South Korea’s benchmark fairness index, the Kospi, has reached a file excessive of 4,340 factors, pushed by prospects of shareholder-friendly insurance policies and optimistic international market sentiment.

The brand new excessive has prompted one analyst to induce warning amongst bitcoin bulls, suggesting that the surging Kospi might mark the tip of the BTC bull run, in keeping with the historic relation between the 2 belongings.

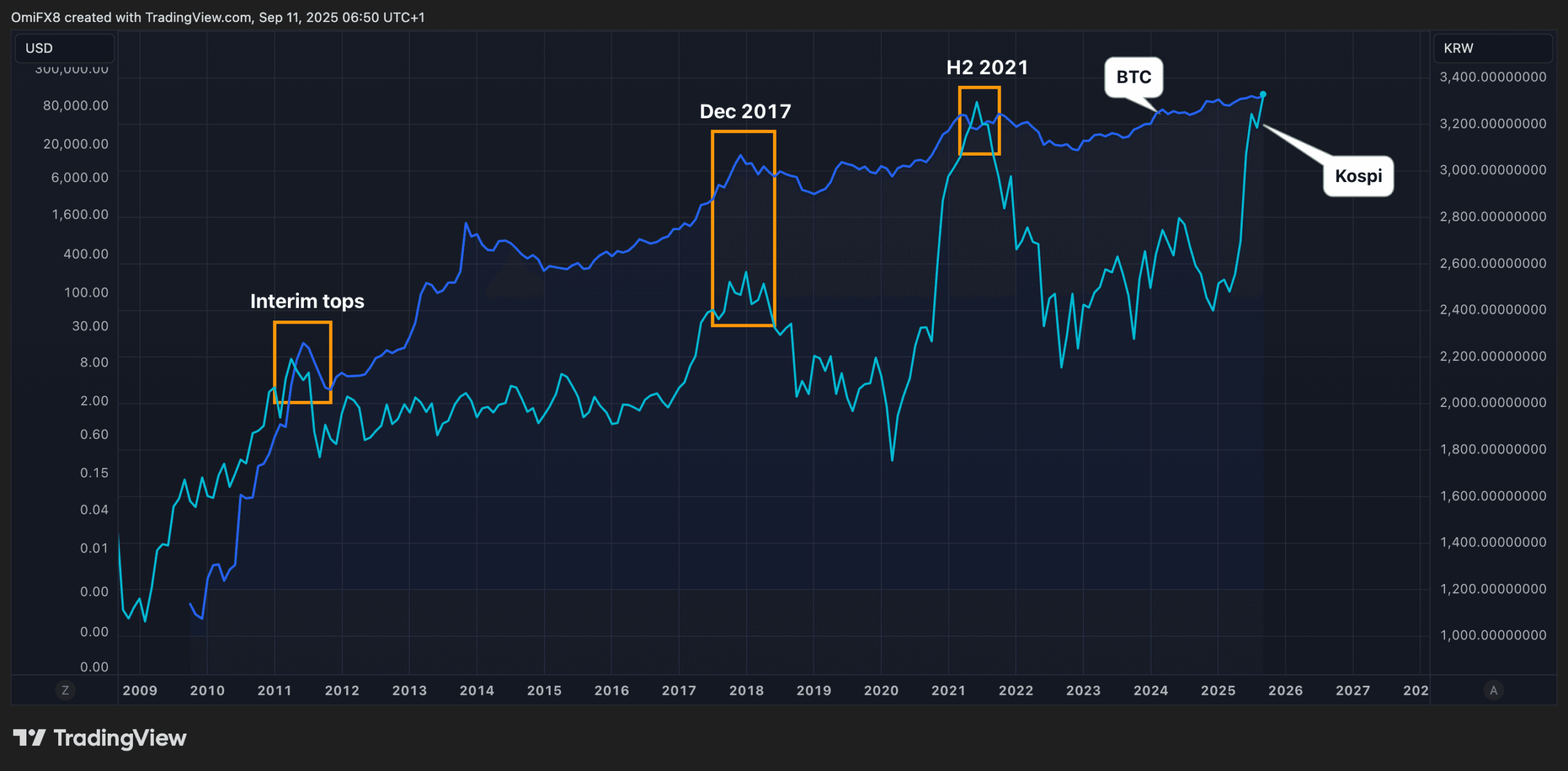

“Each time the Kospi has set a brand new file excessive, Bitcoin was buying and selling near its all-time excessive of the cycle. The final time this occurred was again in 2021,” crypto analytics platform Alphractal stated on X.

The chart signifies that the Kospi reached its peak within the second half of 2021. BTC additionally peaked nearer to $70,000 in November that yr, finally falling right into a year-long bear market.

An analogous sample emerged in late 2017, with concurrent peaks within the two belongings. Additionally observe the concurrent interim tops round June and July 2011.

Incremental sign

The sample, although restricted to help definitive conclusions, warrants consideration, because it underscores the shared sensitivity of Kospi and BTC to international risk-on/risk-off flows and shifts in investor danger urge for food and macroeconomic circumstances.

When danger sentiment is optimistic, capital flows into rising market equities, such because the Kospi, which is closely export-oriented and influenced by international commerce dynamics, in addition to into riskier belongings like bitcoin.

Conversely, during times of heightened uncertainty or danger aversion, each have a tendency to say no collectively. This shut relationship highlights how Bitcoin, regardless of its distinctive traits as a digital asset, is changing into more and more intertwined with broader monetary markets and topic to comparable financial forces.

“Now that the Kospi has reached a brand new all-time excessive, it serves as one more incremental sign that the bitcoin cycle could also be nearing its conclusion. Sensible cash flows repeatedly between main economies, shops of worth, danger belongings, and—generally—extraordinarily speculative devices, like memecoins, typically with out fundamentals,” Joao Wedson, founder and CEO of Alphractal, stated.

Learn extra: Dogecoin Leads Acquire, Bitcoin Pops to $114K as M2 Setup Opens BTC Catchup Commerce