Actual-world asset tokenization platform OpenEden and crypto infrastructure supplier BitGo have entered the competitors to subject Hyperliquid’s deliberate native stablecoin, USDH, bringing the variety of contenders to eight.

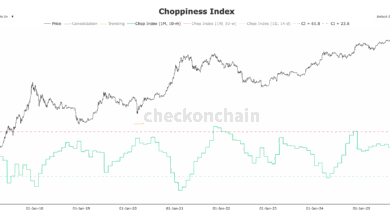

Hyperliquid validators will begin voting for the USDH proposal from Thursday and can be capable of forged their votes till Sunday. Different suitors embody Ethena, Paxos, Frax, Agora, Native Markets and Sky.

The successful bid will determine the way it will handle Hyperliquid’s $5.9 billion stablecoin reserve, with 95.56% of it held in USDC (USDC), in keeping with DefiLlama.

OpenEden’s bid for USDH

OpenEden’s founder and CEO Jeremy Ng on Wednesday laid out the platform’s proposal on the way it will deal with USDH had been it to win the bid.

The RWA platform pledged to distribute all of the yield it’s going to generate from the USDH reserves to the Hyperliquid ecosystem, which can embody buybacks.

It is going to moreover use the proceeds from minting and redeeming USDH to purchase again Hyperliquid’s HYPE token and distribute it to the Hyperliquid validators.

The corporate has earmarked 3% of its native EDEN token provide to supply further incentives, which may very well be boosted sooner or later.

USDH reserves can be saved in a tokenized US Treasury Payments Fund, whose custody can be beneath The Financial institution of New York Mellon.

The corporate has partnered with The Financial institution of New York Mellon, Chainlink, AEON Pay and Monarq Asset Administration for adoption.

BitGo touts regulatory prowess

In the meantime, BitGo stated it’s going to leverage US dollar-backed liquid belongings, financial institution deposits, short-term treasury payments and extra for minting and redeeming USDH.

The corporate said that it’s going to use Chainlink’s crosschain interoperability protocol to take care of interoperability between chains.

The yield from the underlying belongings can be used to purchase and stake HYPE tokens, with the corporate taking a 0.3% payment of the whole reserves.

BitGo touted its regulatory compliance as its main energy, as six of its firms have acquired licenses from Dubai, Singapore, Denmark, New York and a Markets in Crypto-Belongings license from Germany.

Associated: How Hyperliquid hit $330B in month-to-month buying and selling quantity with simply 11 staff

Native Markets leads the pack

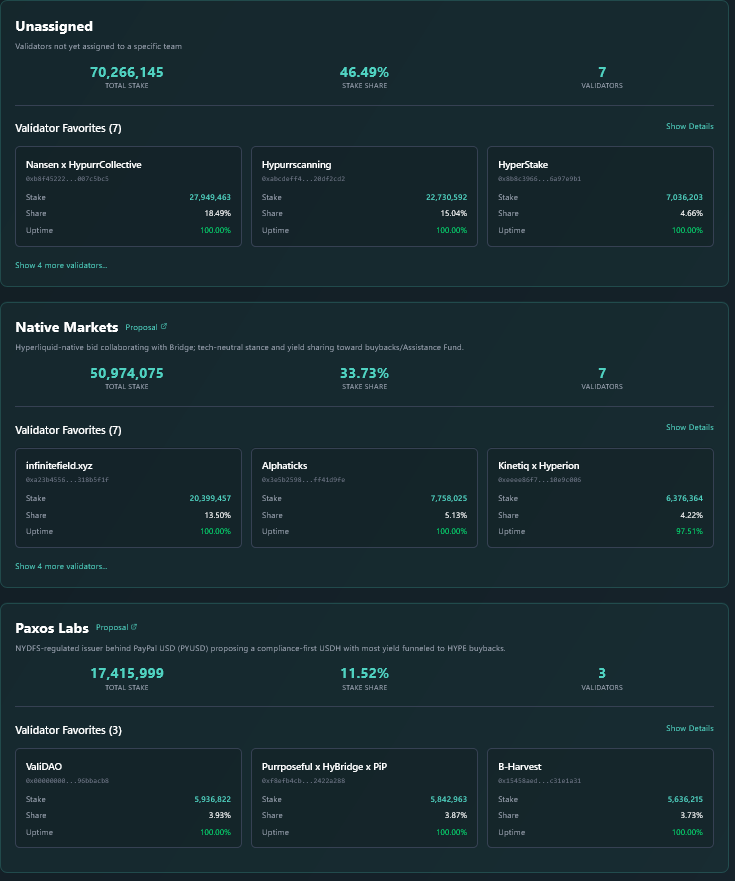

On the time of writing, Native Markets has acquired essentially the most votes, with 33.73% of the delegate stake choosing its proposal.

Native Markets, co-founded by neighborhood member Max Fiege, has proposed splitting the proceeds from the reserves, with half of the proceeds getting used to purchase again HYPE tokens, whereas the opposite half being granted to the Help Fund. Nonetheless, the proposal has acquired backlash from the neighborhood.

Haseeb Qureshi, managing companion at crypto enterprise fund Dragonfly, has forged doubt relating to Native Markets’ bid.

“Listening to from a number of bidders that not one of the validators are desirous about contemplating anybody apart from Native Markets. It’s not even a critical dialogue, as if there was a backroom deal already executed.” Qureshi stated.

Nansen CEO Alex Svanevik refuted the declare, saying that they together with their allies, have been engaged with bidders and have inspired them to place forth their proposal to make the bidding course of aggressive.

Paxos Labs, which submitted a revised bid on Wednesday, is at present second with a vote share of 11.52%.

Nonetheless, 46.49% stake stays unassigned, which may drastically change the result of who will get to create the USDH token.

A Polymarket ballot signifies that market members are largely anticipating Native Markets to win the proposal, with 90% of the ballot customers voting for it.

Different bidders embody Ethena Labs, which submitted its proposal on Tuesday, whereas Sky, previously Marker, submitted its proposal on Monday.

Journal: Meet the Ethereum and Polkadot co-founder who wasn’t in Time Journal