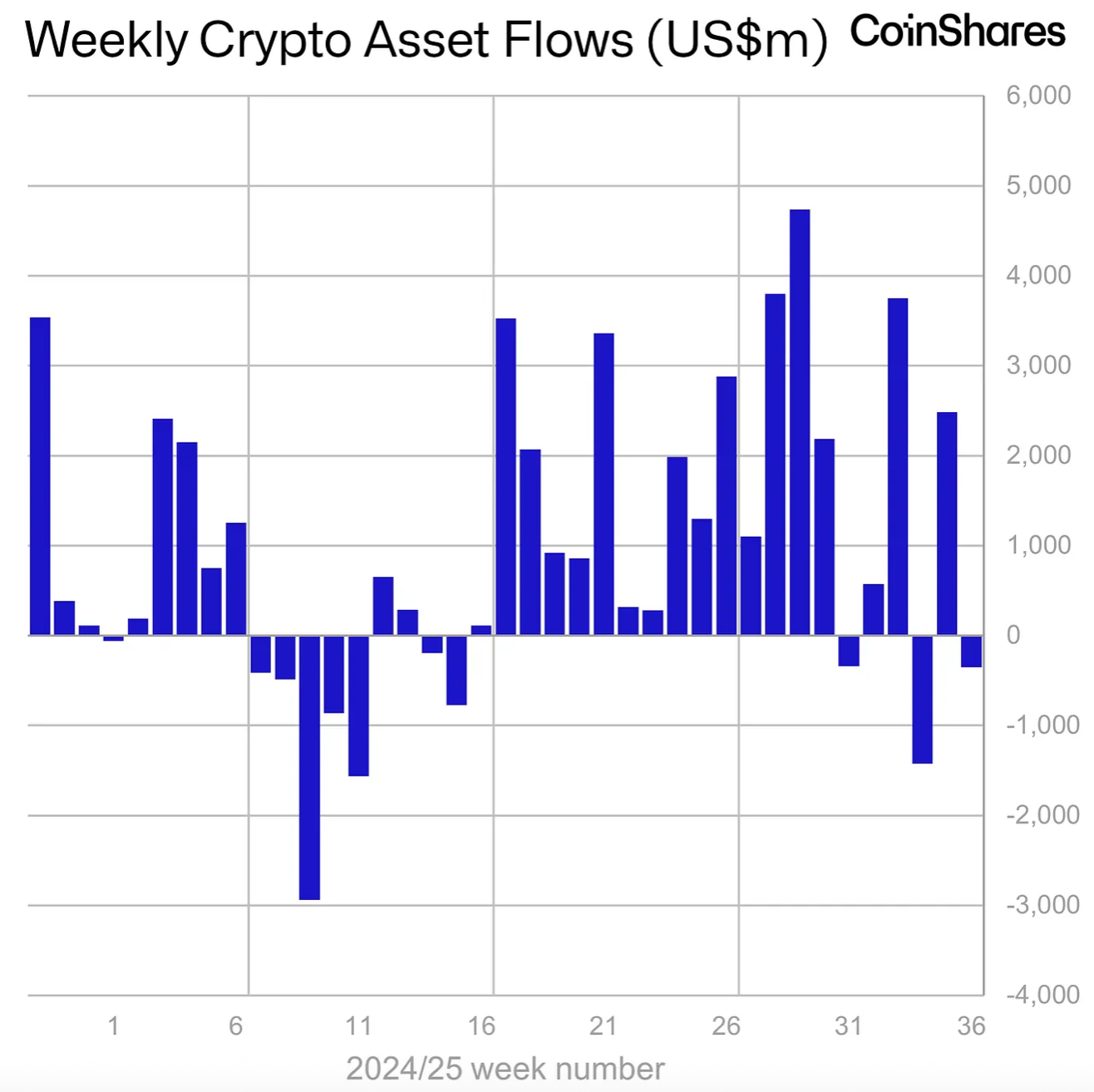

Publicly traded crypto funding merchandise noticed a decline in flows in early September, with weekly buying and selling volumes sliding by 27%, in accordance with CoinShares information.

Decrease buying and selling quantity pushed crypto funds to put up $352 million in outflows over the previous week, regardless of a constructive outlook for riskier property following a weak US jobs report and a possible minimize rates of interest within the US.

In line with CoinShares evaluation, the slower exercise was pushed by Ether (ETH) merchandise and suggests mainstream buyers’ falling demand for cryptocurrencies. “Buying and selling volumes fell 27% week on week, this together with minor outflows suggests the urge for food for digital asset has cooled a bit of.”

Ether funds noticed the most important losses within the first days of September, shedding $912 million in per week. In distinction, Bitcoin (BTC) merchandise acquired $524 million in inflows, serving to offset broader market weak point.

Throughout nations, funds listed within the US market amassed $440 million in outflows final week, whereas Germany recorded inflows of $85 million.

Publicly traded crypto funds give buyers publicity to digital property with out requiring them to immediately purchase or handle cryptocurrencies. Traded on conventional brokerages, these automobiles package deal crypto tokens into shares that observe the underlying worth, making them a preferred manner for mainstream buyers to entry the crypto market.

Regardless of the slowdown in urge for food for crypto ETFs, inflows in 2025 are nonetheless forward of final yr’s efficiency, indicating that “in a broader sense, sentiment stays intact,” CoinShares stated.

Associated: SEC approval of itemizing requirements can mainstream crypto ETFs

ETH outflows possible pushed by profit-taking, macro traits

Jillian Friedman, chief working officer of crypto staking protocol Symbiotic, commented on Monday on ETH ETFs cooling demand, saying the funds are “risk-asset performs” and that “profit-taking close to ATHs and macro economics appear extra possible drivers.”

“U.S. spot ETH ETFs now maintain round US $26 billion AUM, with BlackRock’s ETHA controlling over US $16 billion. That’s only a slice of complete ETH however highlights capital rotation, not narrative collapse.”

The spot worth of Ether has primarily remained degree for the previous week, starting from $4,450 to $4,273, in accordance with Cointelegraph indexes.

Kronos Analysis Chief Funding Officer Vincent Liu just lately advised Cointelegraph that not solely is ETH “coming into a interval of profit-taking” however that the inflows into Bitcoin ETFs point out a flight to exhausting property, corresponding to gold, as a result of macroeconomic uncertainty.

Journal: X Corridor of Flame: Bitcoin $500K prediction, spot Ether ETF ‘staking concern’— Thomas Fahrer