Good Morning, Asia. This is what’s making information within the markets:

Welcome to Asia Morning Briefing, a each day abstract of high tales throughout U.S. hours and an summary of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

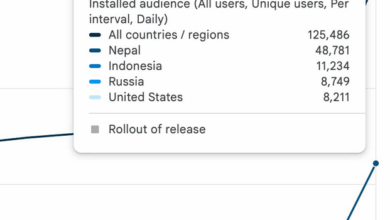

The primary indicators of how validators are leaning in Hyperliquid’s hotly contested stablecoin vote are in, and the Stripe-aligned Native Markets crew has an early lead.

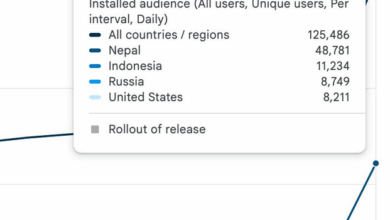

As of Thursday morning Hong Kong time, Native Markets has secured 30.8% of the delegated stake, led by heavyweight validators infinitefield.xyz (13.5%) and Alphaticks (5.2%).

Paxos Labs, the New York–regulated issuer behind PayPal’s PYUSD, sits at 7.6% with backing from B-Harvest and HyBridge. Ethena has picked up 4.5%, whereas Agora, Frax, and Sky, regardless of splashy proposals, have but to draw significant assist, although lots of the most distinguished validators have but to solid their digital vote.

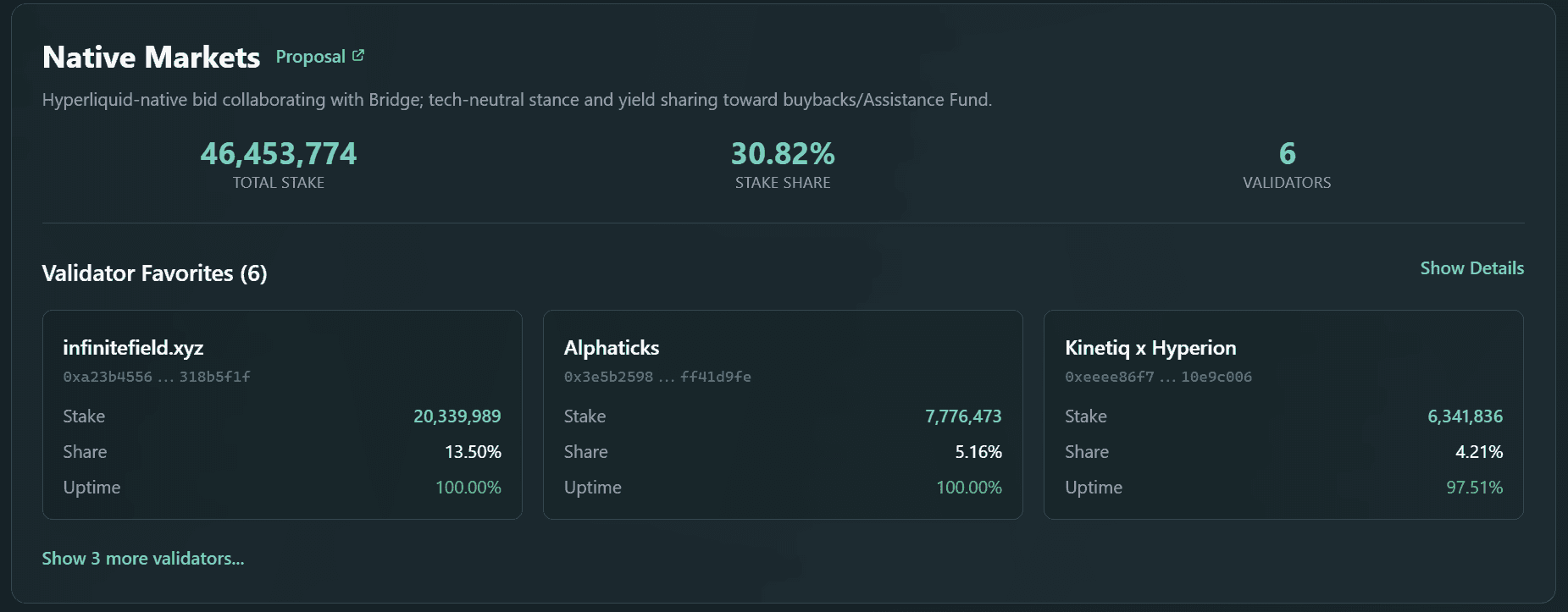

The larger image: greater than half of stake, 57%, stays unassigned.

That block consists of among the most influential validators on Hyperliquid, resembling Nansen x HypurrCollective (the one largest validator with over 18%) and Galaxy Digital. The place they finally land will determine whether or not Native Markets’ early momentum carries by means of to the September 14 deadline.

Native Markets is pitching a Hyperliquid-native stablecoin issued through Stripe’s Bridge infrastructure, promising yield-sharing to the Help Fund and HYPE buybacks.

However distinguished voices, together with Agora CEO Nick van Eck, warn that Stripe’s simultaneous push to launch its Tempo blockchain and its management of pockets supplier Privy might create conflicts.

Regardless of these criticisms, some validators seem to view Stripe’s international fee rails as a compelling benefit.

What’s at stake is way over simply one other token launch. Hyperliquid at the moment holds $5.5 billion in USDC deposits, round 7.5% of the stablecoin’s provide.

Changing that with USDH would redirect a whole bunch of hundreds of thousands in annual Treasury yield. Paxos has pledged 95% of reserve earnings to HYPE buybacks, Frax promised 100% of yield on to customers, Agora provided 100% of internet yield alongside institutional custodianship, and Sky (ex-MakerDAO) proposed 4.85% returns plus a $25 million “Hyperliquid Star” venture to bootstrap DeFi on the chain.

Hyperliquid already instructions almost 80% of decentralized perpetuals buying and selling. Whichever issuer wins the USDH contract gained’t simply be minting a stablecoin, they’ll be wiring themselves into the monetary spine of one in every of crypto’s fastest-growing exchanges.

Market Motion:

BTC: Presently buying and selling at $114,053, up 2.6% prior to now 24 hours and a couple of.1% over the previous week, although nonetheless down 3.9% for the month. The transfer displays a short-term rebound fueled by constructive danger sentiment and regular demand, at the same time as longer-term consolidation continues.

ETH: ETH is buying and selling at $4,373.99, up 2%, as buyers shrug off a mass-slashing occasion that penalized over 30 validators.

Gold: Gold held close to $3,635 an oz after Tuesday’s $3,674 peak as buyers await U.S. inflation information that might form Fed cuts, whereas ANZ raised its year-end gold goal to $3,800 and sees a peak close to $4,000 by June on sturdy funding demand and central-bank shopping for.

Nikkei 225: Asia-Pacific markets opened blended Thursday, with Japan’s Nikkei 225 up 0.23% and the Topix down 0.18%, after Wall Avenue hit report highs on Fed rate-cut hopes and upbeat inflation information.

S&P 500: The S&P 500 rose 0.3% to a report 6,532.04 Wednesday after an sudden drop in wholesale costs bolstered hopes for a Fed fee minimize subsequent week.

Elsewhere in Crypto:

- Trump’s CFTC Hopeful Quintenz Takes His Dispute With Tyler Winklevoss (Very) Public (CoinDesk)

- Polygon rolls out exhausting fork to deal with finality bug inflicting transaction delays (The Block)

- Activist investor Elliott Administration says crypto is dealing with an ’inevitable collapse’ after its ‘perceived proximity to the White Home’ inflated a bubble (Fortune)