Bitcoin bull market indicators have turned predominantly bearish regardless of Bitcoin registering a slight restoration on Friday to $116,000, in accordance with CryptoQuant.

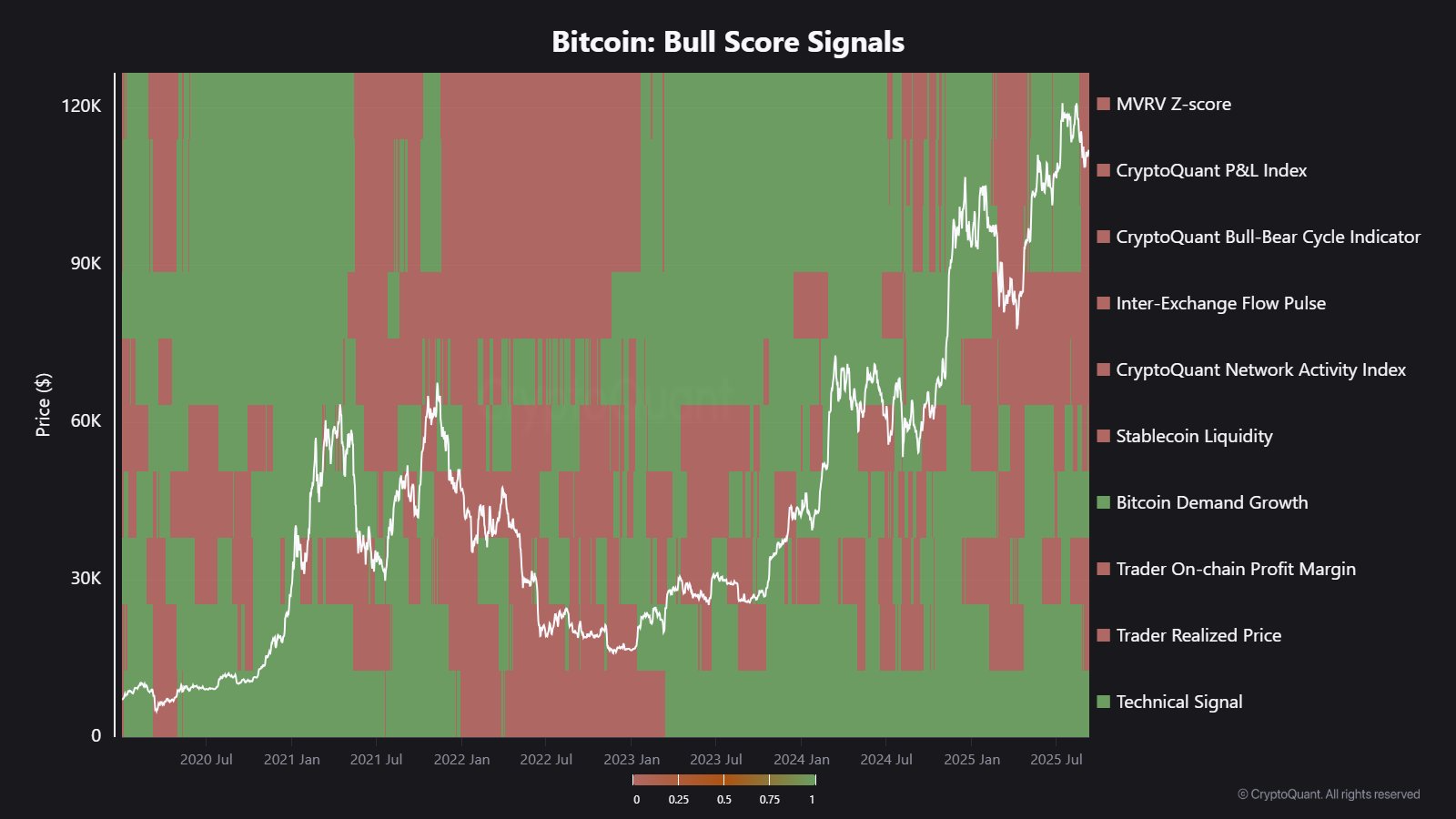

Eight out of ten of the CryptoQuant Bull Rating Index indicators are flashing bearish for Bitcoin, and “Momentum is clearly cooling,” CryptoQuant analyst JA Maartun stated on Thursday.

The blockchain analytics platform’s bull rating indicators are made up of ten indicators, and solely two of them are nonetheless bullish: “Bitcoin demand development” and “Technical sign.”

Bitcoin demand development is a measure of how a lot demand there may be available in the market for the asset, and it has been bullish since July, whereas the “technical sign” seems to trace frequent technical evaluation indicators and metrics.

Nevertheless, the remaining — MVRV-Z rating, revenue and loss index, bull bear cycle indicator, inter alternate move pulse, community exercise index, stablecoin liquidity, dealer onchain revenue margin and dealer realized worth — are all within the crimson.

The MVRV-Z rating is the market worth to realized worth, which measures the ratio of BTC worth in comparison with its realized worth. Revenue and loss indexes present how a lot of the provision is in revenue, cycle indicators present present sentiment, and alternate move pulse signifies how a lot of the asset is being moved to and from exchanges.

The final time eight out of ten indicators had been bearish was in April when Bitcoin (BTC) tanked to $75,000. In July, eight out of ten of these indicators had been within the inexperienced when BTC hit its first peak this 12 months of $122,800.

Bull market peak not right here but

CryptoQuant’s total Bull Rating Index — which measures all the above indicators mixed — has been oscillating between 20 and 30 this month because the correction continues.

The CoinGlass Crypto Bitcoin Bull Run Index (CBBI), which analyzes 9 metrics to establish what stage the bull market is at, is at present registering 74, nearly three-quarters into the bull market.

Nevertheless, solely one of many 30 CoinGlass bull market peak indicators has flashed up, and that’s the altcoin season index.

Associated: Altseason index hits highest degree this 12 months: Right here’s what merchants assume

Bitcoin lagging altcoins, shares and gold

Crypto costs treaded water a lot this week, “however with BTC lagging noticeably each vs its peer group in addition to vs equities and spot gold,” Augustine Fan, head of insights at crypto buying and selling software program service supplier SignalPlus, informed Cointelegraph.

She added that web shopping for momentum has slowed with digital asset treasury shopping for falling off considerably, in addition to centralized exchanges reporting low ranges of recent capital on-ramping, “with traders preferring to remain throughout the fairness proxies.”

“The short-term image appears to be like a bit more difficult, and we might favor a extra defensive stance in keeping with the powerful seasonal story with threat property on the whole.”

Nevertheless, some put it right down to the broadly anticipated September correction and predicted an prolonged bull market.

“World Liquidity has recovered and is trying to hit a brand new excessive,” noticed crypto podcaster Tony Edward, who added, “Seems like this bull market cycle is extending and we might probably see an area high in This autumn and blowoff high in Q1 2026.”

BTC reclaims $116,000

Bitcoin has made a transfer throughout early buying and selling on Friday, topping $116,000 for the primary time in three weeks following a 1.5% every day achieve.

The asset is now simply 6.8% away from its all-time excessive, and the correction to this point has been a lot shallower than in earlier cycles.

Journal: Thailand’s ‘Large Secret’ crypto hack, Chinese language developer’s RWA tokens: Asia Specific