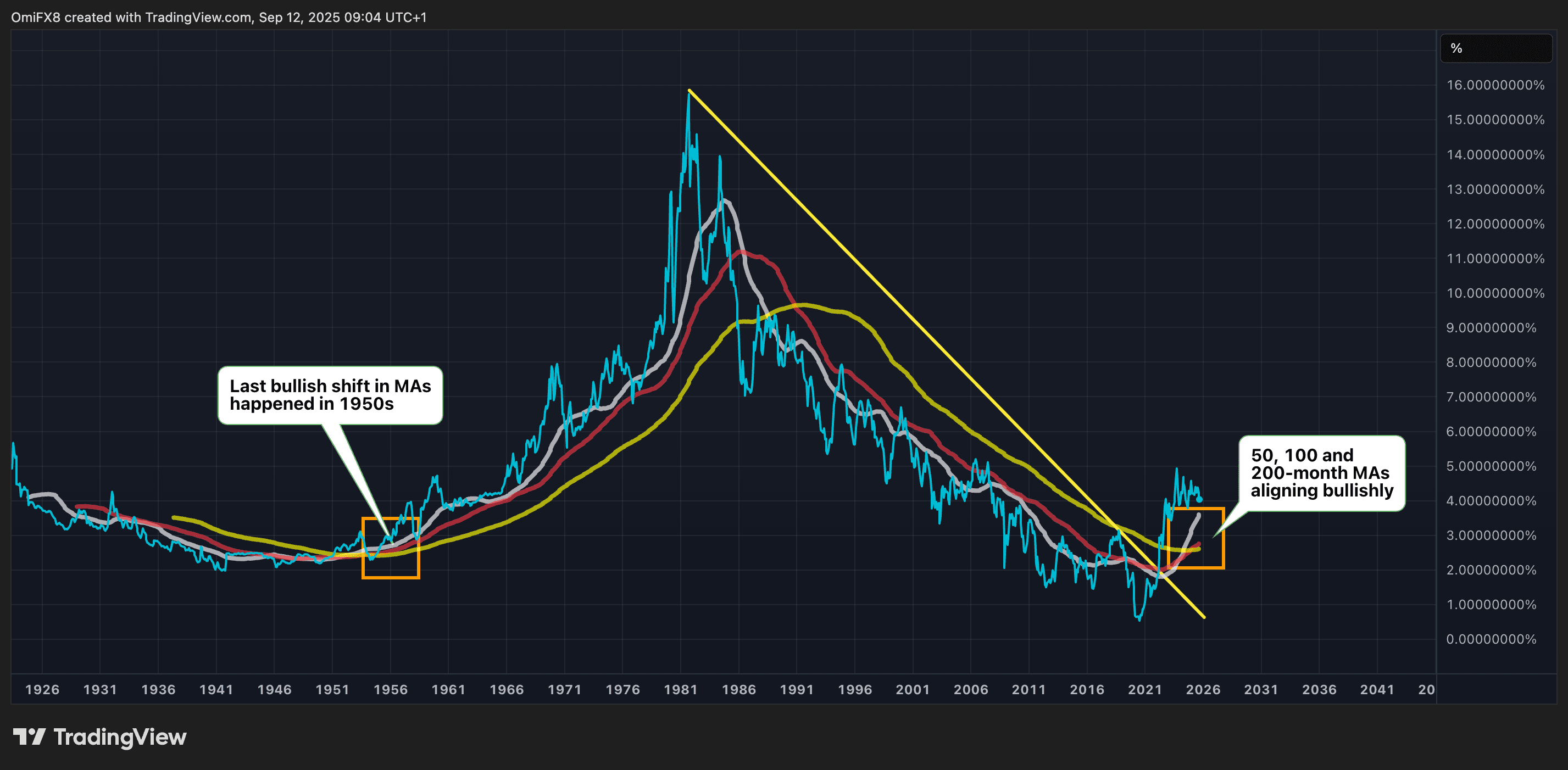

Generational bullish shift in 10-year yield

Expectations of speedy Fed charge cuts have fueled anticipation of a pointy decline within the benchmark 10-year Treasury yield, which influences borrowing prices for customers, companies, and governments alike. Therefore, a slide within the 10-year yield would seemingly result in higher risk-taking throughout each the financial system and monetary markets.

Nevertheless, longer-term month-to-month charts point out a generational bullish shift in momentum for yields, suggesting that the draw back might be restricted. So, the anticipated flood of cash into riskier belongings pushed by expectations of ultra-low charges could not materialize. In different phrases, ultra-low rates of interest are unlikely to return anytime quickly, which ought to preserve fixed-income devices enticing to buyers.

The ten-year yield has surged within the aftermath of the coronavirus pandemic, ending a four-decade-long downtrend that started in 1981.

Moreover, the 50, 100-, and 200-month MAs have realigned bullishly one above the opposite. Such a bullish configuration final occurred within the Fifties, marking the onset of a three-decade rally within the benchmark yield.

The identical factor could be stated for the two-year yield, which tends to be extra delicate to rate of interest expectations.

Learn extra: Crypto Pundits Retain Bullish Bitcoin Outlook as Fed Charge Lower Hopes Conflict With Stagflation Fears