HBAR Maintains Regular Features Amid Institutional Help

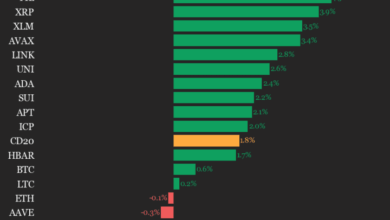

Hedera’s HBAR token posted regular features in a 23-hour buying and selling stretch from September 7 at 09:00 by September 8 at 08:00, buying and selling inside a decent $0.0042 band. Value motion mirrored simply 2% volatility between key $0.22 help and resistance ranges, underscoring a interval of relative stability for the enterprise-focused digital asset.

Institutional Liquidity Surge Anchors Value

Market information confirmed a notable uptick in institutional participation in the course of the September 7 afternoon session. Buying and selling volumes spiked to 67.40 million items at 14:00—effectively above the 24-hour common of 27.33 million—as patrons stepped in to offer liquidity on the $0.22 stage. That intervention helped anchor the token’s value after a quick dip in the course of the 18:00 hour.

Company Curiosity Drives Renewed Momentum

Contemporary company exercise emerged within the early hours of September 8, with renewed demand evident from 02:00 onward. HBAR closed the interval at $0.22, marking a modest 1% advance. Analysts recommend the sample highlights rising confidence amongst enterprise adopters of distributed ledger expertise, with Hedera positioning itself as a number one resolution for company blockchain purposes.

Buying and selling Sample Evaluation

- HBAR established technical help at $0.22 following an preliminary advance to the identical stage at 07:28, with subsequent value consolidation forming an upward trending channel.

- The token maintained constant institutional shopping for curiosity above 600,000 items throughout a number of buying and selling intervals in the course of the one-hour evaluation window.

- A breakout above $0.22 resistance occurred within the last buying and selling minutes, suggesting continued institutional accumulation and potential for additional value appreciation.

- Peak quantity exercise reached 3.23 million items at 07:35, reflecting heightened institutional participation and market liquidity.

- The $0.0042 buying and selling vary represented 2% intraday volatility, demonstrating comparatively secure value motion regardless of broader market uncertainties.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.