Key takeaways:

-

Bitcoin’s $4.3 billion choices expiry favors neutral-to-bullish bets, with a $175 million edge if costs keep above $113,000.

-

Macroeconomic uncertainty, together with weak US employment information and AI sector doubts, may decide Bitcoin’s short-term trajectory.

Bitcoin (BTC) surged previous $114,000 mark on Thursday after a constructive earnings report from Oracle Company (ORCL), a serious participant in synthetic intelligence infrastructure. The transfer pushed Bitcoin to its highest worth in additional than two weeks, elevating expectations for stronger bullish momentum forward of the $4.3 billion BTC choices expiry on Friday.

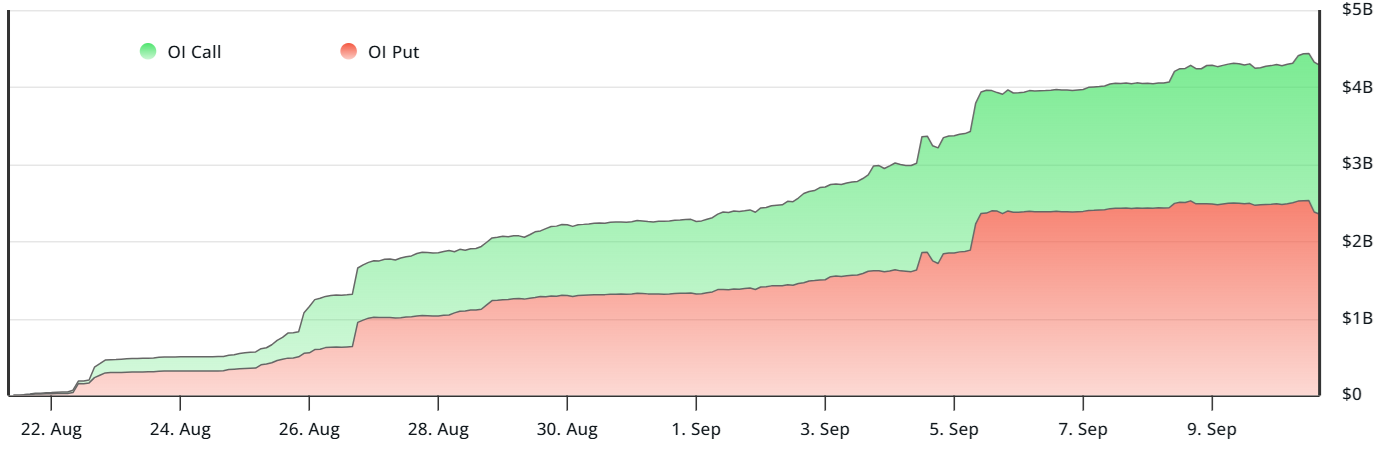

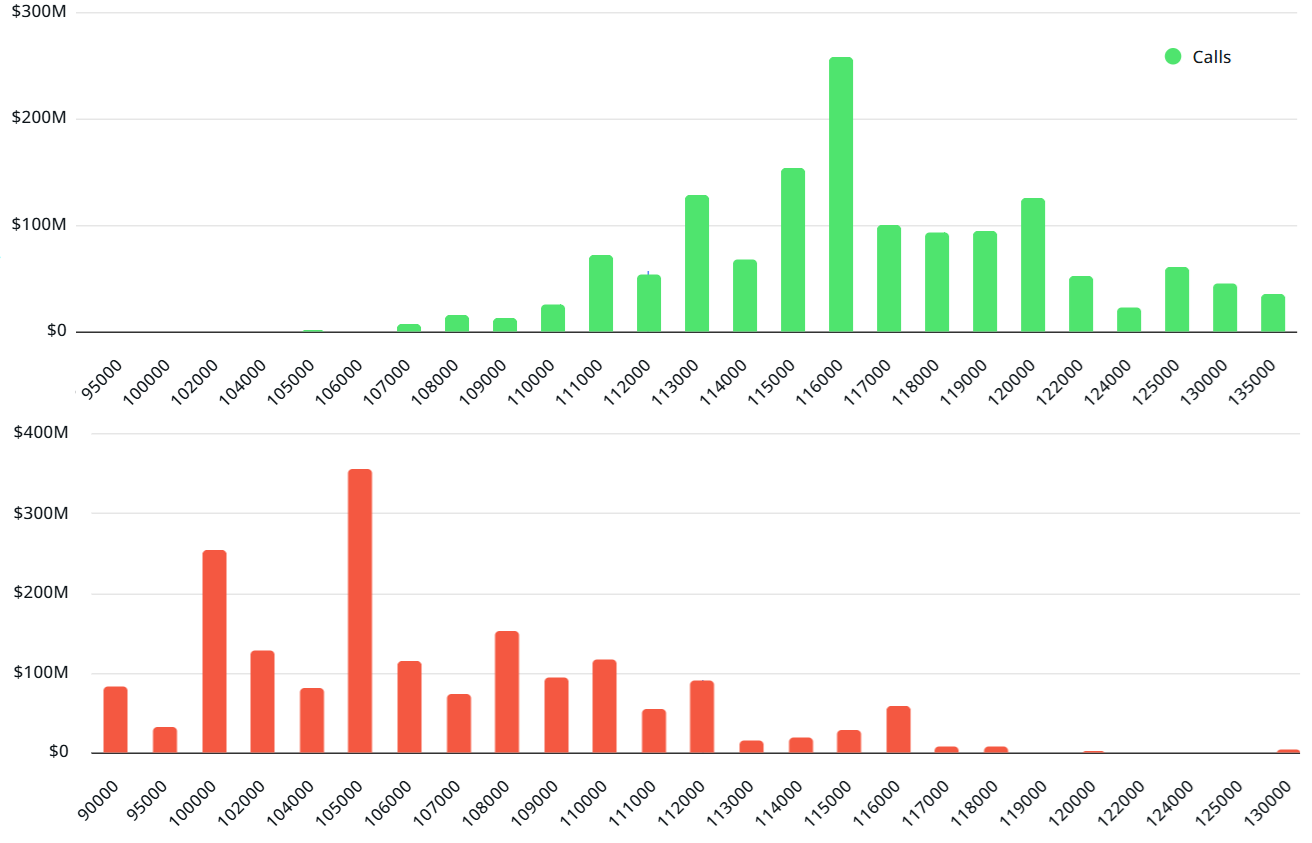

Put (promote) choices dominate this week’s expiry, representing $2.35 billion in open curiosity in contrast with $1.93 billion in name (purchase) contracts. Nonetheless, name choices have gained an edge after Bitcoin’s worth moved away from the $107,500 lows seen earlier in September. The present imbalance favoring put choices is uncommon in a market the place crypto merchants are usually optimistic.

Deribit stays the clear market chief, holding 75% of Bitcoin’s weekly expiry share, adopted by OKX at 13%. Bybit and Binance account for roughly 5% every. Given Deribit’s dominance, its positioning provides the most effective sign to gauge whether or not Bitcoin can push past $120,000 within the brief time period.

Bearish or impartial positions seem poorly positioned, as fewer than $125 million in put open curiosity has been set at $114,000 or larger on Deribit. In distinction, greater than $300 million in name contracts could be activated if Bitcoin sustains ranges above $113,000 by Friday’s expiry. This $175 million benefit for name patrons may present the gas wanted for Bitcoin to increase its bullish development.

US job market issues and AI sustainability may restrict Bitcoin’s upside

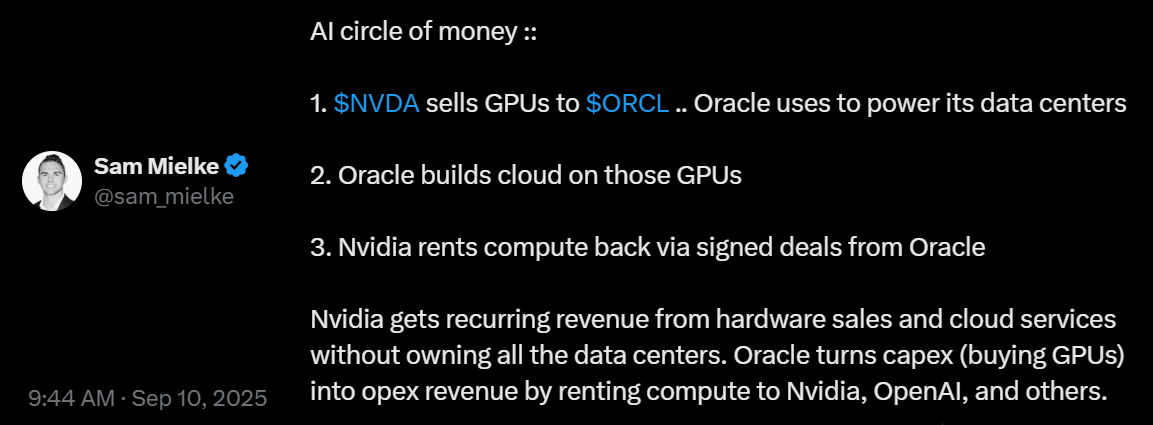

Oracle’s 36% share worth surge on Wednesday was pushed by expectations of stronger earnings after the corporate introduced a $455 billion improve in future contracts. Later that day, The Wall Avenue Journal reported that OpenAI alone accounted for $300 billion of Oracle’s backlog, prompting issues concerning the sustainability of AI-driven development.

X person sam_mielke highlighted how Nvidia (NVDA) advantages from promoting gear to Oracle, producing recurring revenues although Nvidia itself rents out the AI datacenter. The put up prompt these companies could also be partaking in a type of monetary “biking,” successfully changing capital expenditures into revenues.

Whether or not or not the criticism holds weight, recession fears may reinforce Bitcoin bulls’ confidence in reaching a brand new all-time excessive in 2025.

Merchants’ optimism took a success after Tuesday’s sharp unfavorable revision in United States employment information. Financial institution of America fairness analyst Ebrahim Poonawala warned that rising unemployment may weaken credit score high quality at giant banks, in response to Yahoo Finance. He famous, nevertheless, that credit score losses have to this point been “a non-event” all through 2025.

Associated: Crypto merchants’ present concern gained’t final lengthy, analysts say

If Bitcoin holds $112,000 into Friday’s expiry, name choices open curiosity will exceed put choices by $50 million, supporting neutral-to-bullish methods. But when the worth falls under $111,000 at 8:00 am Friday, put choices acquire a $100 million benefit.

In the long run, Bitcoin’s path is more likely to be determined on the closing second, with macroeconomic uncertainty taking part in the decisive position.

This text is for normal info functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the creator’s alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.