Welcome to The Protocol, CoinDesk’s weekly wrap of an important tales in cryptocurrency tech growth. I’m Margaux Nijkerk, a reporter at CoinDesk.

On this challenge:

- SwissBorg’s SOL Earn Pockets Exploited for $41.5M After Associate’s API Is Compromised

- Ledger CTO Warns of NPM Provide-Chain Assault Hitting 1B+ Downloads

- Backpack Opens Regulated Perpetuals Alternate in Europe After FTX EU Acquisition

- Polygon PoS Sees Transaction Finality Lag, Patch in Progress

Community Information

SWISSBORG’S SOL EARN WALLET EXPLOITED: Crypto trade SwissBorg stated about 192,600 SOL ($41.5 million) was stolen from an exterior pockets used completely for its SOL Earn technique. The exploit stemmed from a companion’s compromised software programming interface (API), a mechanism that permits software program programs to speak with each other, affecting a single counterparty, the trade stated in a submit on X. It was not a hack of the SwissBorg platform. The loss affected fewer than 1% of customers and represented about 2% of SwissBorg’s complete property, the agency stated. All different funds and techniques stay safe, and person balances throughout the SwissBorg app are unaffected. SOL Earn redemptions are paused whereas restoration efforts proceed. SwissBorg says it can cowl any shortfall, making certain no person losses. The corporate is working with white-hat hackers, safety corporations and legislation enforcement to recuperate the funds. A full incident report will comply with as soon as investigations conclude. This exploit arrives amid a pointy rise in crypto thefts, with over $2.17 billion already stolen in 2025. — Shaurya Malwa Learn extra.

LEDGER CTO WARNS OF PNM ATTACK: Charles Guillemet, the chief expertise officer at {hardware} pockets maker Ledger, warned on X {that a} large-scale provide chain assault was underway after a good developer’s Node Bundle Supervisor (NPM) account was compromised. In line with Guillemet, the malicious code — already pushed into packages with over 1 billion downloads — is designed to silently swap crypto pockets addresses in transactions. Which means unsuspecting customers may ship funds on to the attacker with out realizing it. Guillemet didn’t identify the developer whose account he stated was compromised. The incident underscores how deeply interconnected open-source software program is and why safety lapses in developer instruments can ripple into the crypto economic system virtually immediately. A day later, Guillemet shared that nearly zero crypto customers had been affected by the hack. “NPM is a device generally utilized in software program growth utilizing JavaScript, which makes integrating packages straightforward for builders,” stated Guillemet in a message to CoinDesk. When an attacker compromises a developer’s account, they will slip malicious code into broadly used packages. “The malicious code makes an attempt to empty customers by swapping addresses utilized in transaction or basic on-chain exercise and changing them with the hacker’s tackle,” Guillemet added. — Margaux Nijkerk Learn extra.

BACKPACK EU GOES LIVE FOLLOWING FTX EU ACQUISITION: Backpack Alternate, a worldwide cryptocurrency buying and selling platform, stated its European division, Backpack EU, is formally reside. Working out of Cyprus and licensed underneath the European Union’s MiFID II framework, the trade is positioning itself as one of many first absolutely regulated venues in Europe to supply crypto derivatives, beginning with perpetual futures. “So far as I am conscious, it is simply going to be us and Kraken” in Europe providing perpetual futures, Armani Ferrante, the CEO of Backpack, stated in an interview with CoinDesk. The debut follows Backpack’s acquisition of FTX EU earlier this yr. In January, the FTX chapter property stated the sale of FTX EU to Backpack was not licensed. Since then, the problem has been resolved and in April the trade started distributing funds to former FTX EU prospects, fulfilling their pledge to compensate customers affected by the collapse of Sam Bankman-Fried’s crypto empire. Backpack EU will present customers entry to over 40 buying and selling pairs with as much as 10x leverage, the staff stated in an announcement. The platform says it goals to offer each retail and institutional merchants a compliant gateway to superior crypto buying and selling merchandise. The rollout additionally highlights Backpack’s broader technique of rebuilding belief in digital property following a string of trade failures. — Margaux Nijkerk Learn extra.

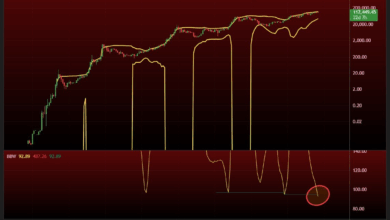

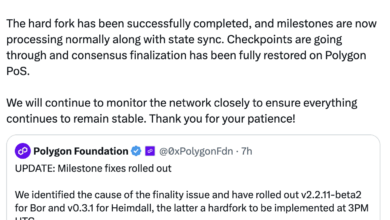

POLYGON POS CHAIN EXPERIENCES FINALITY LAG: Polygon’s proof-of-stake chain is reside, however transactions are taking longer than traditional to lock in, with finality operating 10–quarter-hour delayed. Finality is the reassurance {that a} transaction or piece of information is irreversible as soon as confirmed and added to a block within the blockchain. The muse stated in an X submit {that a} repair has been recognized and is being rolled out to validators and repair suppliers. The slowdown was tied to points on some Bor/Erigon nodes and RPC suppliers, in accordance with Polygon’s standing web page. Node restarts resolved the issue for a lot of validators, whereas others needed to rewind to the final finalized block earlier than resyncing, a standing web page shared. The disruption comes weeks after Polygon’s Heimdall v2 improve promised 5-second finality by a modernized consensus stack. – Shaurya Malwa Learn extra.

In Different Information

- World Liberty Monetary (WLFI), the crypto protocol linked to Donald Trump and his household, blacklisted Tron founder and key investor Justin Solar’s blockchain tackle, stopping him transferring WLFI tokens. The transfer impacts 595 million unlocked WLFI tokens held on the tackle, price roughly $107 million at present costs, in accordance with Arkham information. The motion adopted the Solar-linked tackle making a number of outbound transactions of WLFI tokens on the Ethereum blockchain — together with one for $9 million price of the tokens — blockchain information exhibits. Solar, in a translated submit on X, stated that the “tackle solely performed a couple of generic trade deposit assessments, with very low quantities, after which created tackle dispersion, with out involving any shopping for or promoting, which couldn’t probably have any influence in the marketplace.” In a later assertion Solar urged the WLFI staff to unblock his tokens. — Sam Reynolds Learn extra.

- Decentralized finance protocol Ethena submitted a proposal to challenge Hyperliquid’s forthcoming stablecoin, becoming a member of a bidding competitors that has already attracted corporations together with Paxos, Sky, Frax and Agora. The token can be absolutely backed by Ethena’s USDtb, a stablecoin issued with federally chartered financial institution Anchorage Digital and absolutely backed by BUIDL, the tokenized cash market fund by asset administration big BlackRock and Securitize. If adopted, Ethena pledged that 95% of internet income from USDH reserves would circulate again to the Hyperliquid ecosystem, the proposal stated. Ethena additionally stated it will cowl the prices of migrating current USDC buying and selling pairs on Hyperliquid to USDH to ease adoption. — Kristzian Sandor Learn extra.

Regulatory and Coverage

- Nasdaq, the U.S. trade the place the tech sector’s largest names record their shares, is searching for to place equities on the blockchain, asking the U.S. Securities and Alternate Fee to bless its effort whilst others within the securities world are sprinting towards the identical tokenization aim.If the SEC submitting is accredited, the trade will let prospects select both the normal route for buying and selling equities or achieve this on-chain with tokenized shares — an possibility that might be handled with the identical precedence because the legacy technique. The transfer by Nasdaq follows an effort by digital brokerage Robinhood to challenge inventory tokens for European prospects in July, giving entry to some 200 U.S. shares and exchange-traded funds (ETFs). Bringing equities and different real-world property onto blockchain rails has been among the many most scorching of the digital-asset world’s improvements, and the competitors has been rising fierce for each conventional finance names and crypto natives to make strikes. — Jesse Hamilton Learn extra.

- President Donald Trump’s new crypto man, Patrick Witt, is choosing up the baton from his predecessor, Bo Hines, in goading lawmakers to complete sweeping U.S. crypto insurance policies and pushing regulators to place the brand new stablecoin legislation into apply, he stated in an interview with CoinDesk. Working underneath the administration’s crypto czar, David Sacks, Witt is the brand new level of contact for crypto issues within the White Home after the temporary tenure of his predecessor, who went on to work for stablecoin big Tether. Whereas Hines noticed the conversion of Congress’ stablecoin effort into legislation and was in a position to attend the White Home ceremony to cement it, he left shortly after, leaving a prolonged crypto to-do record for Witt.”There isn’t any drop off right here,” stated Witt, who was elevated to the job final month, simply two weeks after the administration issued its wide-reaching technique report for tackling U.S. crypto coverage. “We’re protecting the pedal to the metallic with all the completely different initiatives on the legislative entrance and the interagency actions beneficial within the report.” — Jesse Hamilton Learn extra.

Calendar

- Sept. 22-28: Korea Blockchain Week, Seoul

- Oct. 1-2: Token2049, Singapore

- Oct. 13-15: Digital Asset Summit, London

- Oct. 16-17: European Blockchain Conference, Barcelona

- Nov. 17-22: Devconnect, Buenos Aires

- Dec. 11-13: Solana Breakpoint, Abu Dhabi

- Feb. 10-12, 2026: Consensus, Hong Kong

- Mar. 30-Apr. 2: EthCC, Cannes

- Might 5-7, 2026: Consensus, Miami