Bitcoin traded round $114,200 in Asian morning hours Thursday, up 2.4% over 24 hours, as majors firmed right into a heavy macro week.

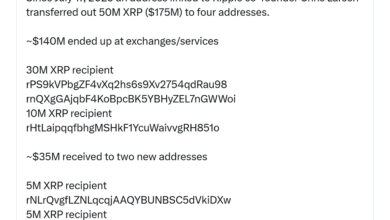

Ether (ETH) was up 2.4% to $4,400, XRP rose above $3, BNB Chain’s BNB (BNB)neared $900 and Solana’s SOL (SOL) gained practically 3%. Dogecoin outperformed with a 5% day by day acquire that prolonged a weeklong transfer greater to fifteen.9%.

A valuation pattern is catching consideration amongst some merchants. CF Benchmarks mentioned in a report earlier this week that prompt bitcoin is buying and selling beneath its honest worth vary when mapped towards U.S. M2 progress.

The agency famous that the hole between M2 enlargement and the BTC value is as large as at any time since August 2024, which has changed into a robust entry level. Comparable divergences in 2016, 2019, and 2021 preceded notable upside.

Over the previous decade, BTC has proven a constructive correlation with M2, with financial progress sometimes main value by roughly three months. If that historic relationship holds, liquidity tailwinds later in This fall might favor a push greater.

Tactically, bulls nonetheless have ranges to reclaim.

“Bitcoin continues to draw consumers on intraday dips, forming a clean and slightly fragile uptrend, with the primary battle now round $112K,” mentioned Alex Kuptsikevich, chief market analyst at FxPro, in an electronic mail to CoinDesk.

“The actual take a look at sits close to $115K, simply above the 50-day transferring common. Staying above it could sign a return to optimism, however for now BTC is lagging shares at file highs,”Kuptsikevich added.

Choices desks report firmer demand for cover forward of this week’s U.S. inflation knowledge, in step with neutral-to-bearish positioning within the quick time period.

In the meantime, SOL’s bid has tracked a gentle rise in TVL to a file $12.2 billion, up 57% since June, whereas memecoins captured recent flows. Analysts floating $300 SOL targets tie the decision to persistent exercise and on-chain liquidity, although follow-through possible relies on broader danger urge for food.

The macro calendar can nonetheless spoil the occasion, nevertheless, as U.S CPI figures are due in a while Thursday. A cooler trajectory would strengthen the case for a near-term Fed minimize and a softer greenback, sometimes supportive for bitcoin and the broader crypto market.

Learn extra: Bitcoin, Ether ETFs Put up Optimistic Flows as Costs Rebound