Tetra Digital Group, a digital asset custodian primarily based in Alberta, Canada, stated on Monday it has raised round $10 million to develop and problem a regulated stablecoin pegged to the Canadian greenback.

Backers of the mission embrace Shopify, Wealthsimple, Objective Limitless, Shakepay, ATB Monetary, Nationwide Financial institution and Urbana Company, which has held a majority stake in Tetra since April.

The agency goals to roll out the stablecoin in early 2026, topic to regulatory approval. The token can be issued by way of Tetra Belief, regulated digital asset custody subsidiary, and can be backed 1:1 with Canadian greenback reserves held domestically, based on the press launch.

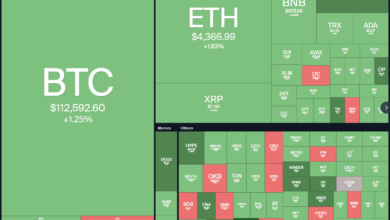

Stablecoins, a particular group of cryptocurrencies on blockchains with costs tied to fiat currencies, are more and more being considered as a quicker, cheaper different for international funds. The market is projected to surpass $1 trillion within the subsequent few years from $270 billion, but it surely’s overwhelmingly dominated by tokens anchored to the U.S. greenback.

Tetra Digital’s objective with creating a Canadian greenback stablecoin is to “create a dependable, institutional-grade resolution for Canadian greenback funds and remittances at scale,” the agency stated.

“By bringing collectively lots of Canada’s most trusted monetary establishments and corporations, we’re not simply launching a stablecoin — we’re supporting homegrown options, constructed by Canadians, for Canadians and making certain we preserve financial sovereignty,” CEO Didier Lavallée stated in an announcement.

Earlier this 12 months, Toronto-based fintech Stablecorp raised $1.8 million together with from Coinbase Ventures to advance improvement of its Canadian dollar-pegged QCAD stablecoin. The agency filed a preliminary prospectus with the Ontario Securities Fee for the token’s issuance in June.