Opinion by: Jamie Elkaleh, chief advertising and marketing officer at Bitget Pockets

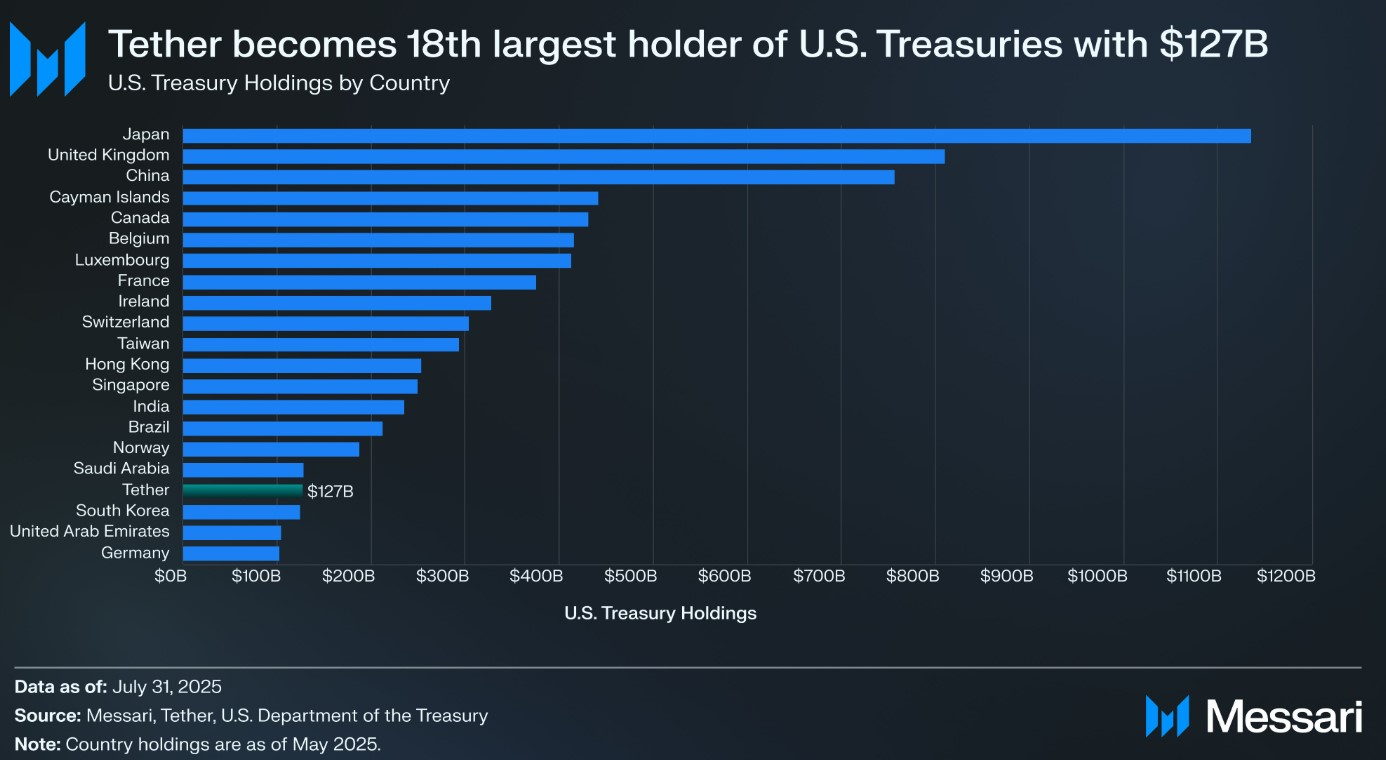

Stablecoins began as a workaround for crypto merchants. By pegging tokens to the US greenback, they created liquidity in a market that by no means closed. In just some years, nevertheless, they’ve outgrown that function. The result’s an onchain monetary layer the place dollar-pegged cash set costs, collateral norms and threat urge for food.

The hazard lies right here: With out the expansion of credible, well-regulated options within the euro, yen and offshore yuan, the US greenback’s dominance will probably be locked into crypto’s basis for years.

If that occurs, liquidity will observe US charges and coverage extra tightly, amplifying drawdowns when Treasury markets wobble and exporting Washington’s coverage shocks straight into DeFi.

Greenback tokens have already transmitted TradFi circumstances into crypto. The headline numbers change every quarter, however the mechanism is secure: Reserves sit in US authorities cash markets, so crypto liquidity rises and falls with US charges.

That plumbing is environment friendly and clear, however concentrates macro publicity by means of a single sovereign’s cash markets. Treating that dependency as “impartial” is a selection that the trade ought to right out there construction it builds subsequent.

Europe and Japan ought to flip coverage into liquidity

Europe is finished admiring the issue. If greenback stablecoins set the foundations of onchain finance, the euro has to seem within the order books, not simply in white papers. EURAU is the primary check: Is euro liquidity clear at depth and turns into a base pair? Alongside MiCA-compliant EURC and EURCV, Europe now has the plumbing — what it wants is deliberate market-making to seed euro books.

Regulators ought to choose winners and underwrite liquidity as an alternative of merely publishing pointers — in any other case “strategic autonomy” turns into a slogan with a bid-ask unfold.

The European Central Financial institution has already mentioned the quiet half out loud: Dollarized stablecoin rails weaken euro autonomy, so coverage should create euro-native ones.

Associated: ECB president calls to handle dangers from non-EU stablecoins

Japan is shifting in parallel. Fintech group Monex is getting ready a yen-backed stablecoin, whereas JPYC not too long ago acquired approval, marking one of many first regulated fiat-backed tokens in Asia. That may solely matter if a JPY token strikes remittances and provider funds and exhibits up as deep base pairs on main exchanges. It’ll stay a compliant pilot with out strict reserve transparency and broad distribution by means of exchanges, PSPs, and wallets.

Hong Kong is the proving floor for non-USD rails

Hong Kong’s new licensing regime issues as a result of it presents a supervised path to non-USD tokens with enforceable reserves, redemptions, and disclosures — precisely the constraints Europe and Japan want in Asian hours.

It begins with the Hong Kong greenback, however the framework can accommodate the offshore yuan, or CNH, which makes Hong Kong the sensible bridge for an offshore-yuan pilot that may be monitored and scaled. Success will hinge much less on code and extra on coverage — CNH swimming pools are shallow, so a licensed CNH token will probably be a helpful hall till liquidity widens and hedging will get cheaper.

What would really shift the bottom pair?

Non-USD tokens will solely matter in the event that they grow to be the models the place value discovery occurs. Which means each day reserve disclosures and impartial attestations that meet — or beat — USDT/USDC requirements. It additionally requires native multichain issuance for wrapper-free settlement and exhausting redemption SLAs so establishments can comfortably fund in euros or yen in a single day. Exchanges ought to record non-USD base pairs and direct incentives to them — even if early spreads are wider — so value discovery occurs off the greenback.

Europe has the primary two items: a regulated issuer pipeline and a central financial institution overtly arguing for euro rails. Hong Kong provides the third: a venue that may license and supervise issuers serving Asian buying and selling hours, with clear expectations on reserves and conduct. Put collectively, these parts can chip away on the greenback’s onchain monopoly with out pretending the greenback disappears.

The larger image: multicurrency rails

Greenback stablecoins will not be going away — and shouldn’t. Nonetheless, a one-currency base layer would make crypto extra brittle and less open. Europe’s EURAU approval exhibits how coverage can grow to be liquidity; Japan’s licensing wave provides regional depth; and Hong Kong’s regime provides the testbed to show whether or not non-USD rails can clear in dimension.

If euro and yen liquidity consolidates on exchanges — with a clear, licensed CNH token following by means of — pricing, collateral, and funding onchain will diversify past a single sovereign’s cash markets, lowering focus threat with out sacrificing velocity or composability. The subsequent cycle will reward issuers and jurisdictions that flip compliance into aggressive FX liquidity — and penalize those who rebuild greenback dominance by default.

Opinion by: Jamie Elkaleh, chief advertising and marketing officer at Bitget Pockets.

This text is for common info functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the creator’s alone and don’t essentially mirror or signify the views and opinions of Cointelegraph.