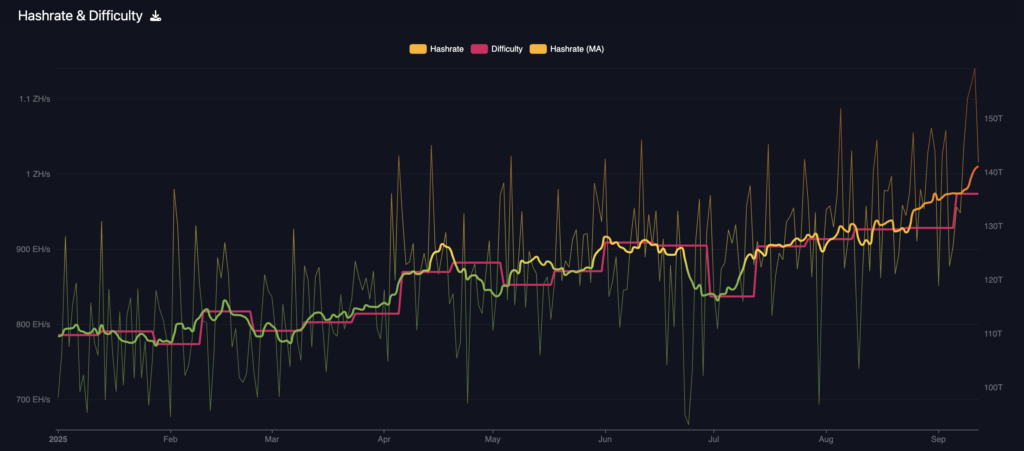

Bitcoin community problem reached 136.04 trillion on Sept. 4, whereas greenback hashprice slipped to about $52 per petahash per day this week. Per Hashrate Index, the final adjustment set a brand new excessive for problem, and the ahead market now costs a mean hashprice close to $49.17 per PH per day for the following six months.

The squeeze leaves miners deciding whether or not to promote inventories, consolidate operations, or pursue high-performance computing income tied to synthetic intelligence.

The manufacturing backdrop is agency. The seven-day common hashrate sits close to one zettahash per second, whereas transaction charges contribute just a little over 1% of block rewards on latest averages.

That blend compresses gross margins on the similar time retail energy costs and wholesale information middle rents pattern larger. International colocation pricing averaged $217.30 per kilowatt per thirty days within the first quarter, with tight provide in main hubs, per CBRE’s International Knowledge Middle Tendencies 2025.

Strategic optionality is widening as compute demand reorders the ability stack.

CoreWeave agreed to accumulate Core Scientific earlier this 12 months in an all-stock transaction that suggests roughly $9 billion of fairness worth. The acquisition would consolidate about 1.3 gigawatts of put in capability with extra enlargement potential.

In its deal supplies, the client outlined lease effectivity beneficial properties and working synergies by 2027, whereas the transaction is a part of the broader AI buildout competing for grid entry throughout North America. The route of journey is evident: AI workloads at the moment are a core various for energy and land that beforehand skewed towards proof of labor.

Public market signaling has additionally shifted with the debut of American Bitcoin Corp. The corporate started buying and selling on Nasdaq as ABTC after finishing a merger with Gryphon Digital Mining. Company filings element a managed construction after the mix, with former American Bitcoin holders proudly owning about 98% of the mixed firm on a totally diluted foundation.

The mannequin emphasizes accumulation alongside self-mining, creating one other lever for treasury methods that will dampen or amplify market gross sales relying on spreads between mining value, spot value, and financing phrases.

Energy constraints and coverage proceed to set near-term provide conduct.

In Texas, miners generally curtail in the course of the 4 Coincident Peak season to handle prices and seize credit, a sample mirrored in Riot Platforms’ June working replace. Curtailments can carry hashprice quickly and shift income timing, however in addition they illustrate why ahead hedging has turn into normal. Luxor’s market reveals an actively traded curve with mid-market quotes revealed on the Hashrate Ahead Curve.

In opposition to this backdrop, break-even math is easy however unforgiving. Utilizing consultant effectivity bands and present economics, the ranges beneath illustrate approximate breakeven energy costs, expressed in cents per kilowatt hour, at a $53 per PH per day hashprice and nominal pool charges.

The inputs reference revealed specs for the Antminer S21 and WhatsMiner M60S, together with incremental firmware beneficial properties evidenced by LuxOS testing.

| Effectivity band, J/TH | Instance {hardware} | Illustrative breakeven energy, c/kWh |

|---|---|---|

| ~17.5 | S21 class, inventory | ~7.0–7.5 |

| ~18.5 | M60S class, inventory | ~6.5–7.0 |

| ~15–16 | S21 with tuned firmware | ~8.0–8.5 |

These thresholds suggest that fleets paying above single-digit energy charges will really feel stress if hashprice tracks the ahead common. That pushes treasurers towards hedges on the hashrate curve, deeper curtailment throughout high-priced hours, and non-mining income.

The final class contains AI colocation and managed GPU companies, the place contracted rents are quoted per megawatt per 12 months and infrequently load follows compute.

5 Days to Smarter Crypto Strikes

Learn the way professionals keep away from bagholding, spot insider front-runs, and seize alpha — earlier than it is too late.

Delivered to you by CryptoSlate

Current contracts body the income step change.

TeraWulf disclosed greater than $3.7 billion of anticipated internet hosting income underneath multi-year agreements, with public reporting estimating an annualized take charge close to $1.85 million per megawatt on the preliminary tranche.

The comparability beneath makes use of these public figures and CBRE’s lease benchmarks to indicate the order of magnitude hole between mature AI colocation and present mining money era per energy unit at prevailing hashprice.

| Use of 1 MW | Consultant annual income | Notes |

|---|---|---|

| AI colocation | ~$1.5M–$2.0M per MW | Based mostly on introduced offers and protection in monetary media |

| Bitcoin mining | ~$0.9M–$1.3M per MW | Derived from $52 per PH per day hashprice and sub-19 J/TH fleets on present averages |

The delta doesn’t mechanically imply each miner ought to pivot.

Retrofits require capex, liquid cooling, and higher-density racks, which may saturate present transformers, and contractual take-or-pay obligations can restrict near-term flexibility.

Nonetheless, the mix of tight colocation provide and introduced consolidation, corresponding to CoreWeave’s deal, will seemingly preserve AI rents agency by means of year-end, which components into treasury decisions each time bitcoin’s payment share stays low.

Miners capable of monetize demand response applications, just like the ERCOT 4CP framework, and tune fleets with effectivity firmware can widen their breakeven bands with out promoting cash.

Case research illustrate the selection set. Iris Vitality continues to increase GPU capability and cloud income alongside self-mining, utilizing a twin monitor that stabilizes money flows in opposition to hashprice volatility.

American Bitcoin presents a treasury-led method combining on-balance sheet accumulation with mining, with management particulars and share counts within the SEC submitting. These paths sit alongside pure play internet hosting that captures AI demand and infrastructure premiums.

The near-term market query is whether or not stability sheets turn into a provide supply by year-end. If hashprice follows the ahead curve and charges stay close to present prints, miners above the single-digit value bands usually tend to elevate money by promoting cash or locking in ahead gross sales of hashrate.

If AI colocation ramps up on beforehand introduced contracts, a few of that promoting could possibly be offset by compute reallocation and hedges already layered in at summer time premiums.

The stability of these forces will decide how a lot miner provide reaches exchanges in the course of the fourth quarter.