UK public sale large Christie’s is reportedly closing its division that handles non-fungible token gross sales, now placing it beneath a broader division amid a world decline within the artwork market.

The “strategic resolution” will see the 256-year-old British public sale home proceed to promote digital artwork resembling non-fungible tokens (NFTs), however now inside the bigger twentieth and Twenty first-century artwork class, in line with a Monday report from Now Media, citing an announcement from a Christie’s spokesperson.

On the similar time, Now Media reported the public sale large laid off two staff, together with its vice chairman of digital artwork, however not less than one digital artwork specialist will probably be stored on employees.

Christie’s has had an enormous presence within the NFT area, promoting a number of artworks, together with Mike “Beeple” Winkelmann’s Everydays: The First 5000 Days, which closed at public sale in March 2021 with a bid of $69.3 million.

The public sale home had additionally been a supporter of the Web3 area, launching an NFT public sale platform in September 2022 and a crypto-only actual property workforce in July.

Market circumstances may have spurred shift

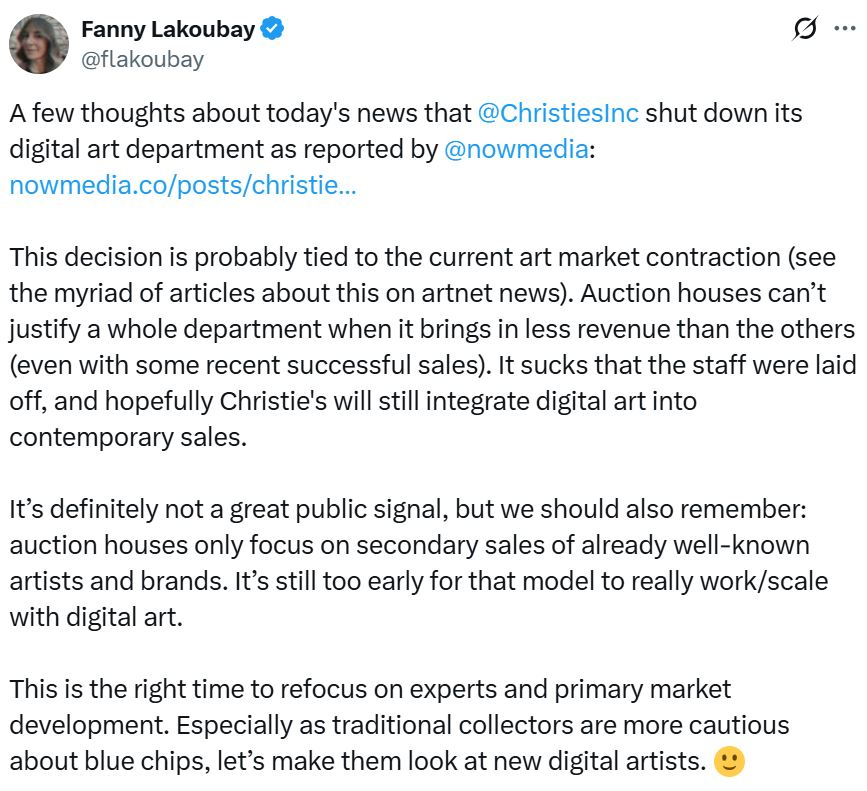

Fanny Lakoubay, a digital artwork adviser, curator and collector, stated in an X put up on Monday that she suspects Christie’s transfer may very well be tied to the “present artwork market contraction.”

The broader artwork market has been declining, with international gross sales down 12% in 2024 to $57 billion, together with mixed private and non-private gross sales by public sale homes dropping by 20% to $23 billion, in line with the Artwork Basel & UBS Artwork Market Report 2025 launched in April.

“Public sale homes can’t justify a complete division when it brings in much less income than the others, even with some latest profitable gross sales,” Lakoubay stated.

“It’s undoubtedly not a terrific public sign, however we must also bear in mind: public sale homes solely concentrate on secondary gross sales of already well-known artists and types. It’s nonetheless too early for that mannequin to essentially work/scale with digital artwork,” she added.

Lakoubay stated it may very well be a great time to concentrate on major market improvement and introduce conventional collectors to new digital artists.

Christie’s may very well be having a “Kodak second”

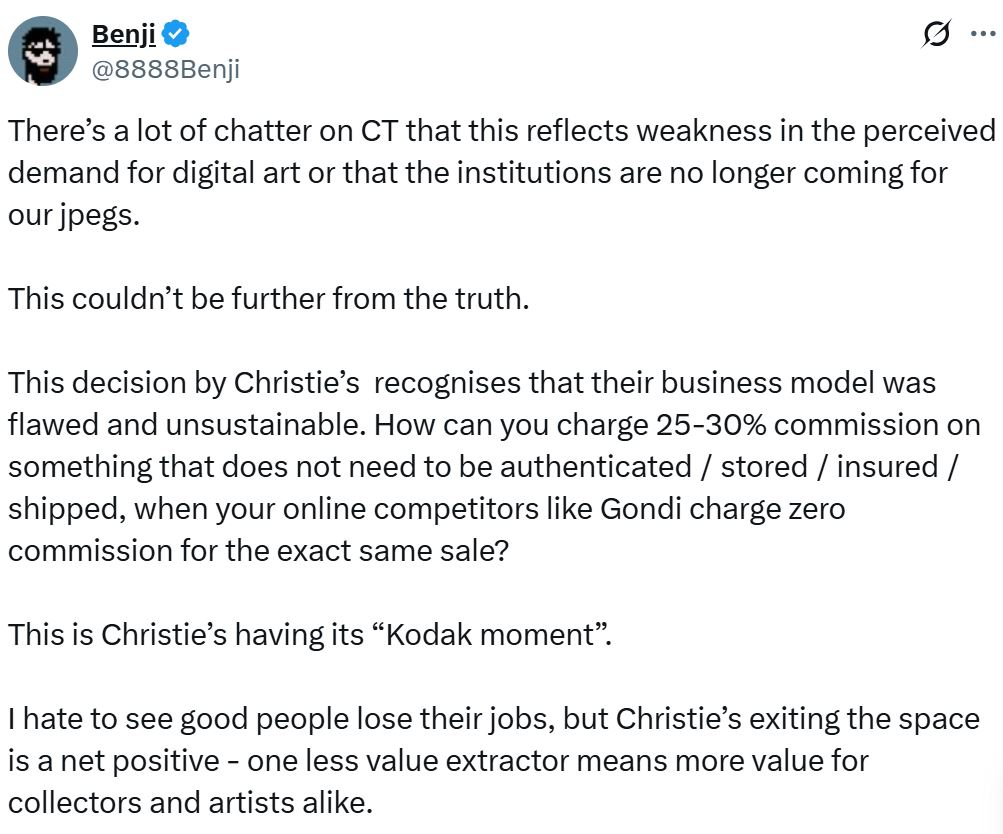

In the meantime, an NFT collector and member of the Doomed DOA, posting beneath the deal with Benji, argued Christie’s transfer to shut its digital artwork division doesn’t mirror a weak spot within the demand for digital artwork, or that “establishments are not coming for our jpegs.”

He speculates the enterprise mannequin is more likely to blame for the choice as a result of it was “flawed and unsustainable,” and this new path may very well be Christie’s “Kodak second.”

“How will you cost 25-30% fee on one thing that doesn’t have to be authenticated / saved / insured / shipped, when your on-line rivals like Gondi cost zero fee for the very same sale?” Benji stated.

“I hate to see good individuals lose their jobs, however Christie’s exiting the area is a web optimistic – one much less worth extractor means extra worth for collectors and artists alike.”

Christie’s didn’t instantly reply to Cointelegraph’s request for remark.

NFT market information blended outcomes

The NFT market has had a turbulent few years. Final 12 months was flagged because the market’s worst 12 months for buying and selling quantity and gross sales since 2020, partly due to volatility and rising token costs.

Associated: NFT market cap drops by $1.2B as Ether rally loses steam

It has been exhibiting indicators of life in 2025. In August, the sector surged to a market capitalization of greater than $9.3 billion, a 40% uptick from July, as Ethereum-based collections and Ether (ETH) elevated in worth.

The market has proven indicators of cooling in latest weeks, however its present market capitalization is up 2% within the final 24 hours and sitting at $5.97 billion.

A number of of the biggest NFT collections by market capitalization have additionally skilled beneficial properties. CryptoPunks is up 1.9% within the final 24 hours, and has a buying and selling quantity of $208,319 with three gross sales.

Yuga Labs’ Bored Ape Yacht Membership is up 3.7% and has clocked a buying and selling quantity of greater than $1.2 million and 30 gross sales, whereas Pudgy Penguins is up 2%, has $905,526 in buying and selling quantity and 20 gross sales.

Journal: Astrology may make you a greater crypto dealer: It has been foretold