By Omkar Godbole

The bearish sentiment that adopted Friday’s disappointing U.S. nonfarm payroll information shortly ran out of steam over the weekend. That has allowed just a few cash, together with Ethena’s ENA, worldcoin , hyperliquid (HYPE) and dogecoin , to submit spectacular good points within the final 24 hours.

Bitcoin , which dropped under the important thing help degree of $112,000 after the report, now seems to be forming a bullish inverse head-and-shoulders sample, typically a precursor to a powerful rally. BTC’s mining problem hit a brand new excessive and Technique (MSTR) Government Chairman Michael Saylor hinted at further BTC purchases.

On-chain indicators, nonetheless, paint a extra nuanced image for the biggest cryptocurrency: The proportion of illiquid provide has surged to document highs, signaling holder conviction. But, as CryptoQuant factors out, whales are offloading cash on the quickest tempo since 2022.

In the meantime, a vigorous debate unfolded on X concerning the well being of the Ethereum blockchain. One observer pointed to August’s income of $39.2 million, the fourth-lowest since 2021, proclaiming, “Ethereum is dying.”

In response, Tom Dunleavy, a senior analysis analyst at Messari, pushed again strongly, noting that Ethereum and Solana are thriving by way of whole worth locked (TVL), energetic addresses, transaction quantity, software income and stablecoin exercise. He emphasised that income alone is a deceptive metric for blockchain networks, because it contradicts their basic objective of enabling low-friction, decentralized monetary exercise and will finally hinder ecosystem progress.

Ethena’s governance token, ENA, surged to three-week highs after StablecoinX, a treasury firm linked to an artificial greenback issuer planning a Nasdaq itemizing, raised $530 million saying it meant to purchase the tokens. The protocol’s sturdy fundamentals, highlighted by seven-day revenues of $53 million — greater than double these of Hyperliquid — mixed with anticipated advantages from StablecoinX’s Nasdaq itemizing and potential Federal Reserve interest-rate cuts, place ENA as a compelling funding alternative, in line with pseudonymous observer Crypto Stream.

Talking of Hyperliquid, the layer-1 blockchain and decentralized change’s plans to launch its personal USDH stablecoin sparked a governance battle, with the group going through backlash over a proposal tied to Stripe’s Bridge platform’s centralized affect.

On the macro entrance, the yen held regular in opposition to the greenback, shrugging off Prime Minister Shigeru Ishiba’s resignation. France, in the meantime, appeared headed towards authorities collapse.

Within the U.S., the Bureau of Labor Statistics (BLS) will launch annual benchmark revisions on Tuesday, that are anticipated to indicate considerably weaker job progress earlier within the 12 months, with some surveys suggesting that between 500,000 and 1 million jobs may very well be revised away. Keep alert!

What to Watch

- Crypto

- Sept. 9: Shares of SOL Methods (HODL), a Canadian firm centered on investing in and offering infrastructure for Solana’s ecosystem, are anticipated to begin buying and selling on the Nasdaq World Choose Market beneath the ticker image STKE. OTCQB buying and selling as CYFRF will finish, and shares will proceed on the Canadian Securities Alternate as HODL.

- Sept. 10, 9:15 a.m.: Comptroller of the Forex Jonathan V. Gould will speak about digital belongings on the CoinDesk: Coverage & Regulation Convention in Washington.

- Macro

- Sept. 9, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases August shopper value inflation information.

- Core Inflation Charge MoM Prev. 0.31%

- Core Inflation Charge Prev. 4.23%

- Inflation Charge MoM Prev. 0.27%

- Inflation Charge YoY Prev. 3.51%

- Sept. 9, 10 a.m.: The U.S. Bureau of Labor Statistics releases preliminary annual benchmark revision to employment information.

- Nonfarm Payrolls Annual Revision Prev. -818K

- Sept. 10, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases August shopper value inflation information.

- Inflation Charge MoM Prev. 026%

- Inflation Charge YoY Prev. 5.23%

- Sept. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases August producer value inflation information.

- Core PPI MoM Est. 0.3% vs. Prev. 0.9%

- Core PPI YoY Prev. 3.7%

- PPI MoM Est. 0.3% vs. Prev. 0.9%

- PPI YoY Prev. 3.3%

- Sept. 9, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases August shopper value inflation information.

- Earnings (Estimates primarily based on FactSet information)

- Sept. 9: GameStop (GME), post-market, $0.19

Token Occasions

- Governance votes & calls

- Lido DAO is voting on a proposal emigrate Nethermind’s ~7,000 Ethereum validators to infrastructure operated by Twinstake, a staking supplier co-founded by Nethermind. Voting ends Sept. 8.

- Uniswap DAO is voting to ascertain “DUNI,” a Wyoming DUNA as its authorized entity, preserving decentralized governance whereas enabling off-chain operations and legal responsibility protections, with $16.5M in UNI for authorized/tax budgets and $75K UNI for compliance. Voting ends Sept. 8.

- Uniswap DAO is voting on an up to date Unichain-USDS Progress Plan to speed up adoption via performance-based incentives and DAO-guided distribution. The proposal introduces minimal KPIs, a “no outcome, no reward” mannequin. Voting ends Sept. 9.

- Hyperliquid to vote on who points its USDH stablecoin. Main contenders embody Paxos, Frax and a coalition involving Agora and MoonPay. Voting takes place Sept. 14.

- Unlocks

- Sept. 9: Sonic (S) to unlock 5.02% of its circulating provide value $46.02 million.

- Sept. 11: Aptos to unlock 2.2% of its circulating provide value $48.86 million.

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating provide value $15.66 million.

- Sept. 15: Sei to unlock 1.18% of its circulating provide value $16.01 million.

- Sept. 16: Arbitrum to unlock 2.03% of its circulating provide value $46.05 million.

- Token Launches

- Sept. 8: Openledger (OPEN) to be listed on Binance Alpha, MEXC and others.

- Sept. 8: OlaXBT (AIO) to be listed on Binance Alpha and others.

Conferences

The CoinDesk Coverage & Regulation Convention (previously referred to as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that permits common counsels, compliance officers and regulatory executives to fulfill with public officers answerable for crypto laws and regulatory oversight. House is proscribed. Use code CDB15 for 15% off your registration.

Token Speak

By Oliver Knight

- Memecoins are displaying recent indicators of life after months within the doldrums, with a number of fashionable tokens posting good points on Monday. The rally comes regardless of lingering skepticism following a string of celebrity-linked launches that flamed out earlier this 12 months.

- Bonk , a Solana-based, dog-themed token, led the cost with a virtually 7% each day acquire. Dogecoin , the unique memecoin, additionally climbed greater than 7%, reaching $0.2335, whereas newer entrants like spx6900 and pump.enjoyable (PUMP) every outperformed the broader altcoin market.

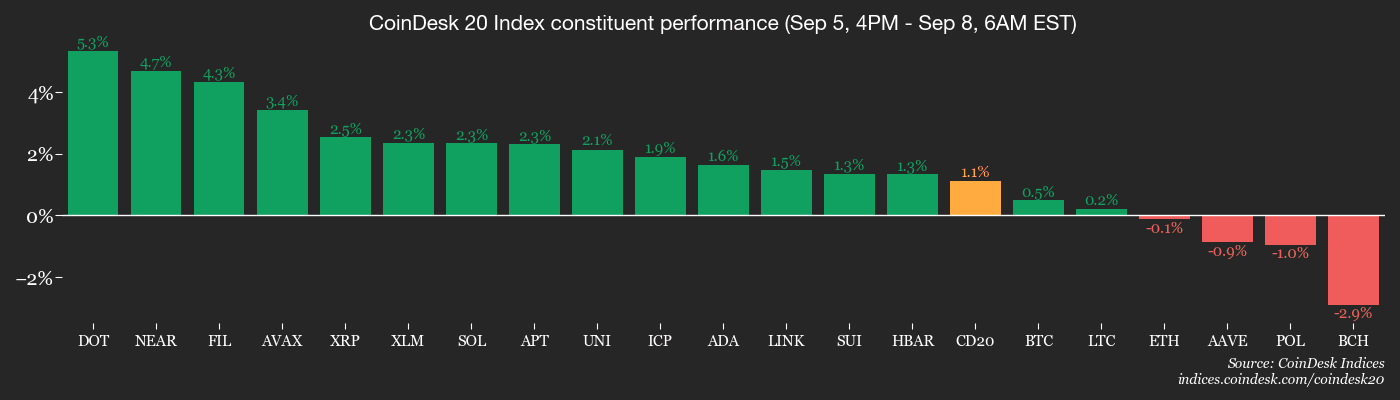

- The CoinDesk Meme Index (CDMEME) has gained 2.20% previously 24 hours, outpacing the broad market CoinDesk 20 Index measure, which added 1.27%.

- Different speculative belongings, together with the irreverently named fartcoin (FARTCOIN), additionally discovered consumers, including to the sense of momentum throughout the sector. The rally suggests renewed urge for food amongst retail merchants for high-risk, high-reward bets after weeks of sideways motion within the broader crypto market.

- The rally marks a pointy turnaround for the sector, which has been depressed for months. A sequence of celebrity-driven launches, together with TRUMP and MELANIA cash, drew headlines in latest months however shortly collapsed beneath the burden of poor liquidity, questionable tokenomics, and investor fatigue.

- Layer-1 blockchain MemeCore (M), which is designed to cater to the memecoin sector, ignited the fuse final week, climbing 164% over a seven day interval.

- The broader crypto market cap is up 0.57% to $3.84 trillion as majors bitcoin and ether (ETH) started to raise themselves away from a vital degree of help, suggesting renewed energy for the altcoin and memecoin markets consequently.

Derivatives Positioning

By Omkar Godbole

- DOGE, SUI and HYPE have seen double-digit good points in futures open curiosity over the past 24 hours, considerably outpacing different high cryptocurrencies.

- Dogecoin OI surged to 16.88 billion DOGE, the best since July 31, validating the 7.5% surge within the cryptocurrency’s value. The token has damaged out of a descending trendline characterizing the sample of decrease highs since mid-July.

- BTC’s OI in USDT and USD-denominated perpetuals on main exchanges continues to hover within the latest vary of 270K-290K BTC. A rise above 290K could also be a harbinger of renewed value volatility.

- On the CME, BTC’s normal futures OI stays at April lows whereas the ETH futures OI has pulled again to 1.87 million ETH from the document excessive of two.2 million ETH, indicating capital outflows.

- On Deribit, XRP and SOL calls commerce at a premium to places throughout all tenors, indicating a bullish bias. In the meantime, BTC and ETH choices sign lingering draw back issues.

Market Actions

- BTC is up 0.39% from 4 p.m. ET Friday at $112,087.64 (24hrs: +0.8%)

- ETH is up 0.26% at $4,328.09 (24hrs: +0.54%)

- CoinDesk 20 is up 1.25% at 4,079.43 (24hrs: +1.92%)

- Ether CESR Composite Staking Charge is down 9 bps at 2.81%

- BTC funding price is at 0.0091% (9.9634% annualized) on Binance

- DXY is unchanged at 97.73

- Gold futures are unchanged at $3,651.60

- Silver futures are up 0.66% at $41.83

- Nikkei 225 closed up 1.45% at 43,643.81

- Grasp Seng closed up 0.85% at 25,633.91

- FTSE is up 0.10% at 9,217.42

- Euro Stoxx 50 is up 0.49% at 5,344.27

- DJIA closed on Friday down 0.48% at 45,400.86

- S&P 500 closed down 0.32% at 6,481.50

- Nasdaq Composite closed unchanged at 21,700.39

- S&P/TSX Composite closed up 0.47% at 29,050.63

- S&P 40 Latin America closed up 1.14% at 2,801.75

- U.S. 10-12 months Treasury price is unchanged at 4.086%

- E-mini S&P 500 futures are up 0.19% at 6,502.25

- E-mini Nasdaq-100 futures are up 0.34% at 23,764.75

- E-mini Dow Jones Industrial Common Index are up 0.11% at 45,510.00

Bitcoin Stats

- BTC Dominance: 58.47% (unchanged)

- Ether-bitcoin ratio: 0.03853 (-0.56%)

- Hashrate (seven-day shifting common): 973 EH/s

- Hashprice (spot): $51.88

- Complete charges: 3.23 BTC / $358,958

- CME Futures Open Curiosity: 134,065 BTC

- BTC priced in gold: 30.8 oz.

- BTC vs gold market cap: 8.72%

Technical Evaluation

- DOGE’s two-day value rise has taken it previous the trendline characterizing the decline from July 21’s excessive of 28.7 cents.

- Costs now look to be crossing into bullish territory above the Ichimoku cloud, a extensively tracked momentum indicator.

- That may shift the main focus to 25.58 cents, the Aug. 14 excessive.

Crypto Equities

- Coinbase World (COIN): closed on Friday at $299.07 (-2.52%), +0.81% at $301.50 in pre-market

- Circle (CRCL): closed at $114.56 (-2.49%), +0.7% at $115.35

- Galaxy Digital (GLXY): closed at $23.49 (+2.53%), -0.38% at $23.40

- Bullish (BLSH): closed at $52.35 (+6.81%), -0.78% at $51.98

- MARA Holdings (MARA): closed at $15.19 (+0.53%), +0.33% at $15.24

- Riot Platforms (RIOT): closed at $13.29 (+0.99%), +0.3% at $13.33

- Core Scientific (CORZ): closed at $13.62 (0%), +1.32% at $13.80

- CleanSpark (CLSK): closed at $9.24 (+1.76%), +0.54% at $9.29

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.45 (+0.96%)

- Exodus Motion (EXOD): closed at $24.03 (-1.15%)

Crypto Treasury Corporations

- Technique (MSTR): closed at $335.87 (+2.53%), -2.02% at $329.10

- Semler Scientific (SMLR): closed at $28.12 (+0.11%)

- SharpLink Gaming (SBET): closed at $14.94 (-3.21%), -0.37% at $14.88

- Upexi (UPXI): closed at $6.04 (-4.58%), +2.65% at $6.20

- Mei Pharma (MEIP): closed at $4.23 (-0.94%), -20.33% at $3.37

ETF Flows

Spot BTC ETFs

- Day by day web flows: -$160.1 million

- Cumulative web flows: $54.47 billion

- Complete BTC holdings ~1.29 million

Spot ETH ETFs

- Day by day web flows: -$446.8 million

- Cumulative web flows: $12.74 billion

- Complete ETH holdings ~6.42 million

Supply: Farside Buyers

Chart of the Day

- The chart reveals that firms have considerably slowed their purchases of BTC in latest months.

- In August, Technique and different corporations cumulatively added 3,700 BTC to their stash, down from 134,000 BTC in November final 12 months.

- The slowdown in shopping for helps clarify BTC’s stalled value rally.

Whereas You Have been Sleeping

- EasyJet Founder Provides Crypto Buying and selling to His Reduce-Worth Empire (Bloomberg): Stelios Haji-Ioannou will launch easyBitcoin this month with Uphold, saying President Trump’s election pushed crypto into the mainstream and promising lower-cost bitcoin and ether buying and selling beneath his increasing “simple” model.

- Hyperliquid Faces Neighborhood Pushback Towards Stripe-Linked USDH Proposal (CoinDesk): Hyperliquid’s plan to interchange USDC with a local stablecoin has drawn bids from Stripe, Paxos, Frax and an Agora–MoonPay coalition, with validators set to decide on the USDH issuer Sept. 14.

- Crypto Alternate HashKey Plans $500M Digital Asset Treasury Fund (CoinDesk): The Hong Kong–primarily based change is launching a $500 million fund concentrating on digital asset treasury initiatives, beginning with bitcoin and ether, to construct an institutional bridge between conventional monetary capital and on-chain belongings.

- Russia Unleashes Largest Drone Assault of Conflict, Setting Authorities Constructing Ablaze (The New York Instances): 805 drones and 13 missiles reached Ukraine on Sunday, with 60 drones and 9 missiles getting via. Particles from a downed drone set Kyiv’s Cupboard of Ministers constructing on hearth.

- Japanese Lawmakers Launch Management Bids After PM Resigns, Yen Sinks (Reuters): Japan’s ruling celebration will select a brand new chief Oct. 4 after Shigeru Ishiba’s Sunday resignation, fueling expectations of looser fiscal coverage and a delay to Financial institution of Japan price hikes.

- Javier Milei Suffers Stinging Setback in Buenos Aires Polls (Monetary Instances): A Peronist coalition beat Javier Milei’s grouping in Argentina’s largest province as voter anger over hovering residing prices and a corruption scandal tied to his sister Karina eroded his help earlier than October’s congressional midterms.

Within the Ether