By Omkar Godbole (all occasions ET until acknowledged in any other case)

Simply 10 days after the U.S. Division of Commerce began posting financial knowledge on a collection of blockchains, the reliability of its knowledge is being questioned by some observers.

On Tuesday, the U.S. Bureau of Labor Statistics disclosed a startling determine: The financial system created practically 1 million fewer jobs than reported within the yr ended March. The document revision calls into query earlier optimism concerning the power of the labor market, casting doubt on all risk-on positions merchants took previously yr or so.

Markets interpreted the downward revisions as one other signal the Fed will introduce aggressive easing within the coming months. One common Polymarket dealer is betting that the Fed will lower charges by 50 foundation factors on Sept. 17.

Bitcoin is buying and selling above $112,000, having reached lows of round $110,800 throughout North American buying and selling hours yesterday. European shares are greater with the S&P 500 futures pointing to a optimistic open later Wednesday.

Nonetheless, warning could also be warranted for 2 causes: The U.S. producer worth and client worth indices due within the subsequent 24 hours are prone to present that inflation stays elevated and properly above the Fed’s 2% goal. Stagflation considerations might grip the market, weakening the case for aggressive Fed easing, if these knowledge units blow previous expectations.

The second motive is that the liquidity tightening is underway.

“Liquidity is tightening because the Treasury Normal Account rises and the reverse repo facility drains, pushing reserve balances decrease,” Mott Capital Administration stated. “With SOFR climbing, spreads widening, and credit score stress displaying up, the market might quickly face renewed strain on danger property.”

That is most likely the rationale why put choices tied to bitcoin and ether proceed to commerce pricier than calls on Deribit, reflecting draw back considerations.

In different information, crypto staking platform Kiln stated it’s exiting its Ethereum validators resulting from an exploit incident that affected SwissBorg.

Actual-world asset protocols proceed to develop, with a complete worth locked of now over $15 billion.

Lastly, a single entity earned $200 million from the MYX airdrop. Discuss windfall achieve. Keep alert!

What to Watch

- Crypto

- Macro

- Sept. 10, 8 a.m.: Brazil August CPI. Inflation charge YoY Est. 5.1%, MoM Est. -0.15%.

- Sept. 10, 8:30 a.m.: U.S. August PPI YoY Est. 3.3%, MoM Est. 0.3%. Core YoY Est. 3.5%, MoM Est. 0.3%.

- Earnings (Estimates based mostly on FactSet knowledge)

Token Occasions

- Governance votes & calls

- Unlocks

- Sept. 11: Aptos to unlock 2.2% of its circulating provide price $50.89 million.

- Token Launches

- Sept. 10: Linea (LINEA) to be listed on Binance Alpha, KuCoin, MEXC, KuCoin, Bitget OKX, CoinW, and others.

- Sept. 10: Kong to be listed on KuCoin.

Conferences

The CoinDesk Coverage & Regulation Convention (previously generally known as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that permits normal counsels, compliance officers and regulatory executives to fulfill with public officers liable for crypto laws and regulatory oversight. Area is restricted. Use code CDB15 for 15% off your registration.

Token Speak

By Oliver Knight

- The crypto market has entered “altcoin season” regardless of sentiment remaining in bearish territory.

- CoinMarketCap’s altcoin season index has ticked as much as 59/100, topping August’s excessive of 57 as capital continues to rotate into the extra speculative tokens.

- Market intelligence platform Santiment famous that whereas costs are shifting to the upside, sentiment is changing into extra damaging.

- “Merchants have modified their tunes, swinging increasingly damaging with expectations of bitcoin falling again under $100K, Ethereum again under $3.5K, and altcoins going by a retrace interval,” Santiment wrote on X.

- Altcoins stay unperturbed with mantle (MNT) and pyth (PYTH) main the best way, gaining 15% and 10%, respectively, over the previous 24 hours.

- Bitcoin , the biggest cryptocurrency by way of market cap, continues to languish round $112,500.

- Earlier altcoin seasons have occurred when bitcoin consolidates as merchants rotated capital to speculative property with out the chance of lacking out on a serious BTC transfer.

- Bitcoin has been buying and selling between $107,000 and $113,000 for greater than two weeks after failing to interrupt past $124,000.

Derivatives Positioning

By Omkar Godbole

- BTC’s futures open curiosity (OI) has remained regular over the previous 24 hours as merchants sit on the sidelines forward of tomorrow’s U.S. CPI launch.

- OI in ETH, SOL and HYPE has elevated by over 2%, whereas XRP, SUI, ADA, and ENA have seen capital outflows.

- Annualized funding charges for high cash besides TRX and XLM are hovering at or above 10%, indicating a bullish bias however nothing out of extraordinary. In different phrases, there are not any indicators of extra leverage buildup or overheating.

- On the CME, notional open curiosity in BTC choices has climbed to a document $5.6 billion, whereas exercise in futures stays subdued.

- On Deribit, BTC and ETH places out to December expiry proceed to commerce at a premium to calls, indicating lingering draw back considerations.

- Block flows at OTC desk Paradigm featured an extended place within the ether $4,000 put expiring on Sept. 26.

Market Actions

- BTC is up 0.68% from 4 p.m. ET Tuesday at $112,296.28 (24hrs: -0.35%)

- ETH is up 0.47% at $4,325.02 (24hrs: -0.54%)

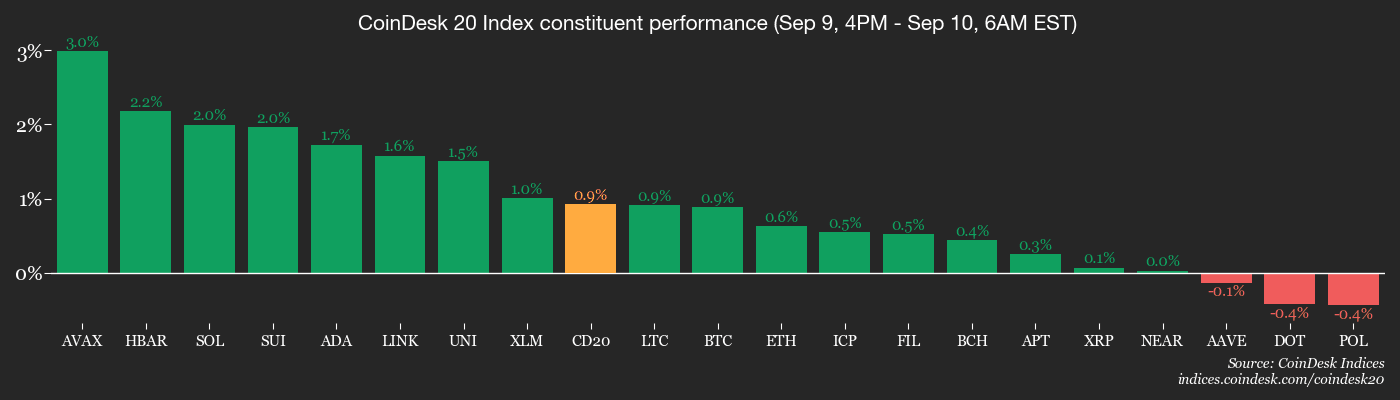

- CoinDesk 20 is up 0.87% at 4,128.56 (24hrs: -0.59%)

- Ether CESR Composite Staking Price is up 3 bps at 2.87%

- BTC funding charge is at 0.0103% (11.2785% annualized) on KuCoin

- DXY is unchanged at 97.76

- Gold futures are up 0.1% at $3,686.00

- Silver futures are up 0.65% at $41.61

- Nikkei 225 closed up 0.87% at 43,837.67

- Grasp Seng closed up 1.01% at 26,200.26

- FTSE is up 0.25% at 9,265.34

- Euro Stoxx 50 is up 0.25% at 5,382.08

- DJIA closed on Tuesday up 0.43% at 45,711.34

- S&P 500 closed up 0.27% at 6,512.61

- Nasdaq Composite closed up 0.37% at 21,879.49

- S&P/TSX Composite closed up 0.12% at 29,063.01

- S&P 40 Latin America closed unchanged at 2,800.26

- U.S. 10-Yr Treasury charge is up 1.3 bps at 4.087%

- E-mini S&P 500 futures are up 0.14% at 6,530.75

- E-mini Nasdaq-100 futures are unchanged at 23,886.50

- E-mini Dow Jones Industrial Common Index are down 0.26% at 45,640.00

Bitcoin Stats

- BTC Dominance: 58.19% (unchanged)

- Ether-bitcoin ratio: 0.03848 (-0.38%)

- Hashrate (seven-day shifting common): 992 EH/s

- Hashprice (spot): $52.47

- Complete charges: 4.61 BTC / $517,036

- CME Futures Open Curiosity: 134,650 BTC

- BTC priced in gold: 30.7 oz

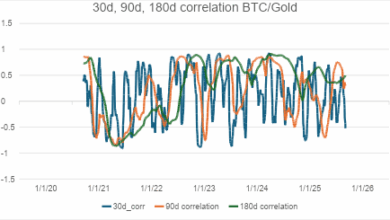

- BTC vs gold market cap: 8.68%

Technical Evaluation

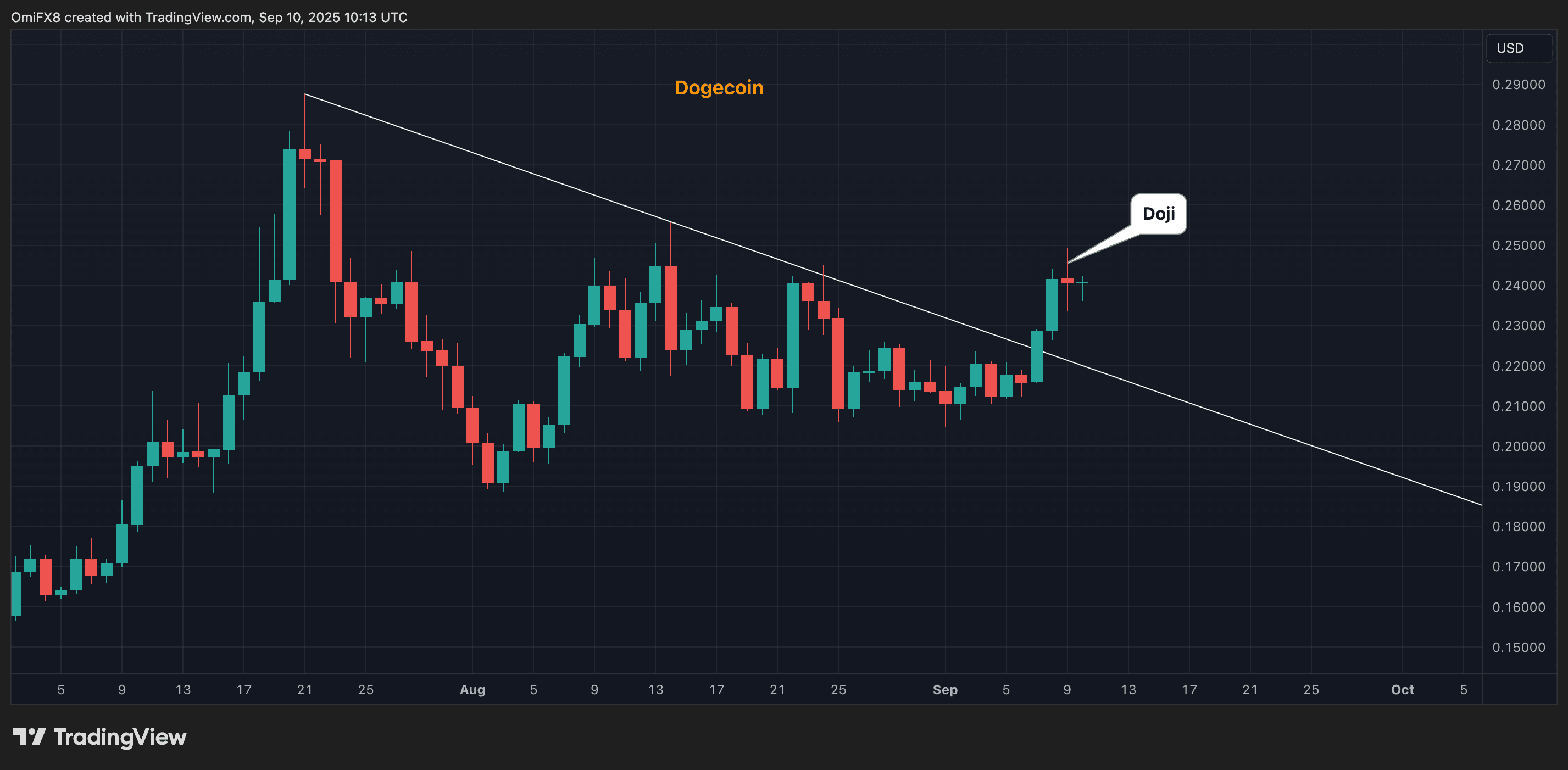

- Dogecoin printed a Doji candle Tuesday, which signifies lack of willingness amongst bulls and bears to steer the value motion.

- The emergence of Doji has neutralized the bullish outlook stemming from the descending trendline breakout confirmed Sunday.

- Tuesday’s excessive of 25 cents is the brand new stage to beat for the bulls.

Crypto Equities

- Coinbase International (COIN): closed on Tuesday at $318.78 (+5.49%), +0.56% at $320.57 in pre-market

- Circle (CRCL): closed at $117.99 (+4.92%), +1.07% at $119.25

- Galaxy Digital (GLXY): closed at $26.58 (+9.74%), +1.35% at $26.94

- Bullish (BLSH): closed at $53.81 (+7.36%), unchanged in pre-market

- MARA Holdings (MARA): closed at $15.93 (+4.8%), +0.75% at $16.05

- Riot Platforms (RIOT): closed at $15.21 (+13.17%), +0.85% at $15.34

- Core Scientific (CORZ): closed at $14.53 (+4.31%), +2.96% at $14.96

- CleanSpark (CLSK): closed at $9.67 (+5.45%), +1.03% at $9.77

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $33.13 (+11.59%)

- Exodus Motion (EXOD): closed at $26.75 (+1.71%), unchanged in pre-market

Crypto Treasury Corporations

- Technique (MSTR): closed at $328.53 (-0.42%), +0.69% at $330.80

- Semler Scientific (SMLR): closed at $28.07 (-0.78%)

- SharpLink Gaming (SBET): closed at $16.69 (+6.51%), +0.48% at $16.77

- Upexi (UPXI): closed at $5.5 (-2.83%), +3.45% at $5.69

- Mei Pharma (MEIP): closed at $2.78 (-7.33%), +4.32% at $2.90

ETF Flows

Spot BTC ETFs

- Day by day web flows: $23 million

- Cumulative web flows: $54.85 billion

- Complete BTC holdings ~1.29 million

Spot ETH ETFs

- Day by day web flows: $44.2 million

- Cumulative web flows: $12.69 billion

- Complete ETH holdings ~6.36 million

Supply: Farside Traders

Chart of the Day

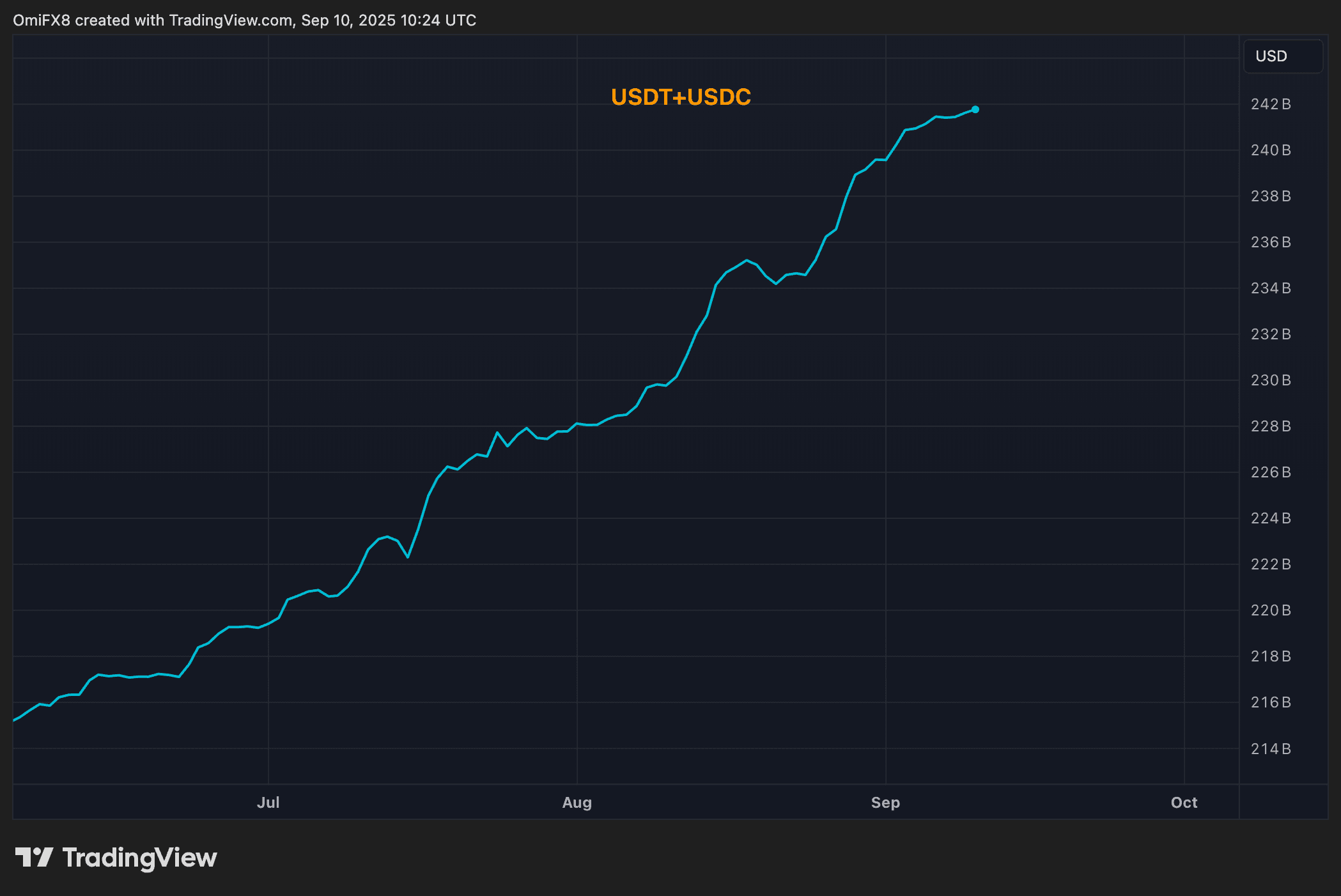

- The mixed market cap of the 2 largest stablecoins, Tether’s USDT and Circle Web’s USDC, continues to set new highs, indicating persistent demand for dollar-linked property regardless of Fed charge lower bets.

- The Fed is predicted to chop charges at its Sept. 17 assembly.

Whereas You Have been Sleeping

- Bitcoin Retakes $112K, SOL hits 7-Month Excessive as Economists Downplay Recession Fears (CoinDesk): The U.S. lower 911,000 jobs from payroll estimates for the yr ended March 2025, unsettling markets, however economists stated the revision signaled slower labor power progress somewhat than recession or stagflation.

- Gold Pushes Towards Report as Merchants Look ahead to Inflation Prints (Bloomberg): Gold rose, fueled by rate-cut expectations, central financial institution shopping for, ETF inflows, Israel’s strike in Doha and President Trump urging the EU to affix him in new tariffs on India and China.

- Choose Blocks Trump From Eradicating Fed Governor Lisa Prepare dinner (The Wall Road Journal): Choose Jia Cobb stated Prepare dinner was prone to prevail since removals have to be based mostly solely on a Fed governor’s conduct whereas in workplace, somewhat than unproven, pre-appointment allegations.

- Metaplanet to Increase $1.4B in Worldwide Share Sale, Inventory Jumps 16% (CoinDesk): Metaplanet is promoting the shares at 553 yen every, with NAKA committing to purchase $30 million price.

- Poland Says It Shot Down Russian Drones That Entered Its Airspace (The New York Occasions): Poland’s army stated Russian drones crossed its airspace throughout strikes on Ukraine, prompting Poland and NATO air forces to deploy warplanes and shut skies over Warsaw.