Bakkt Holdings (BKKT) is attempting to reboot after a turbulent few years, Wall Road dealer Benchmark mentioned in a Monday report initiating protection of the inventory.

Benchmark began protection of the agency with a purchase score and a $13 value goal.

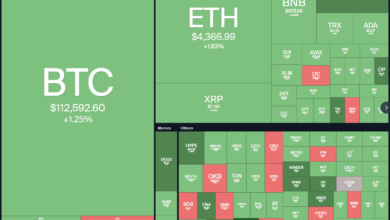

The shares climbed 1.3%, buying and selling round $8.63 at publication time.

Beneath new CEO Akshay Naheta, the agency has shed its custody arm and is promoting off its legacy loyalty enterprise, strikes meant to streamline operations and reset investor confidence, the report famous.

The corporate’s technique now hinges on three initiatives: a “brokerage-in-a-box” platform that lets banks and fintechs plug in crypto providers; a multinational bitcoin treasury program anchored by a deliberate stake in Japan’s Marusho Hotta and enlargement into India and South Korea; and a stablecoin funds community known as Bakkt Agent, developed with Distributed Applied sciences Analysis (DTR), analyst Mark Palmer wrote.

A key benefit, Palmer famous, is Bakkt’s regulatory footprint. It has a BitLicense and cash transmitter licenses throughout all 50 states, which provides it a compliance moat in a crowded discipline.

Benchmark values Bakkt at 5x EV/EBITDA on projected 2026 earnings, touchdown on its $13 goal.

Learn extra: Bakkt Names Akshay Naheta as Co-CEO Amid Stablecoin Funds Push