BlackRock, the world’s largest asset supervisor, is reportedly exploring methods to tokenize exchange-traded funds (ETFs) on the blockchain, following the sturdy efficiency of its spot Bitcoin ETFs.

Citing sources accustomed to the discussions, Bloomberg reported Thursday that the corporate is contemplating tokenizing funds with publicity to real-world belongings (RWA). Any such transfer, nonetheless, would want to navigate regulatory hurdles.

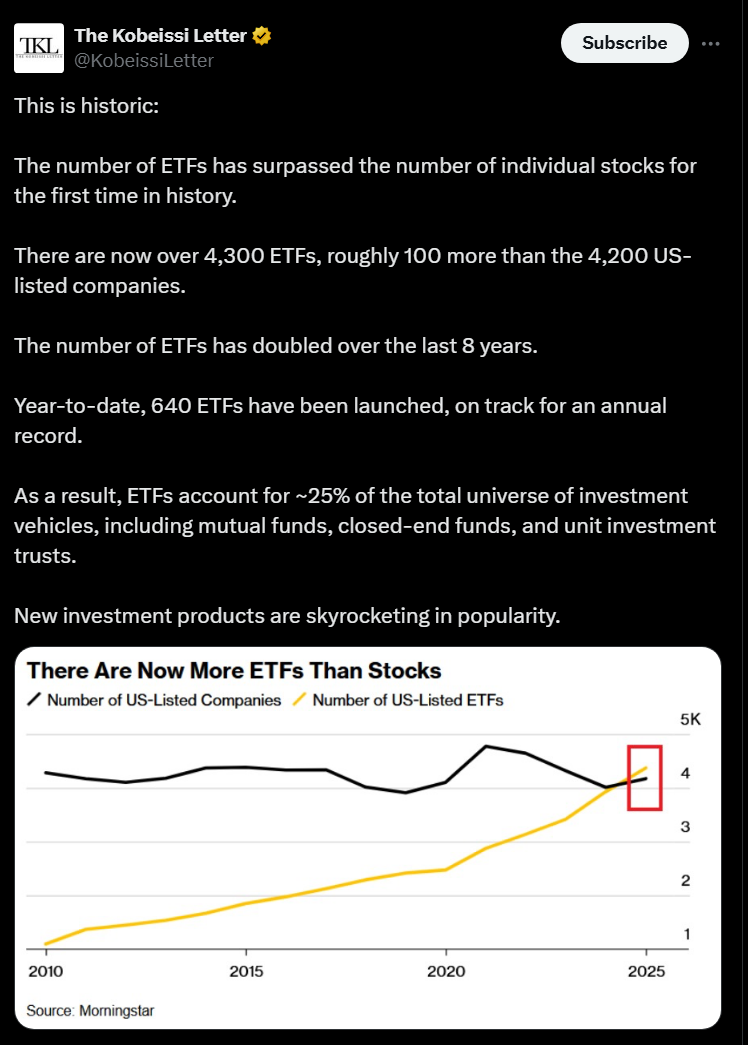

ETFs have change into one of the vital in style funding autos — so widespread, actually, that they now outnumber publicly listed shares, based on Morningstar.

Tokenizing ETFs might probably permit them to commerce past normal market hours and be used as collateral in decentralized finance (DeFi) purposes.

BlackRock’s curiosity in tokenization shouldn’t be new. It already manages the world’s largest tokenized cash market fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), which holds $2.2 billion in belongings throughout Ethereum, Avalanche, Aptos, Polygon and different blockchains.

JPMorgan has referred to as tokenization a “vital leap” for the $7 trillion cash market fund business, pointing to the initiative launched by Goldman Sachs and Financial institution of New York Mellon, which BlackRock will be part of at launch.

Beneath the initiative, BNY purchasers will acquire entry to cash market funds with share possession registered instantly on Goldman Sachs’ personal blockchain.

Associated: Goldman Sachs, BNY to supply tokenized cash market funds for purchasers

Amid blockchain push, TradFi strikes to lock in dominance with cash market funds

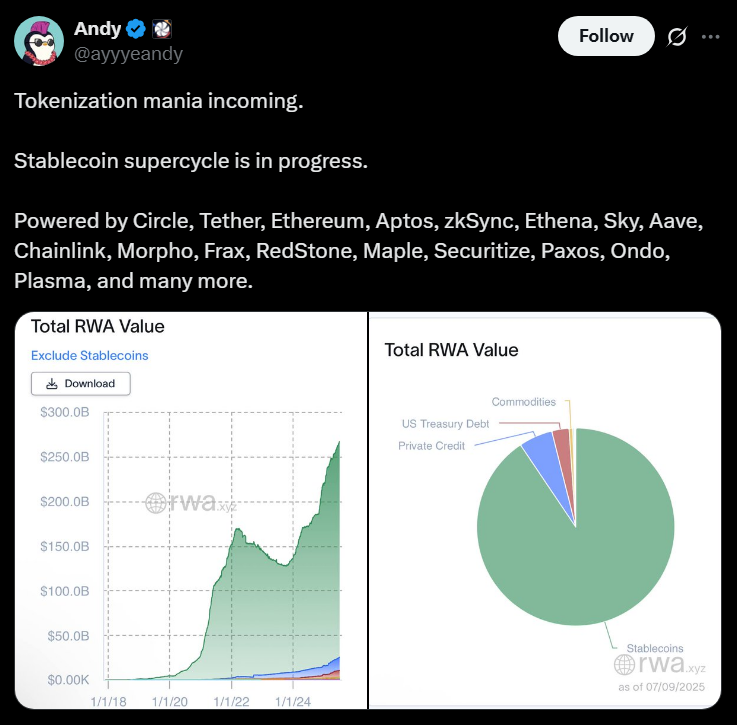

The rise of tokenized cash market funds isn’t taking place in a vacuum however alongside mounting pressures on conventional finance — notably from the speedy adoption of stablecoins and the shift of liquidity into blockchain-based markets.

Cointelegraph reported in Might that the US banking foyer was particularly cautious of yield-bearing stablecoins amid considerations that they may disrupt conventional banking fashions. Notably, such tokens have been excluded from the US GENIUS Act, the primary complete laws on stablecoins.

In June, JPMorgan strategist Teresa Ho mentioned tokenized cash market funds will possible hold attracting capital to the business whereas enhancing their attraction as collateral. This, she famous, might assist protect “money as an asset” within the face of stablecoins’ rising affect.

“As an alternative of posting money, or posting Treasurys, you may submit money-market shares and never lose curiosity alongside the way in which. It speaks to the flexibility of cash funds,” Ho advised Bloomberg.

Nonetheless, analysts say stablecoin progress underneath GENIUS will finally profit tokenization by offering clearer guidelines and stronger on-ramps into blockchain markets.

Journal: Robinhood’s tokenized shares have stirred up a authorized hornet’s nest