Opinion by: Margaret Rosenfeld, chief authorized officer of Everstake

For years, the approval of crypto exchange-traded funds (ETFs) has been probably the most contested battles in monetary regulation. The primary functions for a Bitcoin (BTC) ETF date again greater than a decade. Solely in early 2024, after repeated denials and a court docket battle that compelled the US Securities and Change Fee to rethink, did spot Bitcoin ETFs lastly achieve SEC approval in the USA.

The lengthy highway to that time underscored the regulatory warning, political scrutiny and structural complexity surrounding digital asset markets.

Now, only a yr later, the dialog has shifted dramatically.

The SEC is contemplating a set of proposals from Nasdaq, NYSE Arca and Cboe BZX to undertake generic itemizing requirements for crypto and commodity-based ETFs. These guidelines would permit qualifying funds to listing with out requiring bespoke SEC approval below SEC Rule 19b-4.

If adopted by the SEC, this alteration would align crypto ETFs with conventional ETFs, which gained their very own generic framework by means of Rule 6c-11 in 2019. In different phrases, crypto ETFs could lastly be shifting from distinctive therapy into the mainstream.

Why this issues

The present approval course of for crypto ETFs is cumbersome. Every new submitting can take 240 days or longer, involving rounds of public remark, employees evaluate and sometimes extended uncertainty. Generic itemizing requirements would lower timelines to 60-75 days, making bringing new merchandise to market far simpler. Velocity and effectivity would profit each facet of the sector.

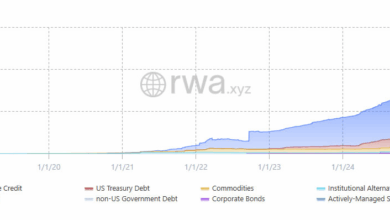

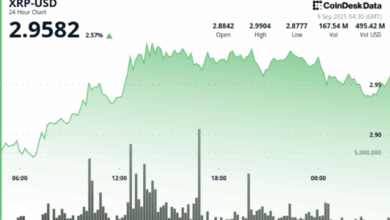

To this point, solely Bitcoin and Ether (ETH) ETFs have cleared the regulatory bar. Generic requirements may open the door to ETFs tied to Solana (SOL), XRP (XRP), Dogecoin (DOGE) or much more progressive constructions like staking-linked merchandise or thematic baskets. By creating clear eligibility standards, like requiring six months of buying and selling historical past on Commodity Futures Buying and selling Fee-regulated futures markets, these proposals make sure that solely sufficiently mature tokens qualify, whereas nonetheless increasing investor alternative.

Critics generally body ETFs as a manner of financializing crypto. The truth, nevertheless, is that ETFs supply exactly the sort of transparency, custody safeguards and surveillance mechanisms regulators have lengthy demanded. Wrapping digital belongings in an ETF construction means higher disclosures, standardized creation and redemption processes, and oversight from regulated exchanges. That may be a safer, extra clear manner for traders to achieve publicity than offshore exchanges or unregulated platforms.

The US has fallen behind in crypto regulatory readability. The EU’s Markets in Crypto-Property framework, Hong Kong’s licensing regime and Singapore’s capital markets strategy all present extra predictable paths for digital asset merchandise. If the SEC finalizes generic itemizing requirements, it should ship a robust message that the US intends to guide, not lag, in integrating digital belongings into regulated markets.

What comes subsequent

The SEC may subject a choice in September 2025. If authorised, exchanges could possibly listing the primary wave of altcoin ETFs earlier than the top of the yr. That may clear a backlog of practically 100 functions and set the stage for innovation, together with index funds, thematic baskets and even hybrid ETFs that mix crypto with equities or commodities.

Associated: SEC pushes again choices on Reality Social, Solana, XRP crypto ETFs

The SEC has already laid the mandatory groundwork. In August 2025, it authorised in-kind creation and redemption mechanisms for crypto ETFs, aligning them with commodity fund norms and decreasing prices. That call demonstrated an understanding that operational effectivity and investor safety can go hand in hand. Generic itemizing requirements are the logical subsequent step.

It is very important get this proper

Skeptics will argue that crypto doesn’t deserve the identical therapy as conventional belongings. The aim of regulation will not be, nevertheless, to resolve which asset lessons are worthy. It’s to supply clear, constant guidelines that defend traders and guarantee market integrity.

Delaying integration solely perpetuates danger. With out accessible, regulated merchandise, traders chase publicity in much less secure venues, together with exchanges with poor custody safeguards, offshore platforms past US oversight or illiquid personal placements. Against this, ETFs deliver crypto into the regulatory perimeter, the place it may be monitored, disclosed and supervised like another monetary product.

Preserve the US on the forefront of market innovation

Adopting Rule 6c-11 in 2019 remodeled the ETF trade, unlocking innovation and decreasing obstacles for issuers. The identical alternative now exists for crypto. The SEC wouldn’t endorse any specific token or undertaking by approving generic itemizing requirements. It might merely present a predictable framework that enables regulated exchanges and issuers to function clearly.

Crypto will not be going away. The query is whether or not traders will entry it by means of clear, regulated merchandise in US markets or by means of opaque constructions abroad. The SEC’s resolution on generic itemizing requirements will assist decide that reply.

The fee ought to transfer ahead if the US desires to stay the worldwide hub of innovation in capital markets. The time has come to deliver crypto ETFs absolutely into the ETF age.

Opinion by: Margaret Rosenfeld, chief authorized officer of Everstake.

This text is for common info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don’t essentially mirror or symbolize the views and opinions of Cointelegraph.