Grayscale Investments has filed recent paperwork with the US Securities and Change Fee (SEC), looking for to transform its Chainlink Belief into an exchange-traded fund ETF).

The submitting, submitted Sept. 5, would enable the $28.7 million car to commerce on NYSE Arca underneath the ticker GLNK as soon as authorized.

The corporate mentioned the shift is designed to offer traders regulated entry to Chainlink’s worth efficiency with out the necessity to handle or safe the tokens straight.

Basically, Grayscale goals to decrease custody dangers whereas providing publicity via conventional markets by utilizing an ETF construction.

Earlier than the ETF can launch, Grayscale should file a corresponding 19b-4 submission, a procedural step that requires SEC approval.

Grayscale’s Chainlink ETF construction

Grayscale said that its proposed ETF might enable a few of the tokens held within the belief to be staked.

In that state of affairs, the asset administration agency mentioned it could depend on third-party suppliers to maintain tokens in custodian wallets.

The agency emphasised that the fund will use a cash-based creation and redemption mannequin.

Whereas the SEC has not too long ago authorized in-kind requirements for different digital asset ETFs, Grayscale famous that it stays unsure how rapidly market contributors will adapt.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

The corporate additionally indicated that NYSE Arca might finally search regulatory clearance to replace its itemizing guidelines to accommodate in-kind transactions.

In accordance with the submitting, CSC Delaware Belief Firm will function trustee, whereas The Financial institution of New York Mellon will act as each switch agent and administrator. Continental Inventory Switch & Belief Firm will perform because the co-transfer agent, and Coinbase will present prime brokerage and custody providers.

Crypto ETFs

The applying marks one other try by Grayscale to broaden investor entry to cryptocurrencies past Bitcoin and Ethereum.

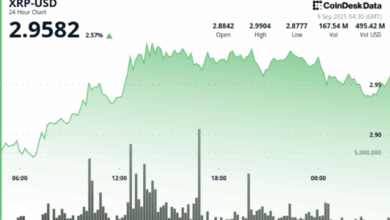

Its present functions already cowl a number of property, together with Solana and XRP, reflecting rising institutional curiosity in altcoins.

Market analysts argue that these functions replicate rising institutional curiosity in altcoins.

Nate Geraci, president of Nova Dius Wealth, identified that main exchanges are collaborating with the SEC on customary frameworks for spot crypto ETF listings.

He mentioned such guidelines could possibly be finalized by October, doubtlessly clearing the way in which for a number of altcoin merchandise to enter the market.