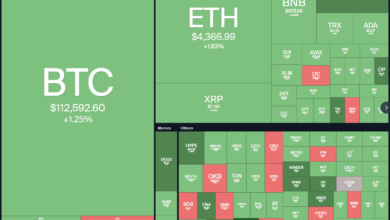

Nasdaq, the U.S. alternate the place the tech sector’s greatest names record their shares, is searching for to place shares on the blockchain, asking the U.S. Securities and Change Fee on Monday to bless its effort whilst others within the securities world are sprinting towards the identical tokenization purpose.

If the SEC submitting is accepted, the alternate would let clients select both the standard route for buying and selling equities or to take action on-chain with tokenized shares — an choice that will be handled with the identical precedence because the legacy technique.

“The Change believes the markets can use tokenization whereas persevering with to offer the advantages and protections of the nationwide market system,” Nasdaq contended in its submitting, suggesting that the tokenized belongings needs to be traded “in regulated markets, particularly nationwide securities exchanges, various buying and selling programs, and at [Financial Industry Regulatory Authority] regulated broker-dealers.”

The transfer by Nasdaq follows an effort by digital brokerage Robinhood to challenge inventory tokens for European clients in July, giving entry to some 200 U.S. shares and exchange-traded funds (ETFs). Bringing equities and different real-world belongings onto blockchain rails has been among the many most scorching of the digital-asset world’s improvements, and the competitors has been rising fierce for each conventional finance names and crypto natives to make strikes.

A number of crypto exchanges, corresponding to Bybit, Kraken and Gemini, have been making the leap. However TradFi behemoth Nasdaq — dwelling of the listings for Apple, Google guardian Alphabet, Amazon, Microsoft and different expertise mainstays — is especially important.

Learn Extra: Tokenized Shares Aren’t Working (But)

For its half, Nasdaq would deal with this enterprise similar to common inventory buying and selling, it stated, and have the buying and selling of tokens clear and settle by the Depository Belief Co.

“The mere incontrovertible fact that an order comprises tokenized securities or signifies a desire to clear and settle securities in token kind shall not have an effect on the precedence through which the Change executes that order,” in response to Nasdaq’s proposed change with the SEC. The already-digital transactions of inventory would — below this new system — be logged through digital ledger, which “presents novel capabilities by which to report proof of securities possession and transactions.”

These shopping for the tokens would acquire full rights to the related shares of inventory, together with voting and liquidation rights.

Nasdaq’s new tokenized buying and selling — additionally providing exchange-traded merchandise, corresponding to ETFs — would start “as soon as the requisite infrastructure and post-trade settlement companies have been established by” DTC, which is engaged on them, the corporate stated.

“Our proposal goals to offer significant advantages to markets by integrating new capabilities into the material of our monetary system and additional advancing the world’s best and trusted markets,” stated Nasdaq President Tal Cohen, in a Monday posting on LinkedIn.

SEC Chairman Paul Atkins has made it clear that tokenization of belongings is a serious precedence for the company, and the regulator gathered a panel in its collection of crypto roundtables earlier this 12 months to discover it. A serious element of Atkins’ new Venture Crypto push on the company is to clear a path for the world’s main tokenized securities market.

“This motion of securities from off-chain to on-chain programs is akin to the transition of audio recordings from analog vinyl data to cassette tapes to digital software program a long time in the past,” Atkins stated in Could 12 remarks on the company. “The migration to on-chain securities has the potential to transform facets of the securities market by enabling completely new strategies of issuing, buying and selling, proudly owning, and utilizing securities.”

Learn Extra: SEC, CFTC Chiefs Say Crypto Turf Wars Over as Companies Transfer Forward on Joint Work

UPDATE (September 8, 2025, 13:49 UTC): Provides remark from Nasdaq.