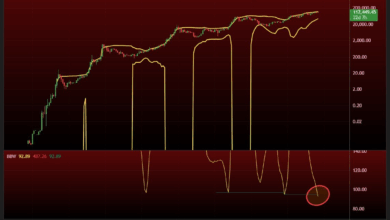

New batches of cryptocurrency exchange-traded funds (ETFs) from REX and Osprey have cleared the US Securities and Change Fee’s (SEC) 75-day assessment window and are anticipated to start buying and selling by Friday, in accordance with Bloomberg Intelligence analyst Eric Balchunas.

“Submit-effective signifies that it’s going to launch, principally,” Balchunas instructed Cointelegraph in a telephone interview, referring to the lineup that features the REX-Osprey Bonk ETF, Trump ETF, Bitcoin ETF, XRP ETF and Doge ETF.

Cointelegraph beforehand reported that the Doge ETF was slated to debut on Thursday, with timing decided by its construction below the Funding Firm Act of 1940. In contrast to merchandise filed below the Securities Act of 1933 — which was used to approve spot Bitcoin (BTC) ETFs final yr — 1940 Act funds face an easier path to market.

“This can be a ‘40 Act, which doesn’t instantly make investments totally in spot,” Balchunas mentioned. “As long as the SEC doesn’t say something, you possibly can let it launch 75 days after submitting.”

Except the SEC raises a last-minute objection, the funds are set to record this week, Balchunas mentioned.

Most US ETFs are organized below the ’40 Act, functioning as open-end funding corporations that may maintain securities akin to futures-based funds. Against this, ’33 Act ETFs are usually used for bodily backed commodities, together with spot Bitcoin and gold merchandise.

Associated: Dogecoin ETF pushes crypto business to embrace hypothesis

SEC delays resolution on different ETFs

Whereas the REX-Osprey funds stay on monitor to launch this week, the SEC has delayed rulings on a number of high-profile ETF purposes from Franklin Templeton, BlackRock and Constancy.

In notices revealed on Wednesday, the SEC mentioned it wants extra time to guage proposals that embrace permitting staking for Ether (ETH) inside the funds. The company additionally postponed choices on purposes for XRP (XRP) and Solana (SOL) ETFs.

Earlier this week, the SEC pushed again its choices on Bitwise’s proposed Dogecoin ETF and Grayscale’s Hedera ETF, setting a brand new deadline of Nov. 12, as Cointelegraph reported.

The delays come roughly a month after the SEC clarified that sure liquid staking actions fall outdoors securities legal guidelines and, subsequently, past its oversight. In Could, the company additionally concluded that proof-of-stake blockchains, in and of themselves, don’t represent securities.

Associated: legally stake crypto in 2025 below the SEC’s new guidelines