Key takeaways:

-

Roughly 1.7 million ETH ($7.5 billion) have been accrued within the $4,300 to $4,400 vary, creating sturdy assist.

-

Institutional demand surges as CME open curiosity hits all-time highs with short-term maturities dominating.

-

$4,500 stays crucial for Ether, with a breakout triggering upside, however dips to $4,000 can’t be dominated out.

Ether (ETH) continues to commerce sideways between $4,500 and $4,200 this month, displaying indicators of fading momentum. The shortage of decisive shopping for strain signifies considerations about short-term weak point, however onchain information suggests a deeper accumulation pattern could also be underway.

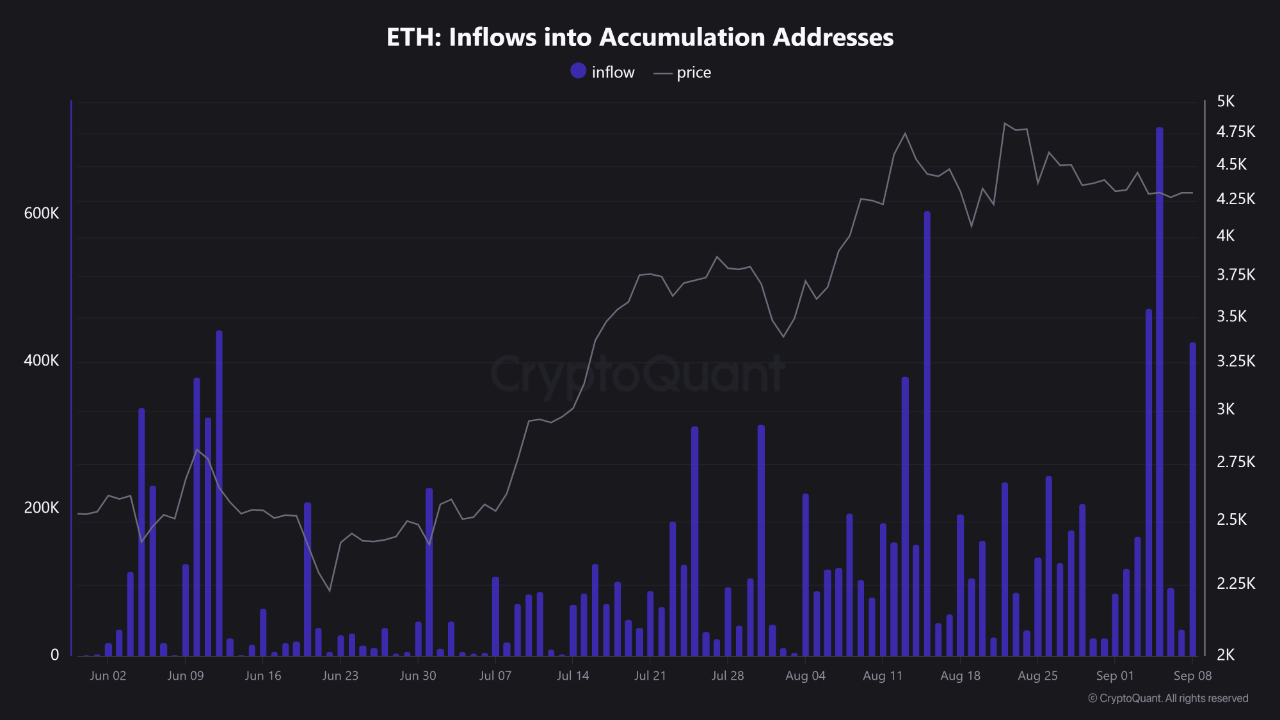

Knowledge from CryptoQuant highlights a crucial growth across the $4,300–$4,400 zone. Roughly 1.7 million ETH, i.e., $7.5 billion, has been absorbed into accumulation addresses at this stage, with many withdrawals from centralized exchanges reflecting a mean price foundation close to $4,300. This establishes a robust zone of curiosity that would function key assist if value checks decrease ranges once more.

Change circulation evaluation exhibits that Binance has performed a major position on this course of, dealing with the biggest outflows through the accumulation section. Curiously, addresses depositing ETH onto Binance present a mean price foundation nearer to $3,150, suggesting divergent positioning between long-term holders and energetic merchants.

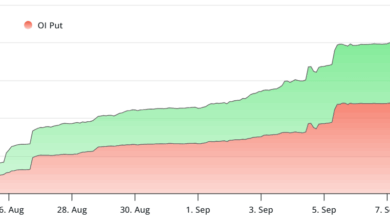

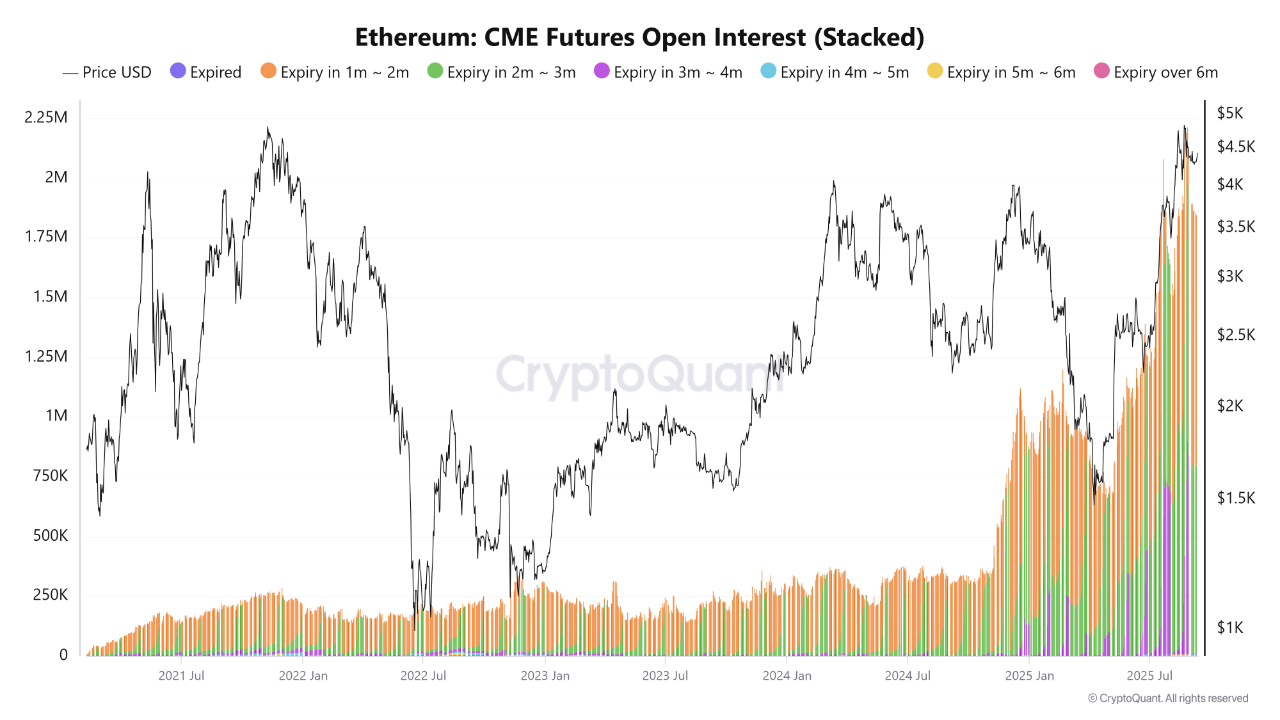

Institutional flows are additionally shaping the present market. Open curiosity (OI) on CME has surged to all-time highs, with a heavy focus in short-term maturities (one to 3 months).

Whereas this raises volatility threat round contract expirations, it additionally alerts aggressive institutional participation. Longer-term maturities (three to 6 months) are additionally constructing, reflecting stronger confidence in Ether’s outlook.

With ETH buying and selling close to $5,000, Crypto analyst Pelin Ay famous that the above institutional demand and derivatives positioning counsel additional upside. Whereas liquidation dangers stay elevated, the analyst argues the broader pattern stays intact. Pelin stated,

“My expectation is that ETH may attain the $6,800 resistance stage by 12 months finish.”

Associated: Latin American devs favor Ethereum and Polygon over new chains: Report

$4,500 stays the important thing inflection stage for Ether

From a technical standpoint, decrease time frames proceed to point out indecision for Ether. The asset has largely ranged between $4,200 and $4,500 all through September, whereas crypto property like Bitcoin and Solana have exhibited increased highs. This divergence factors to short-term capital rotation into different majors, although a decisive break above $4,500 may rapidly shift momentum again towards Ether.

Nevertheless, the chance of a decrease liquidity sweep stays elevated. Key draw back ranges sit round $4,200, with a notable order block/demand zone between $4,000 and $4,100 positioned slightly below. If Ether’s value motion stays weak going into This fall, a dip towards these zones is feasible earlier than any significant breakout above $4,500 materializes.

Crypto dealer Merlijn believes the chance of an instantaneous rally stays increased as a key month-to-month indicator turns inexperienced. The dealer stated,

“MACD simply flipped inexperienced. 3 years of strain coiled and able to detonate. Month-to-month candle says just one phrase: BULLISH. Clear $4,500 and Ethereum goes parabolic.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.