August put a small dent in what stays a longer-term uptrend for digital property. Bitcoin fell about 6.5% — its first month-to-month decline since March — after briefly touching a brand new all-time excessive of $125,000 mid-month. Ether, in contrast, prolonged its sturdy run, gaining almost 19% and lifting its share of total market capitalization to roughly 13%. This rotation from bitcoin into ether was additionally seen in ETFs: bitcoin funds noticed uncommon web outflows, suggesting some profit-taking after this 12 months’s extraordinary rally, whereas ether ETFs attracted heavy inflows that pushed property beneath administration to report ranges. In consequence, bitcoin dominance slipped to its lowest level since January, leaving the general market capitalization of digital property roughly flat on the month.

Regardless of this sideways efficiency, market exercise remained elevated. Spot buying and selling volumes held above their twelve-month common — uncommon for the sometimes quiet summer time season — and derivatives markets had been simply as energetic. Open curiosity in bitcoin and ether choices reached new highs, and August set a report for BTC choice buying and selling volumes at $145 billion. Implied volatility stayed comparatively subdued however did tick up towards month-end, hinting that the choices market could also be underestimating threat.

Whereas bitcoin paused, gold was on a tear. An ideal storm of falling fee expectations, persistent core inflation, widening commerce deficits, a weaker greenback, geopolitical dangers and mounting political uncertainty propelled the yellow metallic to successive report highs. The dismissal of Fed Governor Lisa Cook dinner by the Trump administration additional stirred considerations over the long-term independence of the Federal Reserve. Treasury yields hardly budged, however gold — as a conventional hedge in opposition to inflation and systemic threat — jumped sharply. Bitcoin, nonetheless, traded decrease on the day the information broke.

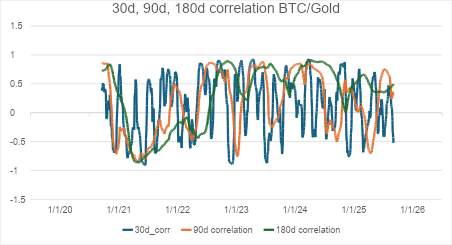

This raises the perennial query of whether or not bitcoin really deserves the label “digital gold.” Its shortage and libertarian origins assist the analogy, however the knowledge tells a extra nuanced story. Brief-term correlations between bitcoin and gold have been inconsistent, oscillating round 12% and 16% on each 30- and 90-day home windows. Over longer horizons (180d), the common correlation is barely increased, however nonetheless low. In different phrases, the 2 property haven’t reliably moved collectively. Nevertheless, since 2024, the common 180-day rolling correlation has proven a significant uptick to round 60%. The impact is seen on shorter horizons as nicely, although much less pronounced. One cheap interpretation is that the ‘digital gold’ narrative is starting to achieve firmer footing with traders because the asset class matures.

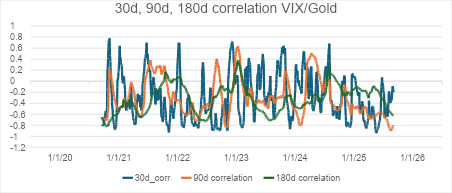

It’s also value remembering that gold itself has an imperfect observe report as a macro and inflation hedge. It doesn’t observe shopper costs month by month, although over a long time it has preserved buying energy higher than most property. Analysis additionally exhibits that gold can function a protected haven throughout episodes of maximum fairness stress, however not all the time, as its combined relationship with the VIX illustrates.

For bitcoin, the narrative continues to be in flux. Some traders view it as a know-how play; others see it as an rising macro hedge. We consider the latter will show extra sturdy over time. In contrast to different blockchains, Bitcoin’s restricted scalability, inflexible governance and lack of Turing completeness imply it’s unlikely to develop into a multi-application platform. Different protocols are much better suited to that position. As an alternative, bitcoin’s long-term worth proposition rests on its shortage and neutrality— options that echo gold’s financial position.

In fact, such narratives take time to solidify. Gold required millennia to develop into broadly accepted as a retailer of worth. Bitcoin, by comparability, is barely sixteen years previous, but it has already achieved exceptional ranges of recognition and adoption. The “digital gold” analogy will not be totally supported by the information at the moment, however it’s far too early to dismiss it. If something, historical past means that the story continues to be being written.

Authorized Disclaimer

Data offered, displayed, or in any other case supplied is for academic functions solely and shouldn’t be construed as funding, authorized, or tax recommendation, or a suggestion to promote or a solicitation of a suggestion to purchase any pursuits in a fund or different funding product. Entry to the services of Lionsoul World Advisors is topic to eligibility necessities and the definitive phrases of paperwork between potential shoppers and Lionsoul World Advisors, as they might be amended infrequently.