US banks ought to give higher rewards to draw and hold clients as a substitute of griping in regards to the risk that stablecoins pose to their earnings, says Bitwise’s funding chief Matt Hougan.

“If native banks are nervous about competitors from stablecoins, they need to pay extra curiosity on deposits,” Hougan wrote on X on Tuesday.

He added that the banks are solely nervous as a result of “they’ve been abusing depositors as a free supply of capital for many years.”

Hougan’s feedback come as Citi claimed final month that yield-bearing stablecoins may spark a wave of financial institution withdrawals, and as US banks have lobbied Congress to tighten up US stablecoin legal guidelines round paying yield.

Hougan slams “first-order considering”

Hougan mentioned that “scare articles about stablecoins destroying native lending markets are absurd,” in response to a Bloomberg report on Monday discussing staff being paid in stablecoins and the doable impact on banks.

Bloomberg’s report mentioned smaller group and regional banks face a brand new aggressive risk from stablecoins as a result of they rely on buyer deposits for lending, not like giant banks that may entry wholesale markets.

The report in contrast yield-bearing stablecoins to the emergence of cash markets within the Nineteen Seventies, which provided a higher-yield different to standard financial savings accounts, leading to a rush to withdraw funds from banks.

Hougan added that the hypothesis that credit score would “dry up” if stablecoins have been allowed to compete with banks was “basic first-order considering.”

Hougan mentioned banks could present much less credit score if they’ve fewer deposits, however folks with stablecoins will present credit score on to debtors by means of decentralized finance functions.

“The loser right here is financial institution revenue margins. The winner right here is particular person savers. The financial system will likely be simply wonderful.”

Stablecoin yields outcompete financial savings accounts

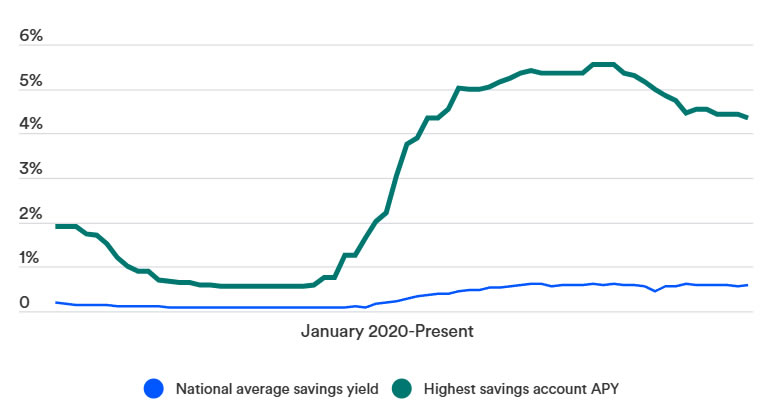

Some stablecoins supply as much as 5% on deposits on sure crypto platforms, a much more engaging fee than the US nationwide common financial savings fee of simply 0.6% and nonetheless above the perfect provided high-interest fee of 4%, in keeping with Bankrate knowledge.

Associated: Yield-bearing stablecoin provide surges after GENIUS Act

When inflation and financial institution fees are thought of, customers typically lose cash by leaving money sitting in a financial institution over time and not using a yield.

Stablecoin proponents have mentioned the tokens supply different benefits over banks, with quicker transaction speeds at a decrease value, whereas having no holding charges.

Banks lobbied in opposition to stablecoin yields

Final month, the banking trade lobbied to stop stablecoin issuers from providing yields, claiming that there’s a “loophole” within the stablecoin-regulating GENIUS Act.

The crypto trade pushed again in opposition to banks’ issues, warning that revisions to the laws would profit conventional banks whereas stifling innovation and client alternative.

Journal: Bitcoin could sink ‘beneath $50K’ in bear, Justin Solar’s WLFI saga: Hodler’s Digest