Key factors:

-

Bitcoin nears three-week highs as US CPI knowledge matches expectations.

-

Loads of market individuals see Bitcoin heading greater as aresult, maybe after a dip to lure late longs.

-

CPI has seen BTC worth fakeouts in latest months.

Bitcoin (BTC) noticed telltale volatility at Thursday’s Wall Avenue open as US macro knowledge furthered interest-rate lower odds.

CPI bullseye sees requires Bitcoin going “greater”

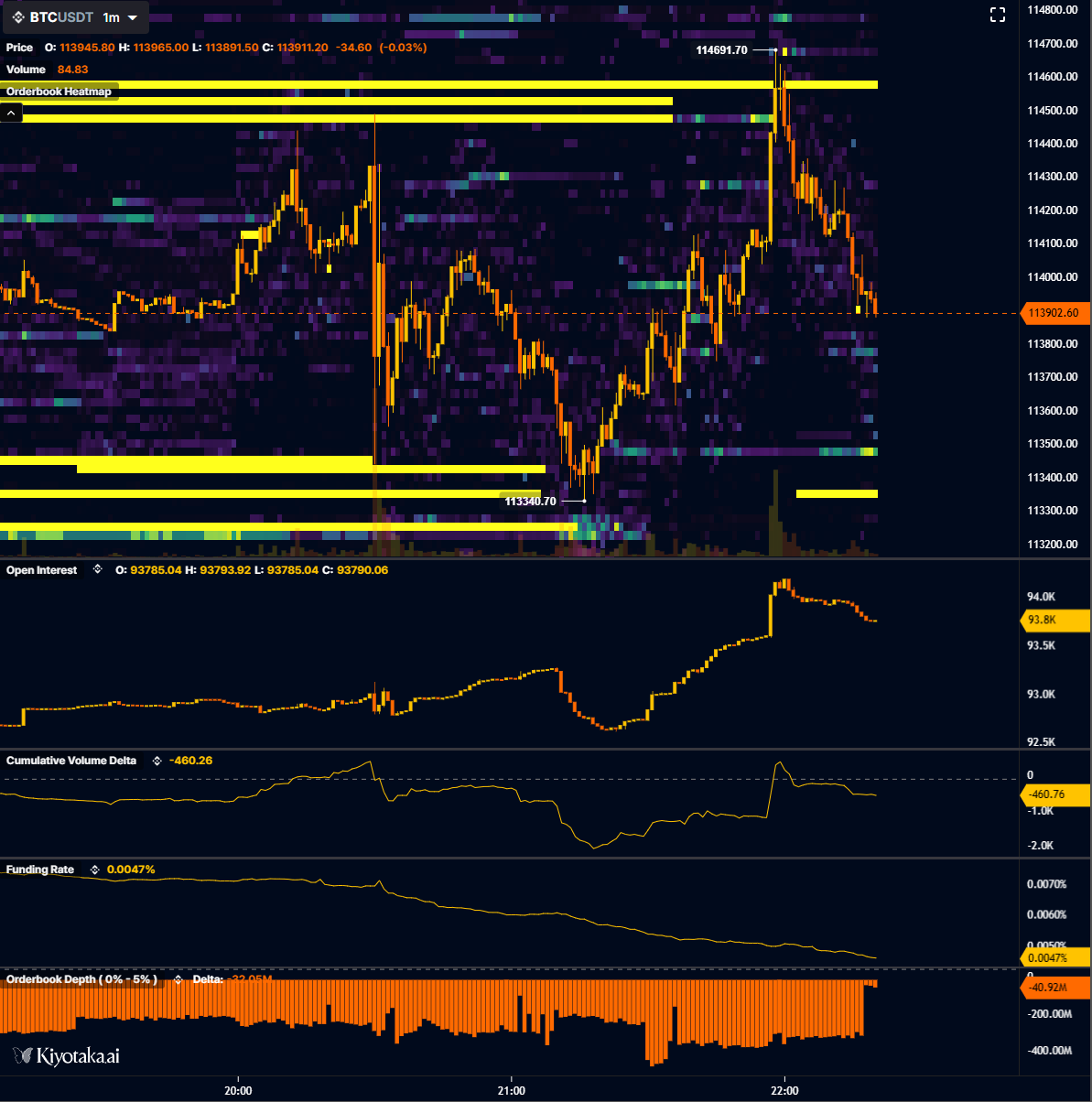

Information from Cointelegraph Markets Professional and TradingView confirmed BTC/USD spiking to $114,731.

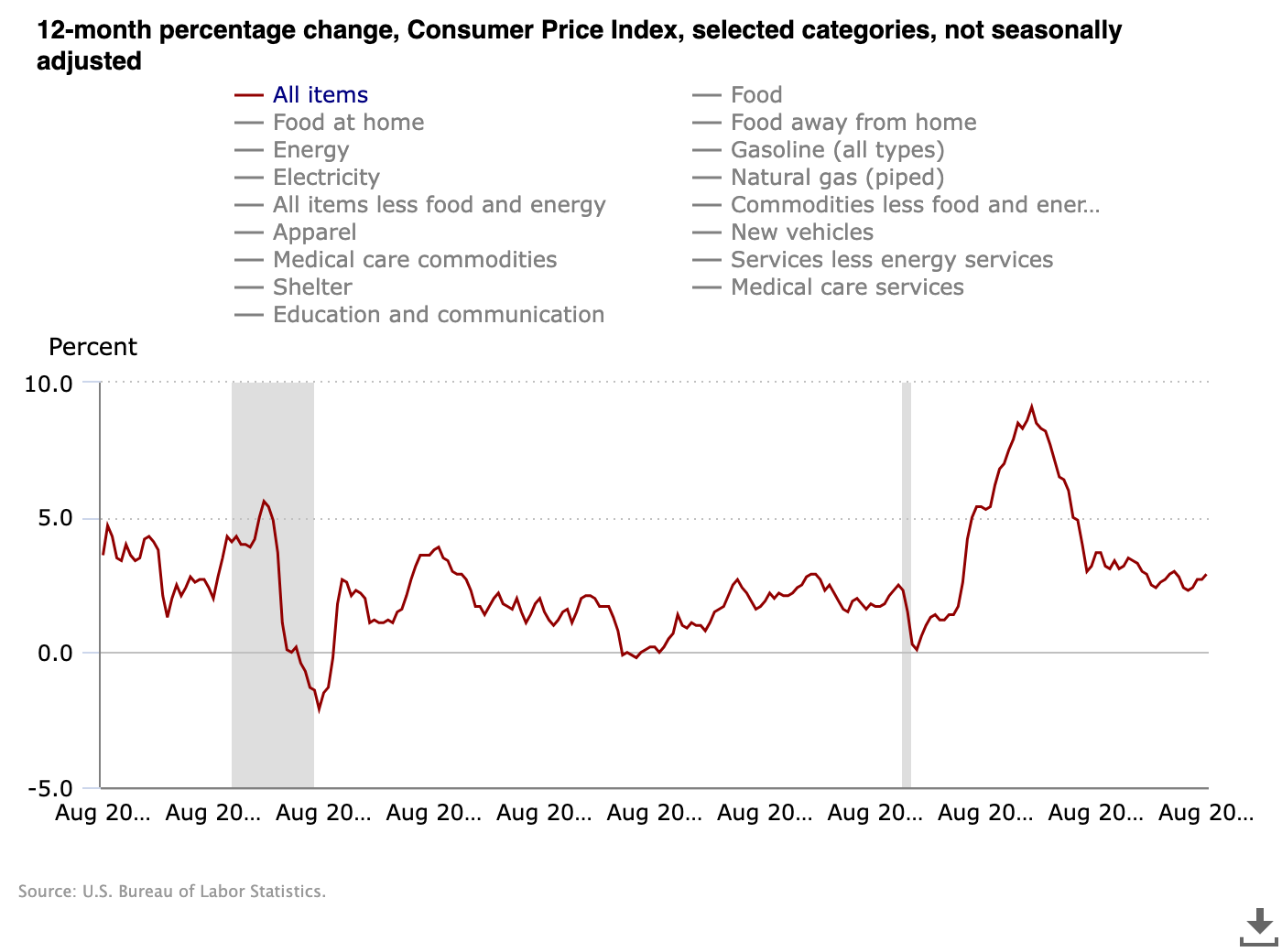

The August print of the US Shopper Value Index (CPI) got here in as anticipated, complementing a marked cooling of the Producer Value Index (PPI) the day prior.

Whereas CPI was at its highest since January, the headline determine was as an alternative preliminary jobless claims, which noticed their largest numbers since October 2021 at 263,000 versus 235,000 anticipated.

Weekly jobless claims simply hit 263,000. That is the very best weekly quantity since October 2021. pic.twitter.com/5hoLBpNCEM

— Josh Schafer (@_JoshSchafer) September 11, 2025

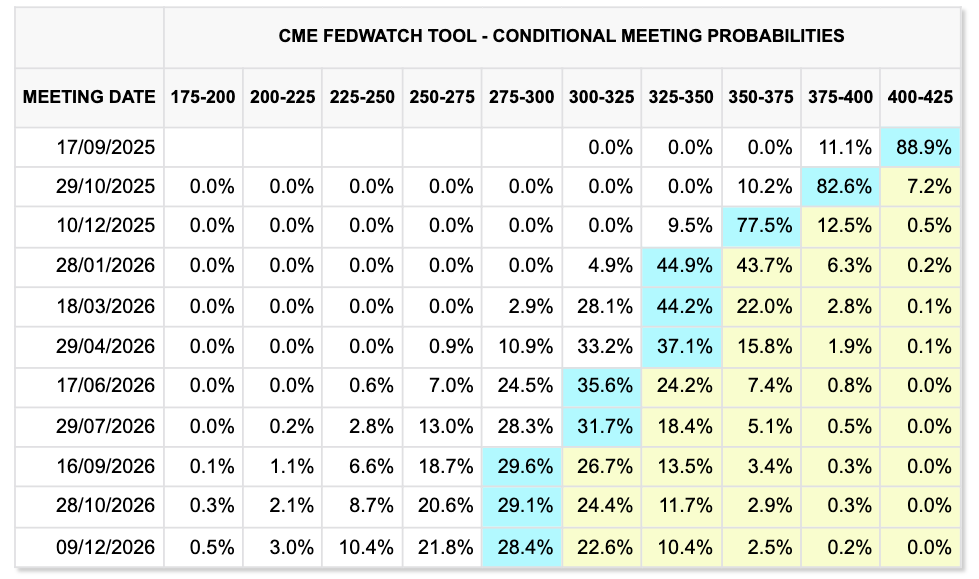

Amid ongoing issues about labor market weak spot, bets of the Fed chopping charges at its Sept. 17 assembly solely strengthened after the CPI launch, with markets even seeing an 11% probability of the lower being greater than the minimal 0.25%.

“Markets at the moment are pricing-in 75 foundation factors of price cuts by year-end,” buying and selling useful resource The Kobeissi Letter famous in a follow-up thread on X.

“Whereas CPI inflation continues to rise, the labor market is just too weak to disregard. Subsequent week will probably be an enormous week.”

Crypto commentators noticed the case for greater costs subsequent as Bitcoin handed $114,500 for the primary time since Aug. 24.

“PPI a lot decrease than anticipated, CPI as anticipated,” standard dealer Jelle responded in an X put up.

“Conclusion: Inflation not as unhealthy as anticipated – carry on the speed lower later this month. Information now behind us, time to renew the scheduled programme: greater.”

BTC worth dangers repeating US inflation knowledge lure

BTC worth forecasts additionally harassed the significance of latest help reclaims.

Associated: Bitcoin worth can hit $160K in October as MACD golden cross returns

For fellow dealer BitBull, flipping $113,500 from resistance to help was the important thing low-time body occasion, which opened the door to a rematch with all-time highs.

$BTC has reclaimed a really essential stage.

The $113.5K stage which acted as a resistance has now been flipped into help.

Now the following key stage for Bitcoin is to reclaim $117K stage, and a brand new ATH will probably be confirmed. pic.twitter.com/3QdrCtH4ho

— BitBull (@AkaBull_) September 11, 2025

Some views nonetheless noticed a recent help retest coming earlier than a return to cost discovery.

Dealer Skew argued that the market would try and lure and liquidate longs that entered on the CPI launch.

“Another liquidation earlier than greater,” a part of an X put up steered, noting 2,000 BTC of liquidity showing on alternate order books.

Crypto investor and entrepreneur Ted Pillows went additional, suggesting that BTC/USD would copy earlier CPI habits to first rise then plumb recent lows.

“Within the final 3 CPI knowledge releases, Bitcoin rallied earlier than CPI knowledge and dumped proper after the info launch,” he noticed alongside an explanatory chart.

“This time, BTC has rallied earlier than at the moment’s CPI knowledge launch, which suggests a dump may occur.”

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.