Key factors:

-

Bitcoin is in the course of a textbook correction section after all-time highs, Glassnode finds.

-

For correction to flip to vendor exhaustion, BTC value should drop to virtually $104,000.

-

Brief-term holders are seeing vital revenue adjustments inside the present BTC value vary.

Bitcoin (BTC) is exhibiting basic “put up euphoria consolidation” as new evaluation eyes $104,000 subsequent.

Within the Sept. 4 version of its common e-newsletter, “The Week Onchain,” crypto analytics agency Glassnode confirmed the brand new BTC value “consolidation hall.”

Bitcoin revenue “quantiles” in focus

Bitcoin value motion continues to unsettle those that really feel that the bull run ought to already be again.

Whereas gold and threat property head larger, BTC/USD is caught in a variety between 10% and 15% under its most up-to-date all-time excessive from August.

“For the reason that mid-August all-time excessive, Bitcoin has entered a risky downtrend, declining to $108k earlier than bouncing again towards $112k,” Glassnode summarizes.

“With volatility rising, the central query is whether or not this marks the beginning of a real bear market or just a short-term contraction.”

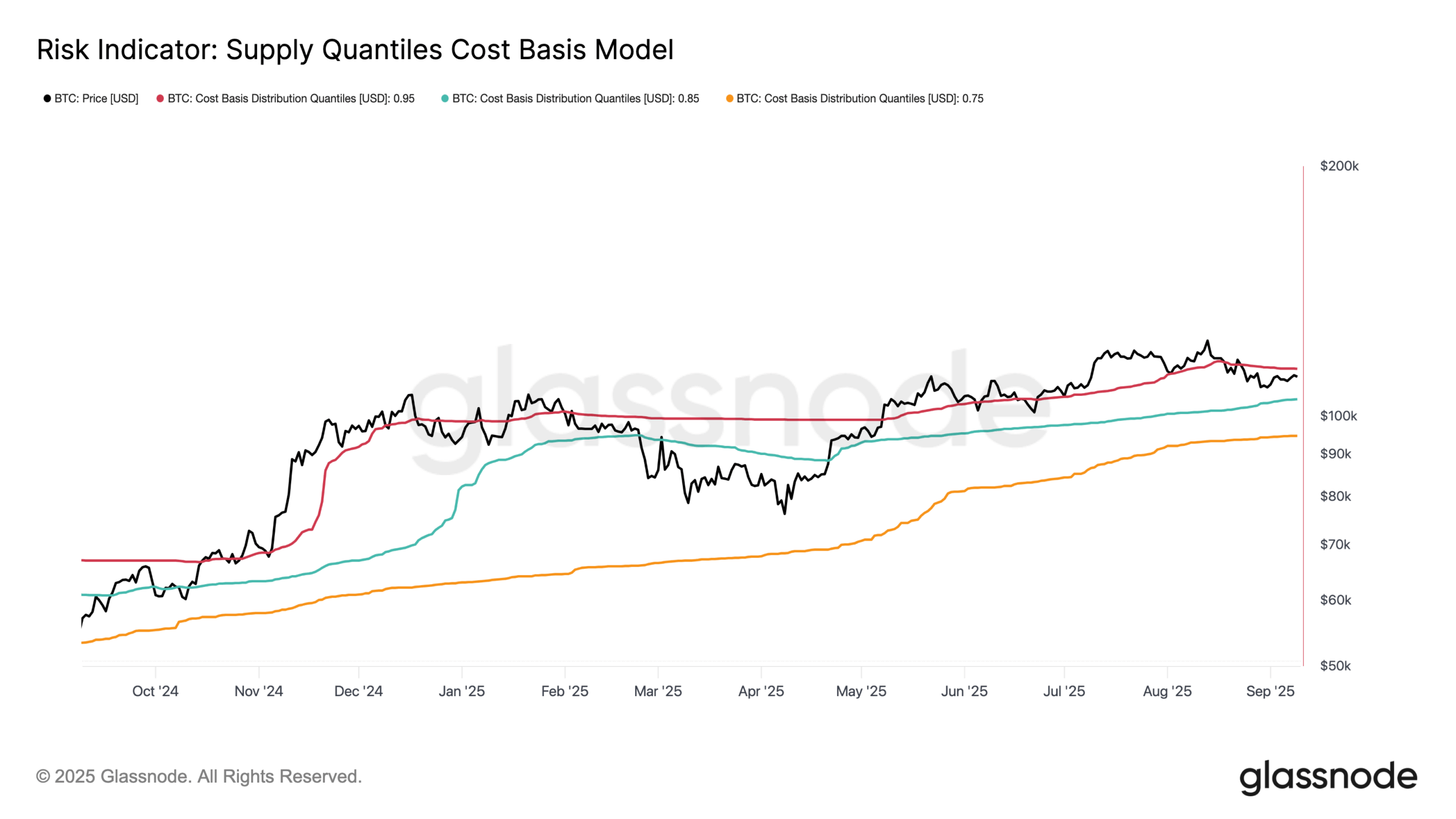

To reply that query, researchers seemed on the value at which the energetic BTC provide final moved, dividing it into varied “quantiles.”

The 0.95 quantile, which corresponds to the value at which 95% of the provision is in revenue, is of specific curiosity.

“At current, the value trades between the 0.85 and 0.95 quantile value foundation, or within the $104.1k–$114.3k vary. Traditionally, this zone has acted as a consolidation hall following euphoric peaks, usually resulting in a uneven sideways market,” The Week Onchain explains.

“Subsequently, breaking under $104.1k would replay the post-ATH exhaustion phases seen earlier on this cycle, whereas a restoration above $114.3k would sign demand discovering its footing and reclaiming management of the pattern.”

Glassnode notes that the journey to August highs marked Bitcoin’s third euphoric uptrend inside the present bull market, and that such strikes are by definition unsustainable for lengthy durations.

Speculators bounce between black and crimson

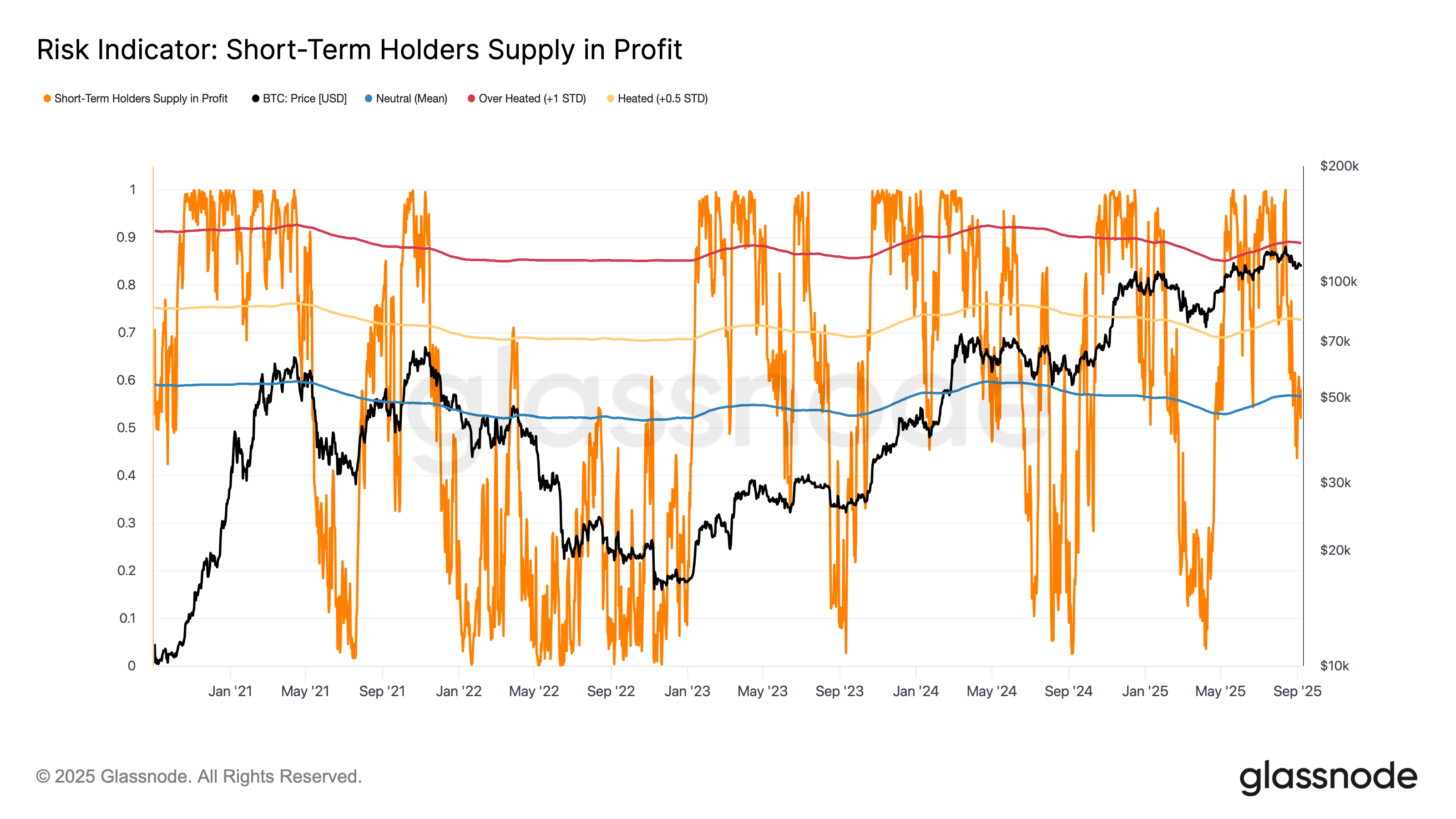

Different key costs on the radar embrace the mixture buy-in stage for Bitcoin speculators, often known as short-term holders (STHs).

Associated: Bitcoin long-term holders offload 241,000 BTC: Is sub-$100K BTC subsequent?

Outlined as entities hodling for as much as six months, these wallets historically prop up value throughout bull-market corrections.

Glassnode notes, nevertheless, that STH profitability adjustments shortly inside the present value vary.

“The share of short-term holder provide in revenue gives a transparent lens on this dynamic,” it continues.

“With the leg all the way down to $108k, their share in revenue collapsed from above 90% to simply 42%, a textbook cooling-off from an overheated state to a zone of sudden stress.”

STHs can react all of the sudden to their profitability flipping damaging, whereas shortly changing into exhausted from promoting at a loss, permitting the market to bounce.

“This sample explains the latest rebound from $108k again to $112k,” Glassnode provides concerning the newest BTC value motion.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.