Bitcoin (BTC) begins the second week of September dealing with essential resistance as merchants keep draw back targets.

-

Bitcoin worth motion coils beneath $112,000 over the weekend, however fears of a ten% correction or worse are mounting.

-

CPI week is right here once more, and markets are questioning how giant subsequent week’s Federal Reserve interest-rate reduce will likely be.

-

Information is beginning to trace that the institutional “rotation” from BTC to Ether exchange-traded merchandise is over.

-

Bitcoin whales convey again the 2022 bear market with mass promoting over the previous month.

-

Binance is within the highlight over a possible BTC worth prime warning from market takers.

BTC worth worries embrace sub-$100,000

Bitcoin managed to keep away from volatility round its newest weekly shut, knowledge from Cointelegraph Markets Professional and TradingView reveals.

$112,000 stays a key goal amongst merchants hoping for a resistance/assist flip.

Analyzing trade order-book liquidity, widespread dealer CrypNuevo flagged $106,700 as an essential degree to the draw back.

“If the earlier vary lows proceed to be resistance, worth will try and hit the liquidation at $106.7k,” he wrote in a part of a thread on X Sunday.

As Cointelegraph reported, consideration is now centered on how low BTC/USD might drop in a possible capitulation occasion.

$100,000 is a favourite line within the sand, with Fibonacci retracement ranges now confluent with a retest of that degree as a “worst case situation.”

Telegram analytics channel Coin Alerts, in the meantime, contributed one other, extra regarding backside goal of 30% versus Bitcoin’s newest all-time highs.

“Based mostly on cycle’s default correction % and time taken to hit lows from an area prime, BTC might see a -30% correction from native prime $124k, Bottoming within the final week of SEP or first week of OCT,” a part of an X submit acknowledged.

Such a situation would put BTC/USD at round $87,000.

CPI week comes with Fed behind the curve

Some traditional US financial knowledge prints are due this week — at a time when markets are already satisfied about what lies forward.

The Producer Worth Index (PPI) and Shopper Worth Index (CPI) will likely be launched on Wednesday and Thursday, respectively.

Inflation is on the rise, whereas indicators of labor-market weak spot are rising — a headache for the Federal Reserve, however one which markets imagine they already know the response to.

Information from CME Group’s FedWatch Device reveals that the chances of the Fed chopping rates of interest at its September assembly subsequent week are totally priced in. There’s even a fledgling likelihood of the reduce being bigger than the minimal 0.25%.

This comes amid rising criticism of Fed coverage, which has saved charges regular all through 2025 whereas different central banks reduce.

“The European Central Financial institution and the Financial institution of England have cuts charges 4 and three instances this yr, respectively. The Financial institution of Canada has reduce charges 2 instances, as has the Swiss Nationwide Financial institution, which grew to become the primary main central financial institution to convey charges again to 0%,” buying and selling useful resource The Kobeissi Letter famous on X Monday.

“In the meantime, the Federal Reserve stays on maintain with 0 charge cuts in 2025. US financial coverage is in its personal world.”

Recession fears are additionally swirling, with Kobeissi reporting on a dip in development spending — one thing it describes as a “key recession sign.”

“Whereas seasonal developments level to weak spot forward, the longer-term path for the S&P 500 will come right down to the financial system as soon as the Fed begins chopping charges once more,” buying and selling agency Mosaic Asset Firm continued within the newest version of its common updates collection, “The Market Mosaic.”

Mosaic defined that the US must keep away from recession to gasoline shares, which, along with gold, are at present gaining whereas Bitcoin lags behind.

“Over the long term, inventory costs in the end comply with earnings which is why the financial outlook is crucial,” it harassed.

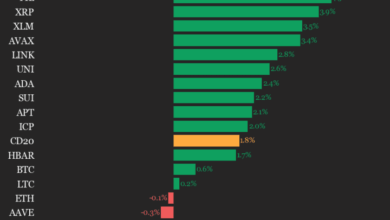

Establishments “re-rotating” into Bitcoin

Buzz round an institutional capital “rotation” from Bitcoin into the most important altcoin Ether (ETH) already seems to be cooling.

🚨 LATEST: US spot ETH ETFs noticed its largest weekly outflows final week with $787.7M whereas BTC ETFs noticed a complete weekly inflows of $246.4M. pic.twitter.com/jWe4Ach9KJ

— Cointelegraph (@Cointelegraph) September 8, 2025

Final week, inflows to BTC-denominated exchange-traded merchandise (ETPs) led to constructive territory, sharply contrasting with ETH equivalents.

Figures uploaded to X Monday by Andre Dragosch, European head of analysis at crypto asset supervisor Bitwise, present Bitcoin ETPs added $444 million within the 5 days via Sept. 5.

In the identical interval, Ether ETPs noticed web outflows of over $900 million.

“Attention-grabbing to see a renewed ‘re-rotation’ from $ETH again to $BTC when it comes to world ETP flows final week,” Dragosch commented.

In the meantime, the US spot Bitcoin exchange-traded funds (ETFs) ended the four-day buying and selling week up round $250 million.

Information from UK funding agency Farside Traders captured 4 straight days of web outflows for spot Ether ETFs, totaling greater than $750 million.

Bitcoin bear whales are again

With regards to the most important Bitcoin traders, the development is giving onchain analytics platform CryptoQuant trigger for concern.

Whales are decreasing their BTC publicity, and up to date market distribution rivals the final bear market in 2022.

“Within the final thirty days, whale reserves have fallen by greater than 100,000 BTC, signaling intense danger aversion amongst giant traders,” contributor Caue Oliveira wrote in considered one of CryptoQuant’s “Quicktake” weblog posts.

The 30-day whale stability drawdown via the top of final week was the most important since mid-2022. On the time, BTC/USD was round midway via its most up-to-date bear market, which bottomed out in November that yr at $15,600.

“Right now, we’re nonetheless seeing these reductions within the portfolios of main gamers, which can proceed to stress Bitcoin within the coming weeks,” Oliveira added.

As Cointelegraph reported, shifts in whale habits have had a noticeable impression on short-term worth motion as giant chunks of liquidity come and go from trade order books.

Taker Purchase/Promote Ratio raises alarm

The Bitcoin futures market on the most important world trade, Binance, is underneath scrutiny as liquidity tails off throughout perp markets.

Associated: Bitcoin could sink ‘beneath $50K’ in bear, Justin Solar’s WLFI saga: Hodler’s Digest, Aug. 31 – Sept. 6

New analysis from CryptoQuant this week flags a traditional sign comparable to bull market corrections.

The Taker Purchase/Promote Ratio, which is the ratio of purchase quantity divided by taker promote quantity, is at present making decrease lows whereas the value itself expands.

“Bullish divergence of the Taker Purchase/Promote Ratio has repeatedly occurred throughout the worth backside or sideways consolidation phases of this Bitcoin bull cycle, which has been ongoing since 2023,” contributor Mignolet summarized in one other “Quicktake” submit.

Mignolet notes that such habits was attribute of the market peak throughout the 2021 bull run. Quantity this time, nevertheless, is completely different due to the presence of institutional exercise.

The state of affairs might nonetheless develop into precarious if the development continues.

“To be blunt, all liquidity is weakening,” the submit concludes.

“If this liquidity recovers, the market possible is not over but. Nevertheless, if liquidity would not get better regardless of quite a few constructive catalysts, the state of affairs might develop into critical.”

Binance Bitcoin futures have traded since 2019, and since then have seen “colossal” volumes of over $700 trillion.

“This staggering quantity surpasses the estimated worth of the worldwide actual property market and is 5 instances bigger than the mixed capitalization of worldwide equities or bonds,” CryptoQuant contributor Darkfost famous Sunday.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.