An extended-dormant Bitcoin whale has resurfaced, shifting funds untouched since 2012.

On Sept. 11, blockchain tracker Lookonchain revealed that three related addresses shifted 137 BTC, price about $15.6 million, out of a cache of 955 BTC (equal to $108 million).

In keeping with the agency, a small portion of the funds, 5 BTC, was despatched to Kraken, suggesting an intent to promote.

Notably, the addresses had been final energetic when Bitcoin traded at simply $12 per coin, leaving their mixed steadiness valued at round $10,000 at the moment.

Nevertheless, with BTC worth close to $113,000 as of press time, that very same stash is at present price greater than $108 million, in keeping with CryptoSlate’s knowledge. This represents a acquire of over 10,000% in simply over a decade.

Dormant Bitcoin wallets resurface

This motion suits right into a latest development of long-dormant Bitcoin wallets reawakening after a number of years of inactivity.

Enrollment Closing Quickly…

Safe your spot within the 5-day Crypto Investor Blueprint earlier than it disappears. Study the methods that separate winners from bagholders.

Delivered to you by CryptoSlate

For context, CryptoSlate reported that Galaxy Digital executed a $9 billion Bitcoin sale in July linked to a Satoshi-era holder. One other whale investor steadily rotated billions from Bitcoin into Ethereum in August, inflicting a short market decline for the highest crypto.

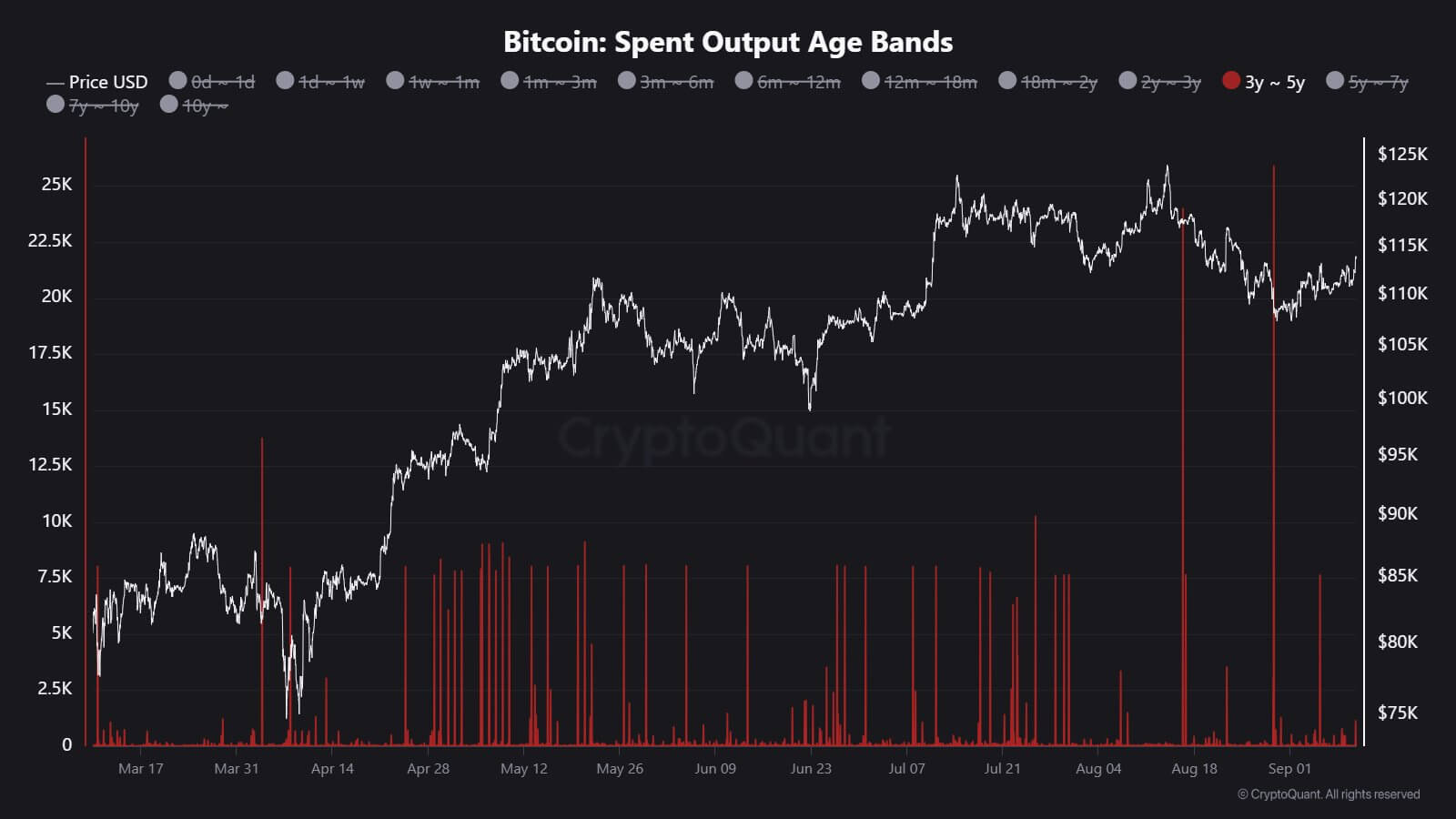

As well as, CryptoQuant analyst JA Maartunn identified that these transfers are usually not remoted instances, as greater than 604,000 BTC aged three to 5 years have moved on-chain since March.

This surge in pockets exercise marks one of the vital behavioral shifts amongst long-term Bitcoin holders in latest reminiscence. Buyers on this cohort sometimes endure a number of market cycles with out shifting their cash, so their sudden transfers carry weight.

In opposition to that backdrop, many analysts see the transfers as profit-taking, with holders selecting to lock in positive factors as Bitcoin breaks via the $110,000 mark to new highs.

Nevertheless, others interpret the exercise otherwise. They counsel it displays portfolio rebalancing of rotating capital from Bitcoin into Ethereum and choose altcoins as institutional demand for crypto rises.