Farmway Applied sciences, a US-based fintech firm specializing in tokenizing agricultural merchandise, has reached a $100 million cope with the Republic of Georgia to place the nation’s almond orchards on the blockchain.

Farmway will make investments the funds in farming infrastructure, processing, logistics and irrigation programs throughout the nation. The deal spans 500 hectares (1,236 acres) and contains amenities to course of almond milk powder, oil and extracts.

“Almonds symbolize one in all Georgia’s fastest-growing agricultural sectors — rising from 2,500 tonnes in 2023 to a projected output of 14,000 tonnes by 2027, putting the nation among the many world’s high 20 producers,” Farmway CEO Upmanyu Misra advised Cointelegraph.

The nation reportedly had 6,000 hectares devoted to almond cultivation in August 2023. A number of the high almond producers within the nation included Udabno, Nuts Integrated, and Nuts Cultivation Firm. In keeping with the Georgia Occasions, domestically grown almonds are more and more changing imports, which fell 49% in 2024, whereas exports continued to rise.

The deal builds on a earlier $20 million funding in Georgia’s almond business, which served as a proof of idea, in accordance with Farmway.

The corporate will tokenize agricultural infrastructure, together with the orchards, irrigation programs and processing amenities. Every token will symbolize a fractional stake in an asset, and the blockchain will file all exercise.

“Conventional local weather finance is usually slow-moving, bottlenecked in multilateral establishments and donor cycles,” Misra stated. “Tokenization modifications this dynamic by creating direct, cost-efficient, investor-driven pathways into agriculture, turning huge areas of land into investable, auditable local weather belongings.”

In keeping with Misra, utility tokens representing belongings are based mostly on ERC-20 requirements, which govern the creation of fungible tokens on the Ethereum community. Actual-world asset (RWA) digital securities might be structured round ERC-1155 requirements, which permit for creating and transferring fungible and non-fungible tokens in a single transaction.

Based in 2020, Farmway is claimed to have lively RWA tokenization tasks in seven nations masking commodities starting from espresso and cinnamon to lavender and ashwagandha. The corporate rework illiquid, conventional asset courses into programmable, globally investable models.

Associated: Big week for tokenized RWAs as Fed preps DeFi, cost talks

RWA commodity tokenization market

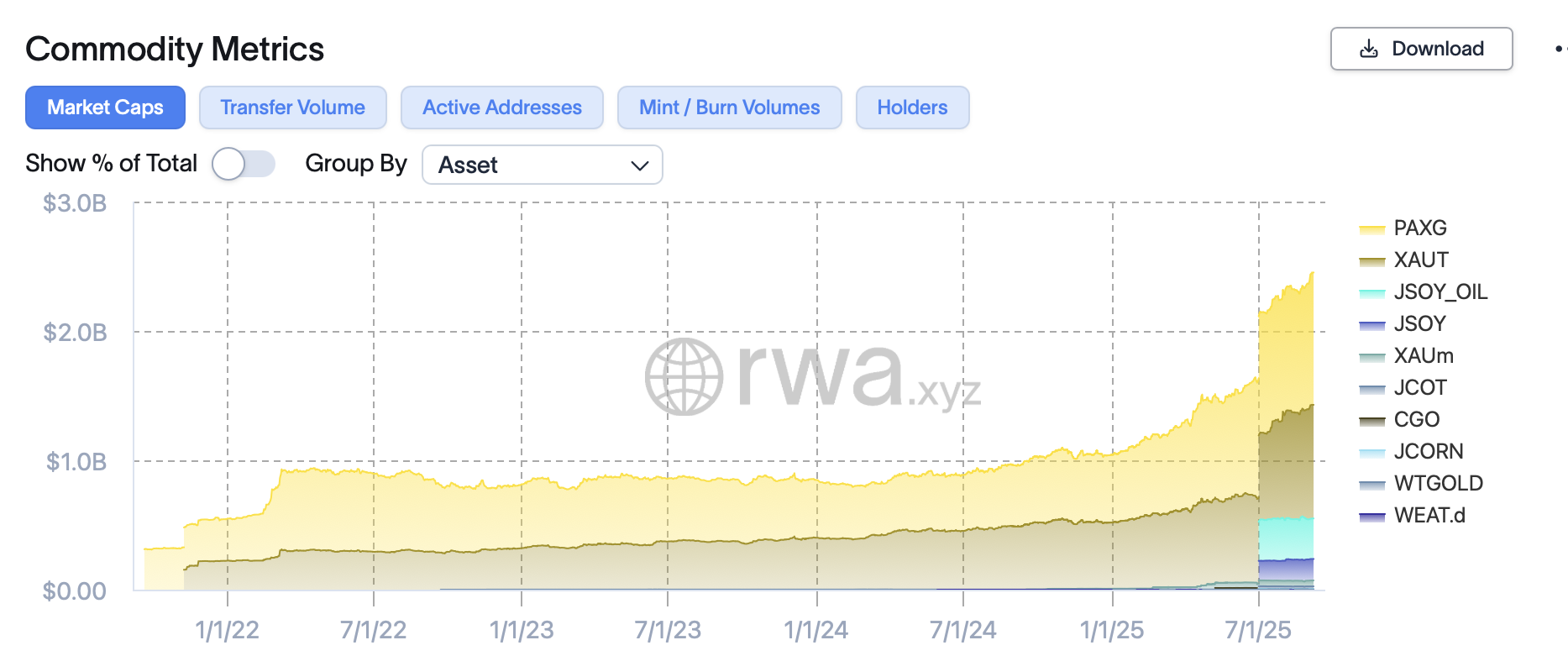

In keeping with RWA tokenization platform RWA.xyz, tokenization of commodities represents a small however rising portion of the RWA tokenization market.

The tokenized commodity market is at the moment valued at $2.5 billion, making up about 9% of the $27.8 billion RWA tokenization sector. It has expanded 5.6% over the previous 30 days.

The market is led by Paxos Gold (PAXG) and Tether Gold (XAUT), each providing tokenized gold, with valuable metals and agricultural merchandise rising because the dominant commodities, in accordance with onchain knowledge.

Justoken, a Farmway competitor based mostly in Buenos Aires, has created tokenized funds for soybean oil, soybean bushels, cotton and corn, amongst different commodities. The 4 funds account for greater than $500 million in market cap at this writing.

RWA tokenization is the method of taking real-world belongings like commodities, shares and credit score to be represented as tokens on a blockchain.

Proponents of RWA tokenization say the expertise will improve accessibility to and liquidity for conventional asset courses. As of June, the market had grown 260% in 2025, impacting far-ranging sectors like DeFi.

Journal: TradFi is constructing Ethereum L2s to tokenize trillions in RWAs — Inside story