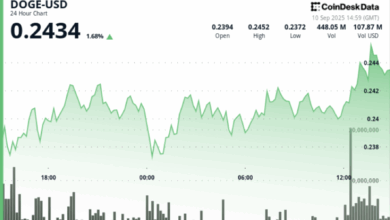

The primary US Dogecoin (DOGE) exchange-traded fund (ETF) is ready to launch Thursday, dividing trade voices between these calling it a breakthrough for crypto’s community-driven legitimacy and people dismissing it as hypothesis in a brand new wrapper.

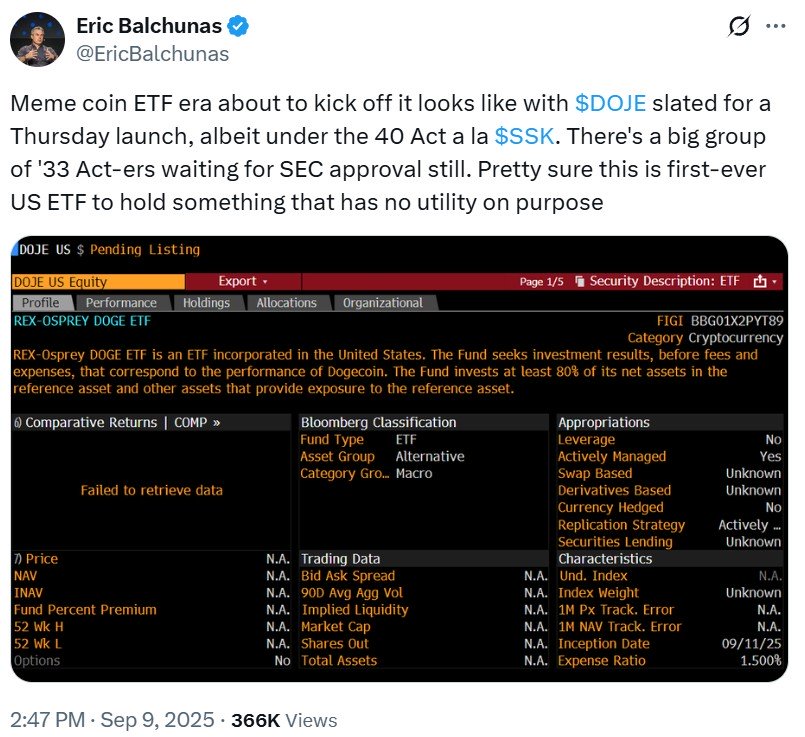

In contrast to Bitcoin ETFs permitted below the Securities Act of 1933, the Rex-Osprey Dogecoin ETF (DOJE) received approval below the Funding Firm Act of 1940, a framework sometimes used for mutual funds and diversified ETFs.

BlackRock’s spot crypto fund, for example, merely holds Bitcoin (BTC) in Coinbase custody. DOJE as a substitute positive factors publicity by means of a Cayman Islands subsidiary and derivatives because the 1940 act requires diversification and restricts single-asset focus.

Crypto ETF debuts are often celebrated by the trade, however critics argue {that a} memecoin fund institutionalizes hypothesis — whereas charging charges that buyers might keep away from by shopping for Dogecoin immediately. Some additionally level to the irony that Dogecoin, which was created as a joke, has leapfrogged tasks with extra tangible use instances to the ETF stage.

Do we’d like a Dogecoin ETF?

Dogecoin is a descendant of Bitcoin. It was created in 2013 as a fork of Luckycoin, a fork of Litecoin, which is a fork of Bitcoin. Whereas it started as a joke, it has since grown right into a top-10 cryptocurrency by market capitalization.

Lengthy embraced by retail merchants, Dogecoin additionally spawned the broader memecoin class, typically criticized for its casino-like nature. That makes its approval for an ETF particularly controversial.

An ETF lets buyers achieve publicity to Dogecoin by means of the inventory market, however not everybody sees the purpose.

“These ETFs are charging off-the-charts charges when you possibly can merely create a Coinbase account in 5 minutes, purchase the token and by no means be charged an expense ratio,” Brian Huang, co-founder and CEO of crypto administration platform Glider, instructed Cointelegraph.

He added that institutional buyers usually tend to prioritize “official” and revenue-generating tokens.

Associated: How plushies saved Pudgy Penguins from chapter

Dogecoin has elevated some crypto buyers into millionaires in its historical past. However its value is in a relentless battle with inflation. Dogecoin’s tokenomics had been designed as a satire of Bitcoin’s shortage. As a substitute of a 21-million-coin cap, Dogecoin is limitless and points a ten,000-DOGE block reward each minute. Meaning about 5 billion new cash are minted yearly.

Throughout previous memecoin booms, analysts warned that such belongings diverted capital and a spotlight from extra critical blockchain tasks. Some see the ETF as reinforcing that drawback.

“It’s wild to see a memecoin front-run critical tasks to the ETF end line,” Douglas Colkitt, a founding contributor at layer-1 blockchain Fogo, instructed Cointelegraph.

“An ETF wrapper doesn’t change the basics; it simply lets Wall Road pump DOGE with a straight face.”

Dogecoin doesn’t open up a crypto ETF free-for-all

By the tip of August, 92 crypto ETPs had been awaiting SEC selections from the Securities and Trade Fee within the US. Dogecoin merchandise had been amongst them, alongside different memecoin functions akin to Pengu, the token tied to the non-fungible token (NFT) model Pudgy Penguins.

“Dogecoin could have began as a joke, nevertheless it’s change into a critical altcoin that’s introduced actual buyers and engineers into the area,” stated Mike Maloney, CEO and founding father of Incyt. “Group engagement is as actual for a coin as it’s for a inventory.”

Whereas critics like Colkitt expressed frustration {that a} memecoin is front-running extra critical tasks, others argue its success displays crypto’s neighborhood dynamics. Maja Vujinovic, CEO of Digital Property at FG Nexus, instructed Cointelegraph that Dogecoin leapfrogging different altcoins reveals how communities can push belongings into regulated constructions.

“If DOGE is first, it’s much less about technical roadmaps and extra about acknowledging that communities themselves can push belongings into regulated constructions. That’s an vital sign regulators are responding to social momentum as a lot as market cap,” she stated.

Associated: Retail merchants lose when OTC token offers win: Right here’s why

In contrast to many altcoins, Dogecoin has typically been within the mainstream highlight. Tesla CEO Elon Musk’s tweets in 2021 despatched its value hovering, and a US authorities division he as soon as led was even dubbed the Division of Authorities Effectivity, or DOGE. The token has additionally endured a number of bear markets, giving it a degree of resilience and maturity that different memecoins lack.

“The ETF pathway received’t be a free-for-all; liquidity, surveillance and custody readiness nonetheless set the bar. However extra tokens will discover their means into regulated wrappers, which broadens adoption,” Vujinovic added.

On Tuesday, the SEC delayed its choice on the Bitwise Dogecoin ETF, extending the evaluation window to Nov. 12.

Dogecoin ETF blurs the road between meme and market

A Dogecoin ETF forces the trade to confront whether or not embracing hypothesis and tradition is a part of the package deal.

Skeptics argue the brand new fund leans too far towards the latter. For Huang, the thought of wrapping a single token in an ETF is “ridiculous,” the equal of packaging a lone inventory as a diversified product. To him, the Wall Road wrapper does little greater than institutionalize a meme whereas charging buyers charges they might simply keep away from by shopping for DOGE immediately.

Others counter that type issues as a lot as operate. Vujinovic factors out that an ETF doesn’t alter Dogecoin’s code or goal, nevertheless it does layer in custody, audits and disclosure necessities that add legitimacy for mainstream buyers.

Colkitt sees the event as each promise and parody. If a memecoin could make it right into a regulated ETF, then “something is on the desk.” That would open doorways for adoption but additionally highlights how crypto continues to blur the road between breakthrough monetary innovation and pure leisure.

In that sense, DOJE doesn’t reply whether or not memes belong in critical markets, nevertheless it reveals that regulators and buyers alike are prepared to deal with them as in the event that they do.

Rex-Osprey has extra memecoin ETFs within the pipeline, with SEC filings outlining merchandise tied to Official Trump (TRUMP) and Bonk (BONK), together with altcoins XRP (XRP) and Solana (SOL).

Journal: Can Robinhood or Kraken’s tokenized shares ever be actually decentralized?