Crypto platform Bullish (BLSH), the mum or dad firm of CoinDesk, obtained quite a few inventory scores from Wall Avenue analysts on Monday, as brokerage corporations initiated protection of the inventory after its current IPO.

Rosenblatt Securities began protection with a purchase ranking and a $60 value goal, citing shifting U.S. political winds and rising institutional adoption as key catalysts for progress, the dealer stated in a analysis report Monday.

The agency argues that Bullish, one of many largest regulated institutional exchanges, is nicely positioned to capitalize on what it calls a “dramatic enchancment” within the U.S. political atmosphere for digital property.

Regardless of not but serving U.S. shoppers, Bullish has already dealt with greater than $500 billion in annual buying and selling quantity, a scale Rosenblatt views as proof of demand.

The upcoming U.S. launch is anticipated to be a significant catalyst, the dealer famous, whereas the passage of the GENIUS Act has opened a brand new alternative in stablecoins. Rosenblatt believes stablecoin-related income might present recurring revenue much less uncovered to buying and selling volatility.

Stablecoin values are tied to property just like the U.S. greenback or gold. They play a significant position in cryptocurrency markets offering, amongst different issues, a fee infrastructure, and are additionally used to switch cash internationally. The sector has a market cap of about $280 billion, CoinGecko knowledge present, and is dominated by Tether’s USDT and Circle Web’s USDC.

Bullish’s possession of media properties and potential growth into retail buying and selling add additional upside, based on the word. On that foundation, Rosenblatt values the inventory at 31x projected 2027 adjusted EBITDA, underpinning its $60 goal.

The ‘BitLicense’ catalyst

Rival dealer Canaccord Genuity has additionally initiated protection of Bullish with a purchase ranking and a $68 value goal, highlighting the alternate’s rising institutional traction and potential enhance from a pending New York BitLicense.

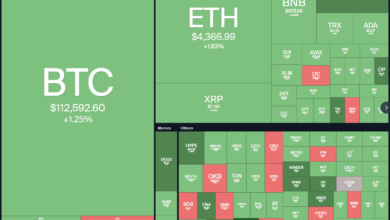

Based in 2020, Bullish has shortly grow to be a significant participant in crypto buying and selling, lately main world regulated exchanges in spot buying and selling volumes for bitcoin , ether (ETH), and stablecoins, the report stated.

The corporate has expanded past buying and selling with the acquisitions of CoinDesk in 2023 and CCData in 2024, including media, knowledge, and knowledge providers to its enterprise traces.

Canaccord analysts additionally word Bullish’s position within the rising “stablecoin wars,” supporting issuers like PayPal (PYPL) and Société Générale (GLE) with listings, liquidity, and promotion.

Already licensed in Europe and Asia, Bullish is anticipated to safe a BitLicense quickly, opening entry to U.S. institutional shoppers, the analysts wrote.

Regardless of conservative assumptions in its forecasts, together with flat bitcoin costs by way of 2027, Canaccord factors to Bullish’s early profitability, stability sheet bolstered by $2.4 billion in bitcoin, and long-term progress prospects as causes for optimism.

Market share seize

In the meantime, dealer Bernstein has initiated protection of Bullish with a market-perform ranking and a $60 value goal, highlighting the alternate’s skilled administration staff and its ambition to grow to be the second-largest institutional platform after Coinbase.

That final result, the agency says, hinges on a profitable U.S. launch in 2026, the place Coinbase at the moment dominates however alternatives are rising round stablecoins, market knowledge and indices. Bullish’s possession of CoinDesk additionally gives potential optionality if it strikes into retail alternate providers.

“We anticipate Bullish to seize ~8% market share in U.S spot institutional crypto volumes by 2027E, whereas world spot market share stays at ~7%,” analysts led by Gautam Chhugani wrote.

Facet-lined by valuation

Wall Avenue financial institution JPMorgan (JPM) has additionally initiated protection of Bullish, assigning the crypto alternate operator a impartial ranking and a value goal of $50.

Like Bernstein, the JPMorgan analyst additionally pointed to Bullish’s skilled administration staff and its means to navigate the fast-evolving digital asset panorama.

The financial institution’s analyst stated progress will seemingly be fueled by rising institutional demand for crypto publicity and the rising position of tokens and stablecoins in buying and selling exercise.

Bullish can also be well-positioned to increase into the U.S. market, constructing on its current foothold in Europe and Asia. In response to the financial institution, one other progress driver shall be its Liquidity Providers enterprise, the place clearer regulation might broaden the vary of supported blockchains and tokens, making a stronger atmosphere for exchanges like Bullish.

Nonetheless, JPMorgan famous that the agency’s present scale stays restricted relative to its market alternative. With the corporate at what the financial institution known as a “crucial level of maturity,” analysts stated valuation considerations justify staying on the sidelines for now.

The shares had been buying and selling 3.6% decrease, round $50.53, at publication time.

Learn extra: Bullish Will get Cautious Outlook from Compass Level