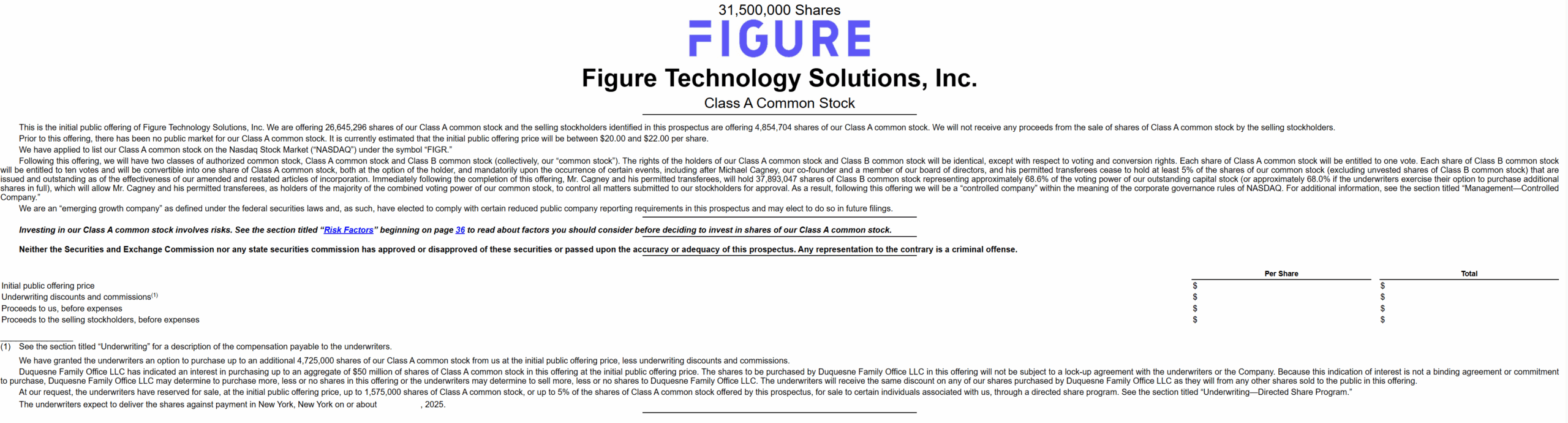

Blockchain-based lending agency Determine Expertise Options has raised the scale of its preliminary public providing (IPO), with the full deal probably reaching practically $800 million.

In line with a Tuesday submitting, the corporate is providing 26.6 million shares of Class A standard inventory at a revised value vary of $20 to $22 per share, up from an earlier vary of $18 to $20. Promoting stockholders will supply an extra 4.85 million shares, bringing the full providing to 31.5 million shares.

If underwriters train their full 4.7 million-share overallotment possibility, the full IPO dimension, together with each main and secondary shares, may attain $796 million. Nonetheless, solely the first shares, these bought by Determine, will generate proceeds for the corporate.

The first sale, which entails the 26.6 million shares issued by Determine, would generate as much as $585 million in gross proceeds. The corporate may elevate as much as $689 million if the overallotment is exercised in full. The remaining proceeds from the secondary shares will go to current shareholders.

Associated: Gemini boots IPO to $433M, goals for $3 billion valuation

Determine to strengthen merchandise

Determine intends to make use of the proceeds to strengthen its blockchain ecosystem, spend money on platform improvement, increase its digital asset marketplaces and repay a portion of excellent debt.

Particularly, the corporate plans to speed up adoption of its mortgage origination platform, Determine Join, and proceed scaling Dart, its onchain lien and eNote registry.

It additionally intends to reinforce infrastructure for its US Securities and Change Fee-registered interest-bearing stablecoin, YLDS, which Determine markets as a compliant different to conventional stablecoins that don’t supply yield.

Determine generated web revenue of $29 million within the first half of 2025 and reported complete stockholders’ fairness of $404 million as of June 30, 2025. Moreover, the corporate has an accrued deficit of $292 million.

Associated: Determine Expertise seeks $4B valuation in public itemizing as crypto IPO wave builds

Gemini upsizes IPO providing

On Tuesday, crypto trade Gemini additionally raised its IPO value vary to $24–$26 per share, aiming for a valuation above $3 billion forward of its Friday debut. The providing dimension stays at 16.67 million shares, however the anticipated elevate has jumped to $433 million from the earlier $317 million.

The Winklevoss-founded agency additionally secured Nasdaq as a backer, with the trade set to buy $50 million price of shares in a non-public placement.

Journal: Can Robinhood or Kraken’s tokenized shares ever be actually decentralized?