Bitcoin traded simply over $111,000 on Monday, sustaining its vary from the previous week, at the same time as merchants proceed to evaluate macro indicators for cues on crypto market positioning.

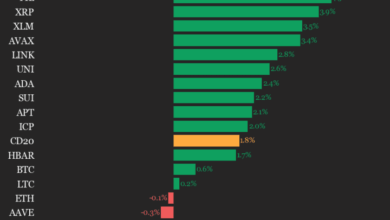

Ether (ETH) traded round $4,293, XRP rose 2.5% to $2.90, Solana’s SOL added 2.6% to $208, and dogecoin outperformed with a 7% soar to 23 cents. Market capitalization throughout majors rose modestly, although volumes stay lighter than August peaks.

Trying to find a catalyst

Merchants proceed to observe U.S. information prints for any upcoming catalysts for the digital belongings market, with producer and shopper inflation experiences due midweek.

“Cryptocurrencies have been buying and selling at a subdued stage because the Fed is conflicted over slicing charges within the midst of inflation that has stubbornly refused to go away,” stated Jeff Mei, COO at BTSE.

“Increased than anticipated numbers would trigger Bitcoin and Ethereum to say no, whereas decrease numbers might trigger a rally.”

The macro information is extra related now for merchants, on condition that flows in spot bitcoin ETFs have cooled. With sub-$100 million day by day inflows in contrast with summer time’s run-up, the market is reliant on macro catalysts.

A brand new BTC purchaser

Company adoption tales, nevertheless, are including a brand new layer.

Johannesburg-based Altvest Capital introduced Monday that it’s going to elevate $210 million to buy bitcoin and rebrand as Africa Bitcoin Corp., turning into the primary listed African agency to include BTC as a core treasury asset.

CEO Warren Wheatley stated the plan permits pension funds and unit trusts that can’t instantly maintain bitcoin to realize regulated publicity by way of fairness.

Altvest’s market cap sits close to $3 million, making the dimensions modest; nevertheless, the technique mimics that of Japan’s Metaplanet and U.S. agency MicroStrategy, which make the most of fairness issuance to fund long-term bitcoin reserves. Bitcoin has practically doubled over the previous yr, validating the strategy for smaller corporations looking for to faucet fairness buyers to build up crypto.

Japan’s macro danger

In the meantime, Japanese authorities bonds added recent macro uncertainty.

Prime Minister Shigeru Ishiba’s resignation triggered a selloff in long-dated paper, with 30-year yields touching 3.285% and curve steepening to ranges unseen in different main markets.

Japan’s shifting market might impression the yen, which tends to affect bitcoin and crypto costs given its positioning as a secure macro hedge.

Intervals of relative stability have typically preceded giant directional strikes, with merchants break up on whether or not $111,000 will maintain as a flooring into September — traditionally the weakest month of the yr for the market.

For now, the market appears to be in a little bit of a limbo because the break up display screen defines the commerce.

Bitcoin is supported by treasury adoption in Africa and regular ETF flows within the U.S., whereas macro headwinds from Japan to Washington maintain volatility shut at hand. This leaves the week’s US inflation information to resolve which narrative drives the following leg.