Grayscale has filed with the U.S. Securities and Alternate Fee to transform its present Chainlink Belief right into a spot exchange-traded fund.

The proposed ETF — if authorized — would commerce on NYSE Arca underneath the ticker GLNK, in accordance with a Monday S-1 registration assertion submitted to the regulator. That is certainly one of two paperwork required to make an ETF software official.

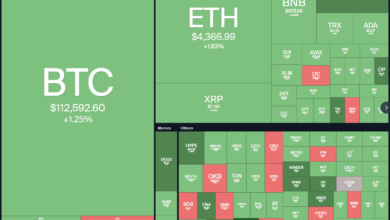

Chainlink’s LINK token is larger by 3% over the previous 24 hours alongside a common rally in altcions that is seen XRP add 2.6%, SOL 5% and DOGE 7.4%.

Grayscale’s submitting additionally features a potential staking characteristic. If permitted, the fund may use third-party staking suppliers whereas preserving the LINK tokens in custodian wallets. Staking rewards could possibly be retained by the fund, distributed to shareholders, or bought to cowl bills, relying on future regulatory steering.

The product would convert from the Grayscale Chainlink Belief, which has existed since February 2026 and presently manages almost $29 million in belongings. Coinbase Custody Belief Firm would function custodian.

Grayscale stated the ETF would course of share creations and redemptions in money, mirroring the construction utilized by lately authorized spot bitcoin and ethereum ETFs. Nevertheless, the submitting permits for the opportunity of in-kind redemptions if future laws allow.

The transfer is a part of a broader effort by Grayscale to transition a number of single-asset crypto trusts into ETFs. Different pending proposals embrace funds tied to the worth of solana , dogecoin , and XRP.

The SEC underneath chair Paul Atkins has but to approve or deny any of those pending purposes however that hasn’t stopped companies from making ready merchandise they consider could possibly be among the many first of their asset class.

If authorized, the GLNK ETF would give conventional buyers regulated entry to Chainlink’s value efficiency, which powers decentralized information feeds for blockchain purposes and sensible contracts. The addition of staking may additionally present an revenue part not but accessible in most U.S. crypto ETFs.

For now, the market appears to be reacting optimistically, with LINK posting one of many day’s stronger features amongst main cryptocurrencies.