Crypto trade Gemini lifted the worth vary for its preliminary public providing to $24 to $26 per share, establishing a debut that might worth the corporate at about $3.2 billion, in line with a submitting this week.

The New York-based trade, run by Cameron and Tyler Winklevoss, beforehand aimed for a spread of $17 to $19. The share depend stays unchanged at 16.7 million.

On the prime finish, Gemini would increase roughly $435 million, up from about $317 million underneath its earlier aim.

Nasdaq partnership

Nasdaq has agreed to take a position $50 million within the IPO, highlighting institutional backing for the crypto trade because it prepares to go public underneath the ticker GEMI.

The partnership is seen as a vote of confidence in Gemini’s long-term prospects and a sign of Wall Road’s rising acceptance of digital asset platforms.

The IPO comes amid a flurry of fintech listings and renewed urge for food for digital-asset firms. Nonetheless, investor enthusiasm will hinge on Gemini’s potential to stabilize its funds whereas navigating an evolving regulatory setting.

Do not Get Left Holding the Bag

Be part of The Crypto Investor Blueprint — 5 days of pro-level methods to turbocharge your portfolio.

Dropped at you by CryptoSlate

CFTC nominee allegations

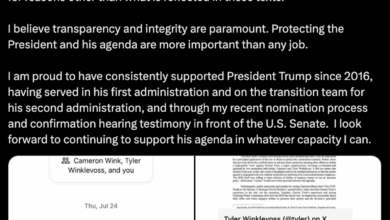

The IPO can also be going down in opposition to the backdrop of contemporary regulatory controversy after President Donald Trump’s CFTC chair nominee Brian Quintenz alleged that Tyler Winklevoss tried to sway his affirmation after failing to provoke a evaluation of Gemini’s long-running dispute with the company.

Quintenz launched personal textual content messages displaying Winklevoss sharing Gemini’s grievance in opposition to the CFTC Inspector Basic, which accused the regulator of pursuing unfair enforcement actions.

Quintenz mentioned he refused to vow favorable remedy, committing solely to handle the matter “totally and pretty” if confirmed. Within the messages, Winklevoss expressed frustration over what he described as years of selective enforcement and urged Quintenz to align with Trump’s push to reform regulatory oversight.

The disclosure, made simply days earlier than Gemini’s market debut, highlights the corporate’s excessive stakes because it seeks to persuade traders and regulators of its stability.