Bitcoin faces essential take a look at at $114k as low liquidity threatens additional upside motion

Bitcoin (BTC) should maintain the $114,000 stage to draw buyers’ confidence and new liquidity to breach the slim $110,000-$116,000 vary.

In line with a Sept. 11 report by Glassnode, BTC has been caught within the “air hole” vary following its mid-August peak. The buying and selling vary threatens to stall the present rally.

Within the present panorama, Bitcoin faces mounting strain from conflicting forces as latest consumers notice losses whereas earlier buyers take income.

The report famous three distinct investor cohorts shaping present value motion. The primary are top-buyers over the previous three months holding positions close to $113,800, whereas the second consists of dip-buyers clustering round $112,800.

The third cohort, comprising short-term holders from the previous six months, is anchored close to $108,300, creating outlined help and resistance zones.

The rebound from $108,000 uncovered underlying market stress. Seasoned short-term holders realized roughly $189 million in each day income, representing 79% of all short-term holder features. The buyers who purchased through the February-Could dips used latest energy to exit positions profitably.

Loss realization weighs on restoration

Latest high consumers compounded promoting strain by realizing each day losses of as much as $152 million throughout the identical interval. This habits mirrors stress patterns noticed in April 2024 and January 2025, when peak consumers capitulated below comparable circumstances.

Web Realized Revenue as a share of market cap peaked at 0.065% throughout August’s rally earlier than trending decrease. Whereas present ranges stay elevated, the metric suggests inflows present diminishing help in comparison with earlier phases of the cycle.

US spot exchange-traded funds (ETFs) web flows dropped sharply since early August, hovering close to 500 BTC each day, in comparison with the strong inflows that fueled earlier rallies.

5 Days to Smarter Crypto Strikes

Find out how execs keep away from bagholding, spot insider front-runs, and seize alpha — earlier than it is too late.

Delivered to you by CryptoSlate

The slowdown removes a essential pillar of institutional demand that drove Bitcoin’s ascent by way of 2024.

Derivatives offering stability

With spot flows weakening, derivatives markets assumed better significance in value formation. Quantity Delta Bias recovered through the bounce from $108,000, indicating vendor exhaustion throughout main futures venues, together with Binance and Bybit.

The three-month annualized futures foundation stays under 10% regardless of larger costs, reflecting measured demand for leverage with out speculative extra.

Perpetual futures quantity stays muted, in line with post-euphoric market phases moderately than aggressive hypothesis.

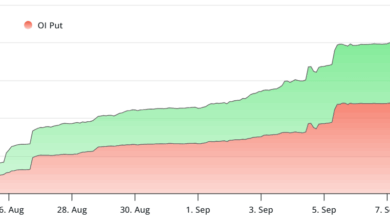

Bitcoin choices open curiosity reached report highs as establishments more and more use derivatives for threat administration by way of protecting places and lined calls. In the meantime, implied volatility continues to say no, signaling market maturation and diminished speculative positioning.

With these metrics as a backdrop, reclaiming $114,000 decisively would restore top-buyer profitability and appeal to recent institutional capital.

Failure to carry this stage dangers renewed strain on short-term holders, with $108,300 and in the end $93,000 serving as essential draw back targets the place main provide clusters await.