Key takeaways:

-

Bitcoin choices skew and futures funding charges spotlight persistent warning, regardless of BTC defending the $110,000 assist degree.

-

spot Bitcoin ETF outflows and Technique’s S&P 500 index unfavorable choice proceed weighing on dealer sentiment.

Bitcoin (BTC) climbed above $112,000 on Monday, pulling away from the $108,000 degree seen the earlier week. The advance, nevertheless, has not been sturdy sufficient to revive confidence, in response to BTC derivatives metrics. Merchants are actually attempting to find out what’s stopping sentiment from bettering and whether or not Bitcoin has the momentum to push previous $120,000.

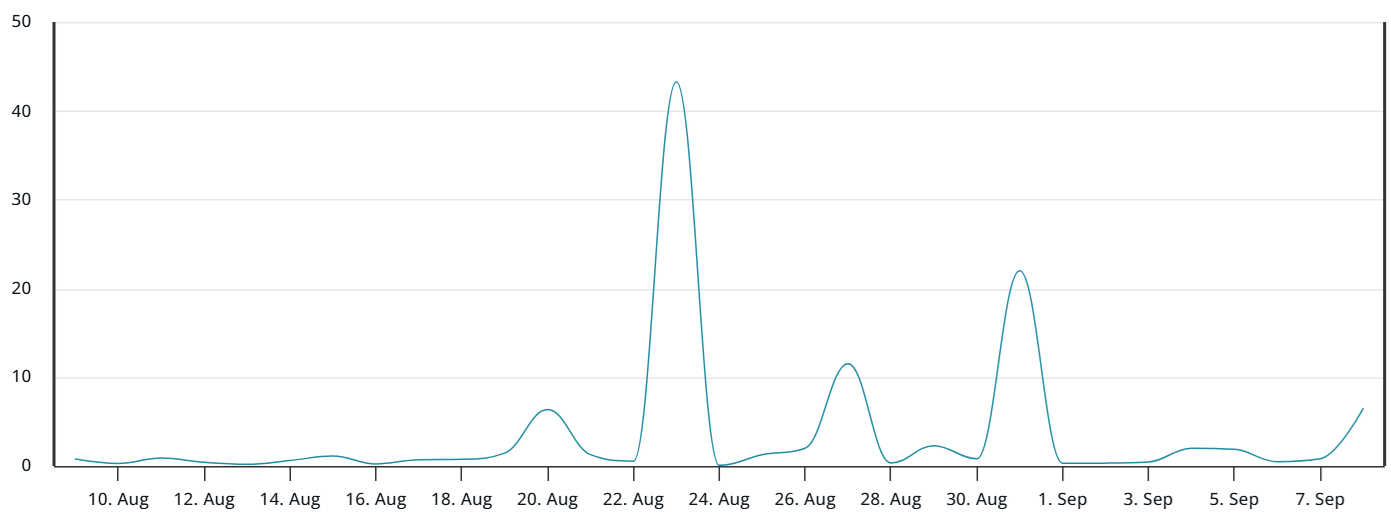

The BTC choices delta skew at present stands at 9%, which means put (promote) choices are priced at a premium in comparison with equal name (purchase) devices. This usually alerts danger aversion, although it could merely mirror final week’s buying and selling situations reasonably than a transparent expectation of a pointy decline. A real surge in demand for draw back safety can be evident within the choices put-to-call ratio.

On Monday, demand for put choices jumped, reversing the pattern of the prior two periods. The information factors to a stronger urge for food for neutral-to-bearish methods, suggesting merchants stay cautious a couple of potential drop under $108,000.

A few of this lack of enthusiasm stems from Bitcoin’s incapability to reflect the contemporary all-time highs in each the S&P 500 and gold. Weaker-than-expected labor market figures in the US bolstered expectations of financial easing.

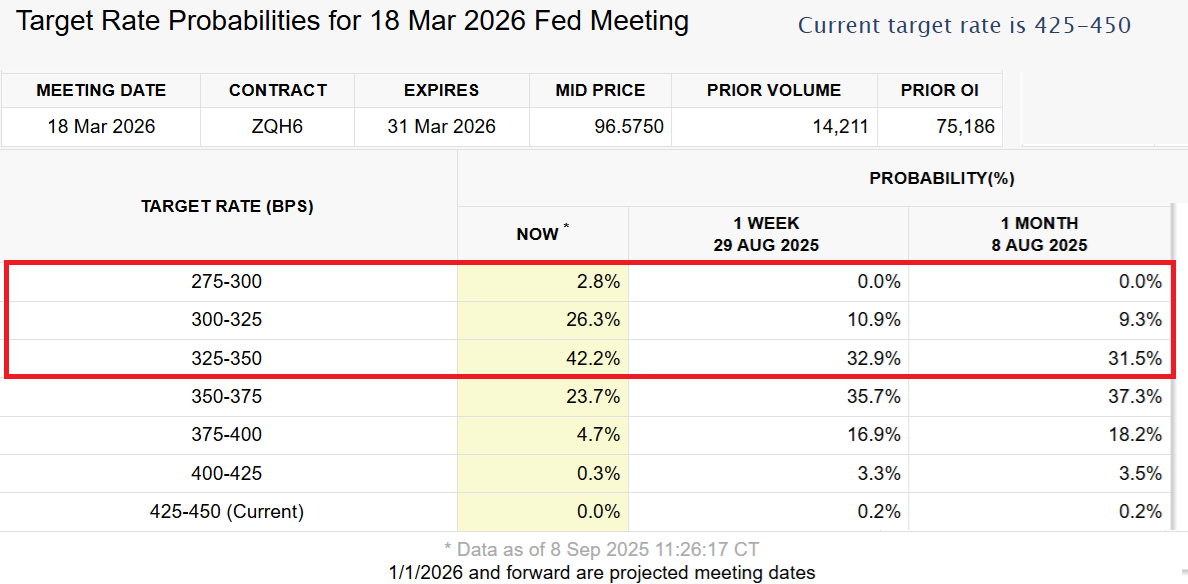

Merchants now assign a 73% likelihood that rates of interest will fall to three.50% or decrease by March 2026, up from 41% only one month in the past, in response to the CME FedWatch software.

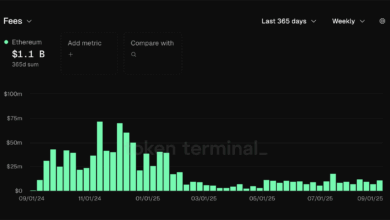

Spot Bitcoin ETFs face outflows as company Ether reserves achieve traction

Including to the warning, spot Bitcoin ETFs recorded $383 million in web outflows between Thursday and Friday. The withdrawals possible unnerved traders although Bitcoin efficiently held the $110,000 assist. Competitors from Ether (ETH) as a company reserve asset may additionally be influencing sentiment, as firms have allotted an extra $200 million over the previous week alone, in response to StrategicETHReserve knowledge.

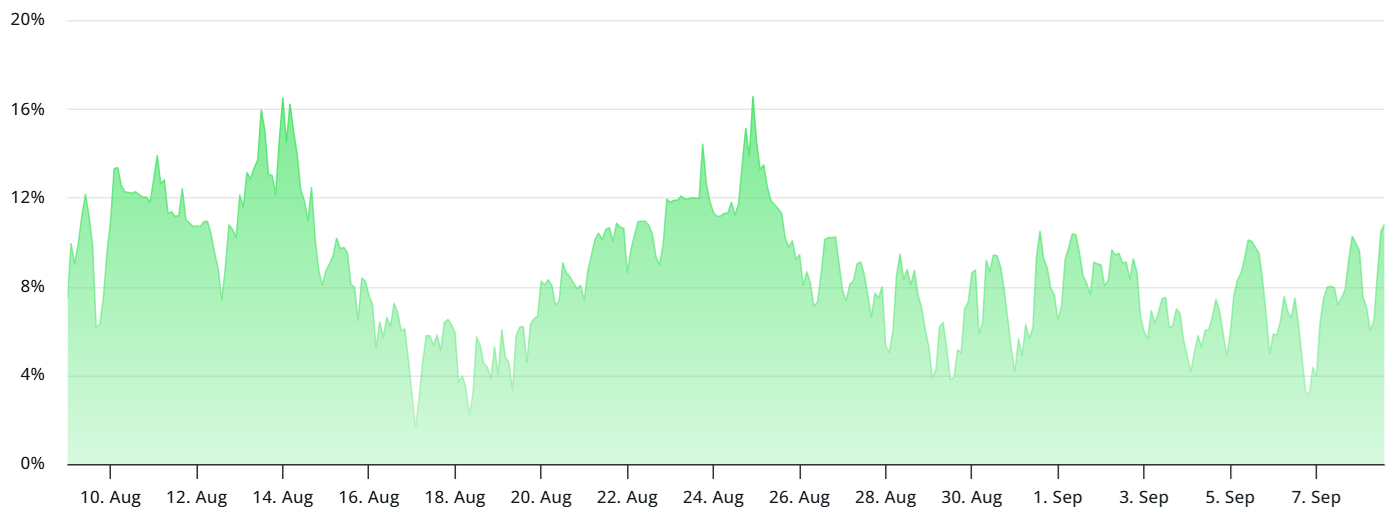

To find out whether or not bearish sentiment is confined to BTC choices, it’s needed to take a look at the Bitcoin futures market. Below regular situations, funding charges on perpetual contracts usually vary from 6% to 12% to account for the price of capital and exchange-related dangers.

At current, Bitcoin’s perpetual futures funding fee sits at a impartial 11%. Whereas impartial, this marks an enchancment from the bearish 4% degree noticed on Sunday. Merchants could also be responding to heightened competitors from altcoins, significantly after Nasdaq filed with the US Securities and Change Fee to checklist tokenized fairness securities and exchange-traded funds (ETFs).

Associated: Crypto ETFs log outflows as Ether funds shed $912M–Report

Bitcoin derivatives proceed to mirror skepticism towards the newest rally, as each choices and futures present little enthusiasm for the transfer above $112,000. What might shift merchants out of this cautious stance stays unsure. The frustration that Technique (MSTR) was excluded from the S&P 500 rebalance on Friday may additionally clarify a few of the muted sentiment amongst bulls.

For now, a surge to $120,000 seems unlikely. Nonetheless, if spot Bitcoin ETFs handle to stabilize, total sentiment might shortly enhance and set the stage for renewed value momentum.

This text is for basic info functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don’t essentially mirror or signify the views and opinions of Cointelegraph.