Key factors:

-

Bitcoin nears three-week highs as US CPI knowledge matches expectations.

-

Loads of market members see Bitcoin heading larger as aresult, maybe after a dip to entice late longs.

-

CPI has seen BTC worth fakeouts in current months.

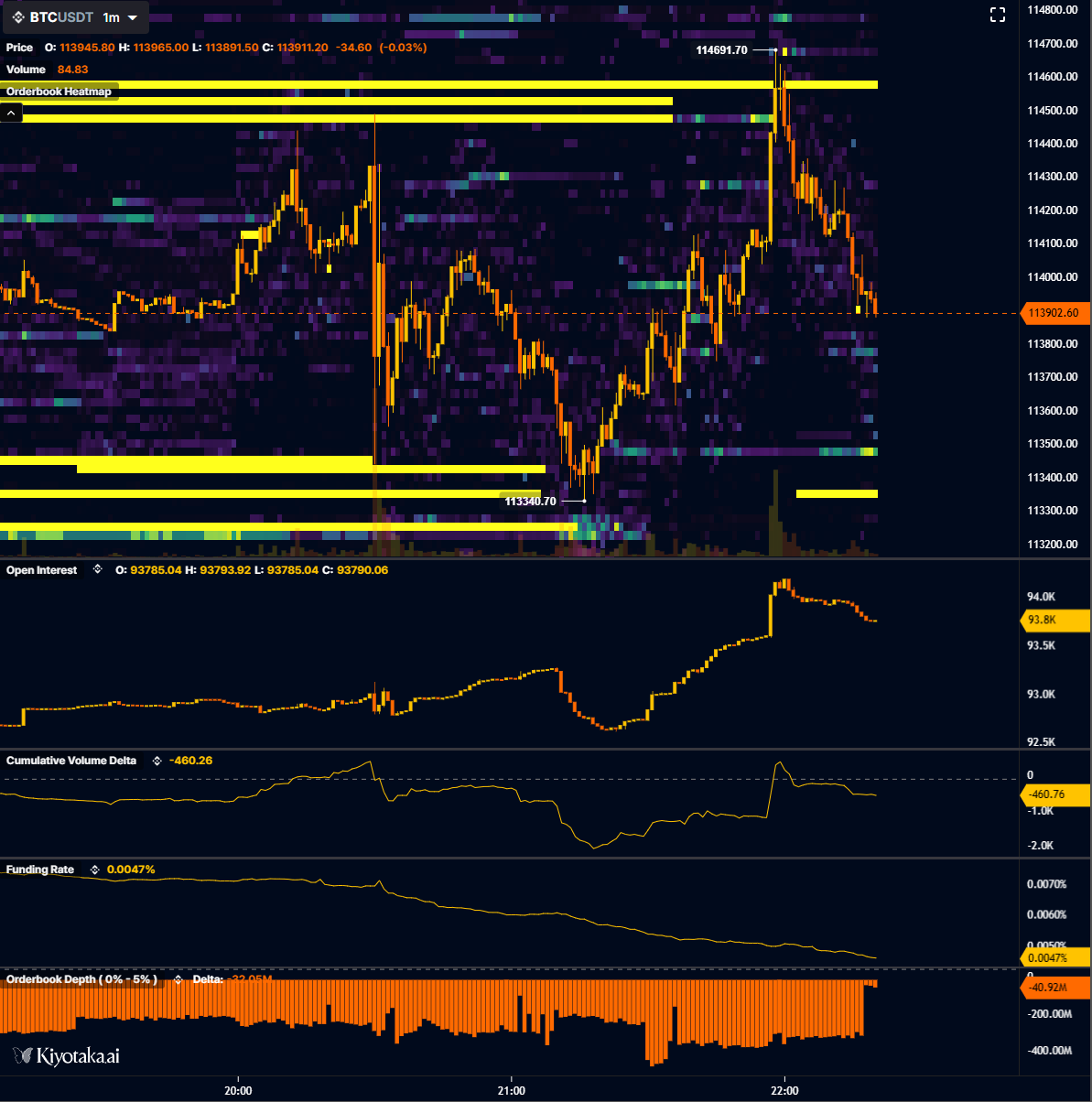

Bitcoin (BTC) noticed telltale volatility at Thursday’s Wall Road open as US macro knowledge furthered interest-rate reduce odds.

CPI bullseye sees requires Bitcoin going “larger”

Information from Cointelegraph Markets Professional and TradingView confirmed BTC/USD spiking to $114,731.

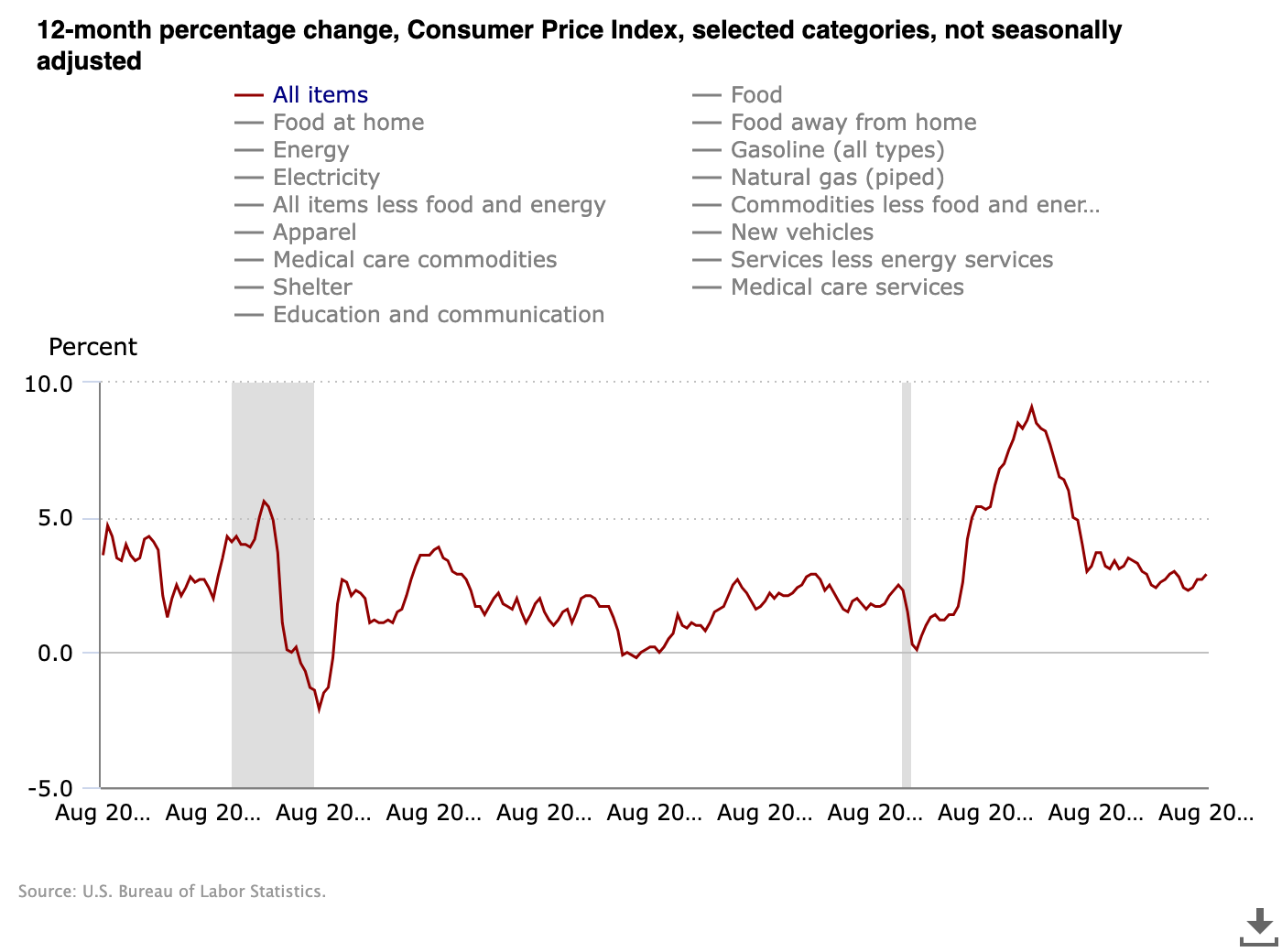

The August print of the US Client Value Index (CPI) got here in as anticipated, complementing a marked cooling of the Producer Value Index (PPI) the day prior.

Whereas CPI was at its highest since January, the headline determine was as an alternative preliminary jobless claims, which noticed their largest numbers since October 2021 at 263,000 versus 235,000 anticipated.

Weekly jobless claims simply hit 263,000. That is the best weekly quantity since October 2021. pic.twitter.com/5hoLBpNCEM

— Josh Schafer (@_JoshSchafer) September 11, 2025

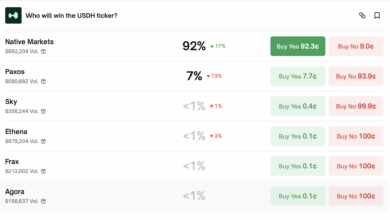

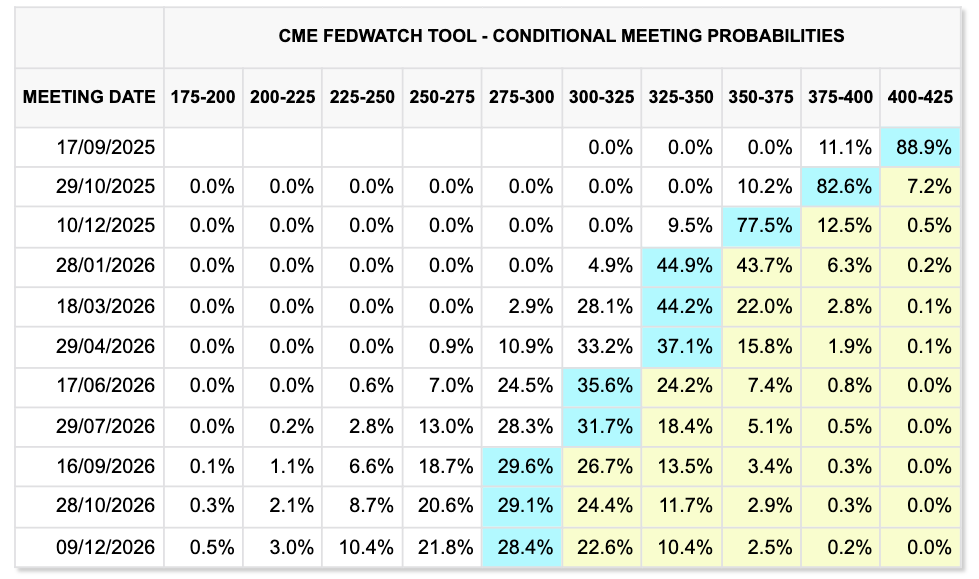

Amid ongoing issues about labor market weak point, bets of the Fed reducing charges at its Sept. 17 assembly solely strengthened after the CPI launch, with markets even seeing an 11% likelihood of the reduce being greater than the minimal 0.25%.

“Markets are actually pricing-in 75 foundation factors of charge cuts by year-end,” buying and selling useful resource The Kobeissi Letter famous in a follow-up thread on X.

“Whereas CPI inflation continues to rise, the labor market is just too weak to disregard. Subsequent week will probably be an enormous week.”

Crypto commentators noticed the case for larger costs subsequent as Bitcoin handed $114,500 for the primary time since Aug. 24.

“PPI a lot decrease than anticipated, CPI as anticipated,” well-liked dealer Jelle responded in an X submit.

“Conclusion: Inflation not as unhealthy as anticipated – convey on the speed reduce later this month. Information now behind us, time to renew the scheduled programme: larger.”

BTC worth dangers repeating US inflation knowledge entice

BTC worth forecasts additionally pressured the significance of current help reclaims.

Associated: Bitcoin worth can hit $160K in October as MACD golden cross returns

For fellow dealer BitBull, flipping $113,500 from resistance to help was the important thing low-time body occasion, which opened the door to a rematch with all-time highs.

$BTC has reclaimed a really essential degree.

The $113.5K degree which acted as a resistance has now been flipped into help.

Now the subsequent key degree for Bitcoin is to reclaim $117K degree, and a brand new ATH will probably be confirmed. pic.twitter.com/3QdrCtH4ho

— BitBull (@AkaBull_) September 11, 2025

Some views nonetheless noticed a contemporary help retest coming earlier than a return to cost discovery.

Dealer Skew argued that the market would try to entice and liquidate longs that entered on the CPI launch.

“Yet another liquidation earlier than larger,” a part of an X submit advised, noting 2,000 BTC of liquidity showing on alternate order books.

Crypto investor and entrepreneur Ted Pillows went additional, suggesting that BTC/USD would copy earlier CPI habits to first rise then plumb contemporary lows.

“Within the final 3 CPI knowledge releases, Bitcoin rallied earlier than CPI knowledge and dumped proper after the information launch,” he noticed alongside an explanatory chart.

“This time, BTC has rallied earlier than immediately’s CPI knowledge launch, which implies a dump might occur.”

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.