Threat belongings could face stormier circumstances if the Federal Reserve cuts rates of interest, as anticipated, on Sept. 17. That is the message from futures tied to the VIX index, a measure of expectations of volatility within the S&P 500 over the following 30 days.

The index, additionally known as Wall Road’s worry gauge, is calculated in actual time from costs of choices on the S&P 500, and displays how a lot buyers count on the market to swing, with increased values indicating larger ranges of uncertainty.

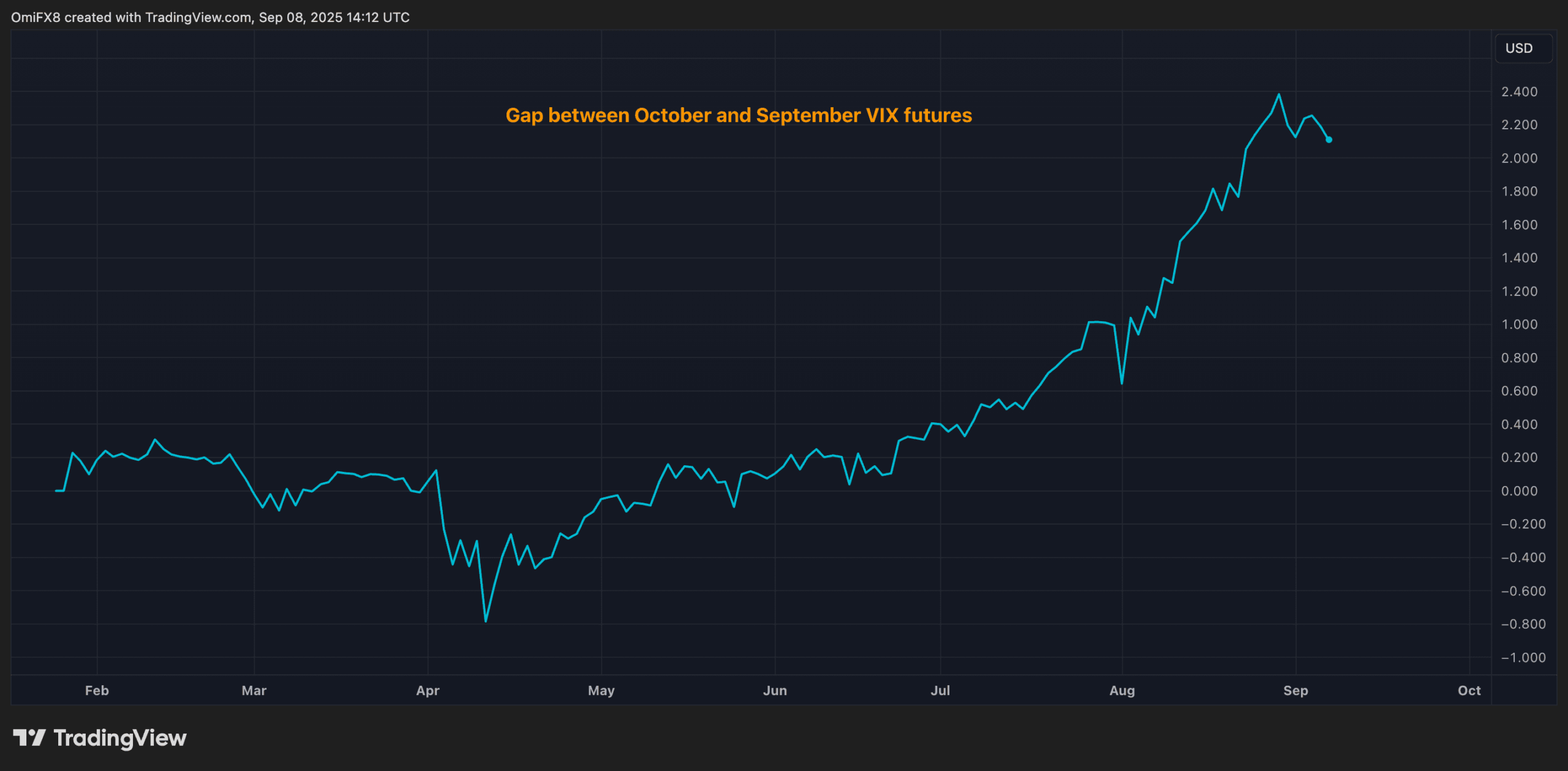

The unfold between the October VIX futures contract (the next-month contract) and the September contract (the front-month contract), has widened to 2.2%, an excessive stage by historic requirements, in response to knowledge supply TradingView. The September contract expires the identical day because the Fed assembly.

In the meantime, the front-month contract trades solely at a slight premium to the money index.

“Money is truthful in comparison with Sept. … however Sept. is extraordinarily low in comparison with October futures,” Greg Magadini, director of derivatives at crypto derivatives knowledge analytics agency Amberdata, wrote within the weekly e-newsletter.

In different phrases, merchants are discounting threat forward of the Fed assembly, wagering that the rate-cut expectation will hold markets regular as they method the choice.

The U.S. central financial institution is predicted to decrease its goal fee by not less than 25 foundation factors when it meets subsequent week, in response to the CME’s FedWatch software. Some market members are even positioned for a 50 bps discount.

The October futures, nevertheless, inform a distinct story, suggesting that buyers are anticipating elevated turbulence as soon as the Fed’s determination is out of the best way and fee cuts are priced in.

“The VIX futures for September have priced away threat whereas October may very well be ugly … A theme to remember for threat belongings in my view,” Magadini wrote.

Traditionally, the VIX has exhibited a powerful detrimental correlation with inventory costs, usually rising throughout bear markets and durations of market stress, whereas declining when inventory costs advance. It signifies that the potential volatility growth after the Fed determination may very well be marked by a downswing in equities.

Bitcoin is thought to intently observe the temper on Wall Road, which signifies that a possible volatility explosion in shares might shortly spill over into the cryptocurrency market. And like shares, the turbulent interval may very well be marked by bearish worth motion.

Since November final yr, the correlation between bitcoin’s spot worth and its 30-day implied volatility indices has turned detrimental. Moreover, Bitcoin’s volatility indices — BVIV and DVOL — have lately reached document excessive correlation ranges with the VIX, highlighting bitcoin’s rising alignment with broader market volatility developments.