Good Morning, Asia. This is what’s making information within the markets:

Welcome to Asia Morning Briefing, a each day abstract of prime tales throughout U.S. hours and an summary of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

BTC is pinned close to $111,000 with volatility compressed to multi-month lows, the type of calm that tends to precede decisive strikes. Merchants know what may break the lull: September’s U.S. inflation knowledge and the Fed’s price resolution per week later.

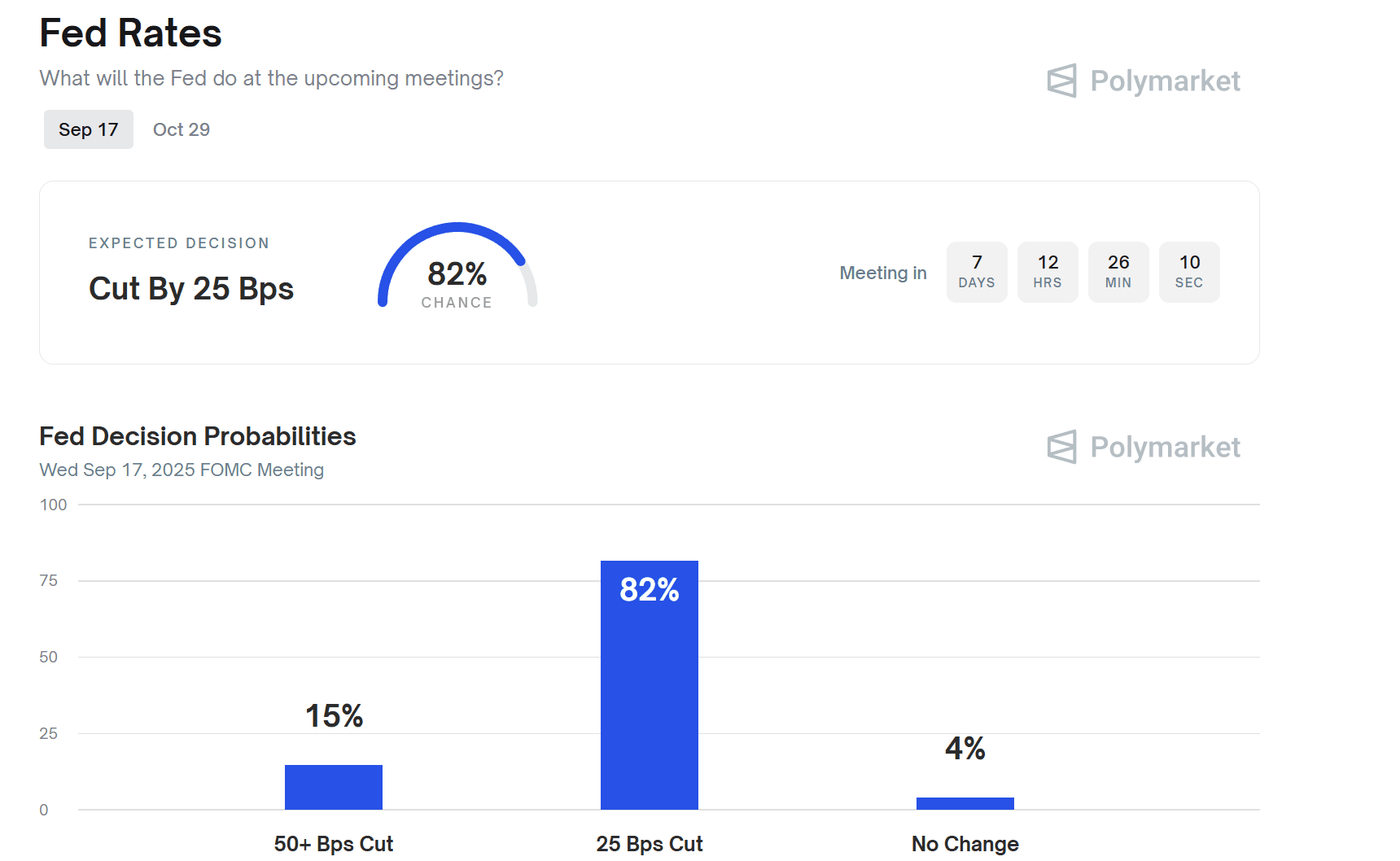

Prediction markets are leaning closely towards easing. Polymarket bettors are assigning an 82% likelihood of a 25-basis-point reduce on Sept. 17, leaving solely slim odds for a deeper transfer or no change. Past that, October expectations are fractured, with almost even possibilities for one more reduce or a pause. That divergence explains why volatility, although absent now, is unlikely to remain that manner.

“Markets typically look calm simply earlier than they transfer. Bitcoin is buying and selling in one in all its tightest ranges in months, and volatility throughout crypto has compressed to multi-month lows,” stated Gracie Lin, OKX Singapore CEO. “With U.S. inflation knowledge like Core CPI out on Sept. 11 and the Fed’s much-anticipated price resolution simply forward, this quiet interval is setting the stage for the following decisive transfer. Whether or not the catalyst is an upside inflation shock or a dovish sign from the Fed, what’s clear is that the absence of volatility isn’t everlasting in digital belongings; historical past exhibits the market will discover its subsequent path quickly sufficient.”

If a reduce pulls money-market returns decrease, the chance price of sitting in money rises, which is the pivot market maker Enflux says may ship flows towards crypto.

“The actual debate now is just not if cuts come, however whether or not liquidity deployment shifts into BTC, ETH, and even riskier belongings,” the agency informed CoinDesk.

In different phrases, the Fed’s reduce could seize headlines, however the true commerce is whether or not sidelined money rotates into digital belongings — a shift that might gasoline the return of volatility.

Market Motion

BTC: Bitcoin has dipped barely intraday, buying and selling between roughly $110,812 and $113,237, reflecting short-term volatility amid shifting investor sentiment and broader crypto market dynamics.

ETH: ETH is modestly up intraday, with a spread between roughly $4,279 and $4,379, signaling regular demand and a few renewed investor curiosity. Vary, nonetheless, is restricted with modest ETF flows and merchants awaiting the Fed’s subsequent transfer.

Gold: Gold is rallying to file highs, fueled by mounting expectations of U.S. Federal Reserve rate of interest cuts, a weakening U.S. greenback, and renewed safe-haven demand.

Nikkei 225: Asia-Pacific shares opened largely increased Wednesday, with Japan’s Nikkei 225 up 0.2%, as buyers awaited China’s August inflation knowledge displaying an anticipated 0.2% CPI drop and a smaller 2.9% PPI decline.

S&P 500: U.S. shares closed at file highs Tuesday, with the S&P 500 up 0.27% to six,512.61, as buyers appeared previous a file payroll revision that reduce 911,000 jobs from prior figures.

Elsewhere in Crypto

- OpenSea Teases SEA Token With Remaining Section of Rewards Amid App Launch (CoinDesk)

- California Man Sentenced in $36.9M Crypto Rip-off Tied to Notorious Huione Group (CoinDesk)

- Collector Crypt drives $150 million in randomized Pokémon card trades as CARDS token soars (The Block)