XRP struggled to keep up momentum above the $3.00 threshold on September 9–10, with heavy institutional promoting wiping out early beneficial properties. Regardless of a push to $3.035, volume-driven liquidation erased upside makes an attempt and pulled the asset again to $2.94 by session shut.

The transfer is indicative of mounting resistance close to $3.02, at the same time as merchants weigh ETF catalysts and rising change reserves which will mood bullish momentum.

Information Background

• Federal Reserve’s September 17 assembly is anticipated to ship a 25-basis-point fee lower, with markets assigning near-certainty to the end result — a possible liquidity driver for danger property.

• Six XRP spot ETF purposes await SEC evaluate in October, a call merchants see as pivotal for institutional adoption.

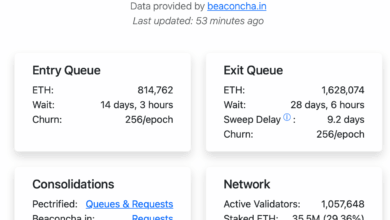

• Change custody balances for XRP hit a 12-month peak, elevating issues about near-term promoting strain regardless of whale accumulation patterns in current weeks.

• Analysts be aware parallels to XRP’s July breakout failure, suggesting market construction is once more being examined on the $3.00 barrier.

Value Motion Abstract

• XRP traded in a $0.10 band (2.9%) from $2.935 to $3.035 between September 9 at 03:00 and September 10 at 02:00.

• Token superior to $3.035 throughout morning buying and selling however confronted quick rejection close to $3.02 resistance.

• A 14:00 selloff dropped XRP from $3.018 to $2.956 on 165.67M quantity — practically triple the every day common.

• Value consolidated into the shut between $2.94 and $2.96, with subdued exercise averaging 650k quantity per minute.

Technical Evaluation

• Resistance: $3.02–$3.04 degree capped upside, with a number of rejections on excessive quantity.

• Assist: $2.94 zone examined and held, suggesting accumulation by institutional gamers.

• Momentum: RSI exhibits early bullish divergence, however change reserves at highs weigh on follow-through.

• Construction: Failed breakout implies consolidation inside $2.94–$3.00 until quantity returns.

• Vary: 3% intraday swings spotlight institutional-driven volatility.

What Merchants Are Watching

• Whether or not XRP can maintain closes above $2.95 to construct momentum for a $3.02 breakout.

• Change custody balances at 12-month highs — will inflows convert to sustained promoting strain?

• SEC’s October ETF rulings, which may act as a structural catalyst if approvals land.

• Fed’s September 17 fee lower choice, with merchants positioning for its affect on greenback liquidity.

• Whale inflows — 340M tokens amassed in current weeks — and whether or not shopping for offsets change distribution.