Shares of crypto-linked corporations diverged sharply on Tuesday, with Hong Kong’s QMMM Holdings rocketing greater than 1,700% after unveiling a blockchain technique, whereas Canada’s Sol Methods tumbled 42% in its Nasdaq debut.

QMMM, a Hong Kong–based mostly funding holding firm, stated Tuesday it would combine synthetic intelligence with blockchain to construct a platform combining crypto analytics and a Web3 autonomous ecosystem. The agency additionally plans to ascertain a “diversified cryptocurrency treasury” centered on Bitcoin (BTC), Ether (ETH) and Solana (SOL).

QMMM’s inventory efficiency shot via the roof after the announcement, rising over 2,100% earlier than closing its Nasdaq buying and selling up 1,737%.

In the meantime, Sol Methods, a Canadian Solana treasury and staking firm, noticed its inventory transfer in the other way. Newly listed on the Nasdaq, its shares plunged 42% on Tuesday. Buying and selling on the Canadian Securities Alternate fared barely higher however nonetheless dropped by 16%.

“Whereas share costs can fluctuate, our strategy facilities on what we name our DAT++ mannequin,” Sol Methods CEO Leah Wald informed Cointelegraph. “We stay centered on constructing long-term worth via disciplined execution of our enterprise technique.”

In June, Sol Methods reported a Q2 internet lack of $3.5 million. Nevertheless, it elevated its validator and staking income, promoting massive chunks of its BTC holdings for SOL and Sui (SUI).

Associated: Metaplanet, Semler Scientific have been ‘zombie corporations’ till Bitcoin, execs say

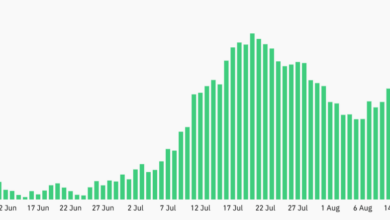

Crypto corporations have combined one-month outcomes

Publicly traded crypto corporations, particularly these counting on crypto treasuries, have had combined outcomes over the previous month.

Solana treasury firm Upexi’s share worth has dropped 2.1% prior to now month, whereas the share worth of DeFi Improvement Corp., one other Solana treasury firm, has seen an increase of 13.2%.

Metaplanet, a Bitcoin treasury firm based mostly in Japan, has seen a drop of 37% in its share worth over the previous 30 days, regardless of its continued shopping for of Bitcoin, and up to date shareholder approval to pursue its crypto accumulation technique.

Technique, the primary firm to deploy a crypto technique, has additionally seen a drop-off, with its share worth falling 18% within the final month.

Journal: How Ethereum treasury corporations might spark ‘DeFi Summer season 2.0’