Key takeaways:

-

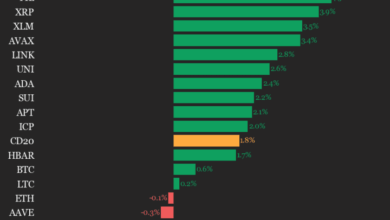

Lengthy-term Bitcoin holders offered 241,000 BTC over the previous 30 days.

-

BTC worth bear flag targets $95,500.

Bitcoin (BTC) long-term holders have offered greater than 241,000 BTC over the previous month. Continued promoting may ship the worth towards $95,000 or decrease, based on analysts.

Bitcoin long-term holders promote $26 billion price of BTC

Bitcoin long-term holders (LTHs) — entities holding cash for no less than six months — have began to dump cash as BTC worth hit new all-time highs above $124,500 in August.

Associated: Bitcoin faucets $111.3K as forecast says 10% dip ‘worst case state of affairs’

Analyzing the LTH provide change, CryptoQuant analyst Maartunn stated that on a rolling 30-day foundation, the provision had decreased by a internet 241,000 BTC, price round $26.8 billion at present market costs as of Monday. He added:

“That’s one of many largest drawdowns since early 2025.”

This will likely proceed to strain Bitcoin’s worth within the coming weeks, significantly when coupled with whales, who’ve offloaded greater than 115,000 BTC over the identical interval.

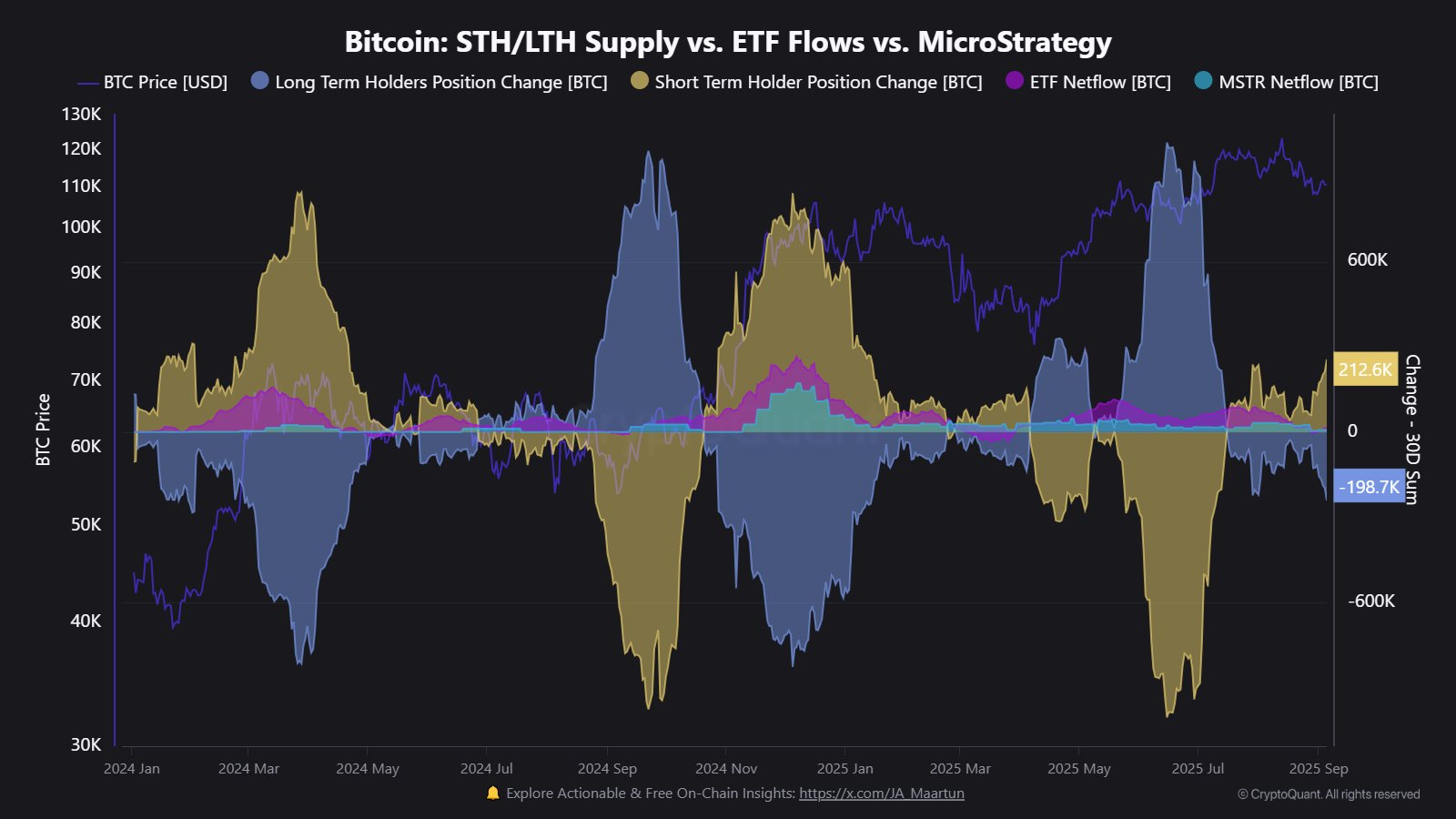

In the meantime, regardless of the overall holdings of Bitcoin Treasury Firms reaching a report excessive of 1 million BTC, progress has slowed sharply over the previous month.

Technique’s month-to-month buys collapsed from over 134,000 BTC in Nov 2024 to only 3,700 BTC in Aug 2025, based on knowledge from CryptoQuant.

Different Treasury Firms bought 14,800 BTC in August, in comparison with their record-high buy of 66,000 Bitcoin June 2025.

“August purchases additionally fell under the 2025 month-to-month averages, 26K BTC for Technique and 24K BTC for different corporations,” the onchain analytics agency stated in its newest Weekly Crypto Report, including:

“Smaller, cautious transactions present institutional demand is weakening.”

Capriole Investments founder Charles Edwards additionally factors out that the speed of firms buying Bitcoin per day continues to fall, an indication that establishments may very well be “exhausted.”

Treasury Firm demand continues to break down. The businesses are nonetheless staunchly shopping for, however the price of firms buying per day continues to fall. Are establishments exhausted, or is it only a dip? pic.twitter.com/3ItN1tVIaU

— Charles Edwards (@caprioleio) September 7, 2025

The decreased shopping for from treasury firms additional weakens demand, exacerbating the downward pattern.

Bitcoin worth bear flag targets $95,000

Bitcoin dropped 14% from its $124,500 report excessive reached on Aug. 16 to a seven-week low of $107,500 on Aug. 30, knowledge from Cointelegraph Markets Professional and TradingView exhibits.

The value has since recovered to the present ranges round $111,500.

This worth motion has printed a bear flag on the each day chart, as proven under. Bitcoin dropped under the flag on Saturday and is now retesting the decrease boundary of the flag at $112,000 (100-day SMA).

Failure to flip $112,000 into assist would set off the continuation of the downtrend towards the measured goal of the bear flat at $95,500, or a 14.5% drop from the present worth.

Nonetheless, the macro image appears a lot more healthy, because the 13% pullback from all-time is way shallower than earlier pullbacks, based on X person Coin Indicators.

As Cointelegraph reported, the newest predictions now embody Bitcoin presumably dropping under $90,000, whereas nonetheless on observe for brand new all-time highs.

Be aware {that a} 30% drawdown from the present all-time highs locations the BTC worth backside at $87,000, which aligns with the realized worth of 6-12 months holders.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.