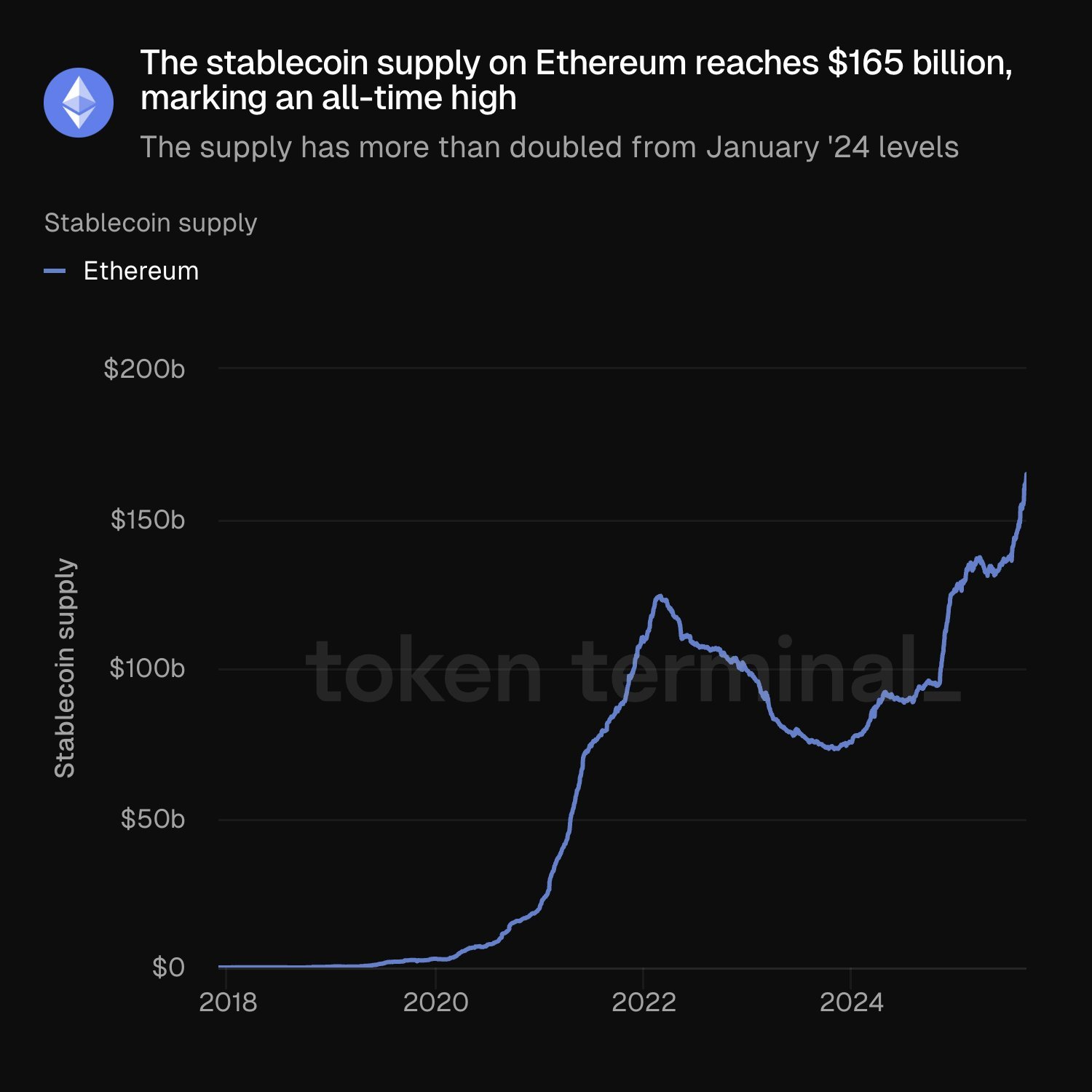

Ethereum added round $5 billion in new stablecoins over the previous week, pushing the full provide of stablecoins on the community to an all-time excessive.

The stablecoin provide on Ethereum has greater than doubled since January 2024 and has reached an all-time excessive of $165 billion, Token Terminal reported on Sunday.

Figures range barely relying on the info supplier, as RWA.xyz experiences a complete of $158.5 billion in Ethereum-based stablecoins, which can also be an all-time excessive, giving the community a commanding market share of 57%.

Ethereum has been the community of selection for stablecoins. Its subsequent closest competitor, Tron, has a market share of 27%, whereas Solana, in third place, has lower than 4%.

Tokenized gold on Ethereum surges

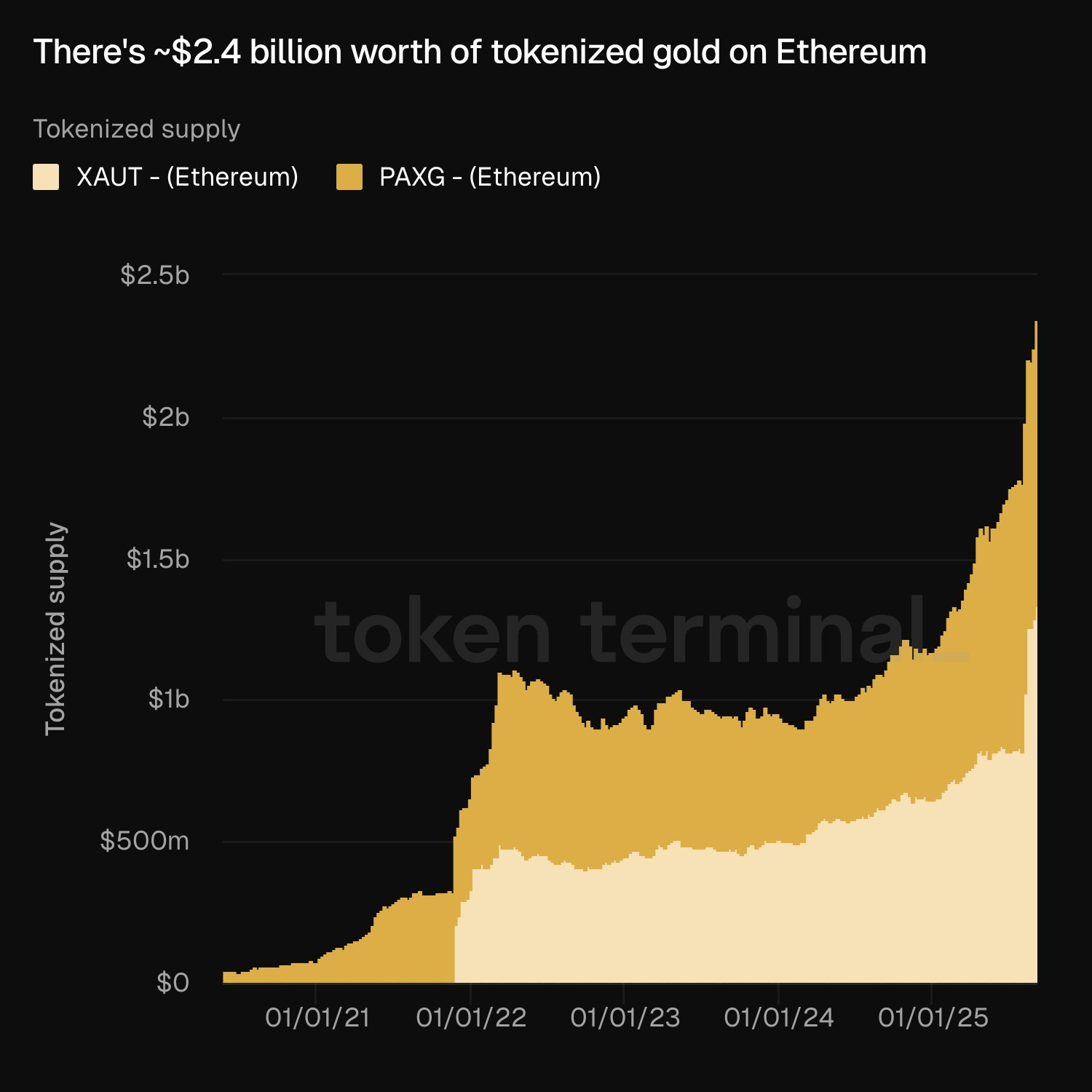

Stablecoins aren’t the one monetary devices tokenized on Ethereum, because the community has additionally seen an all-time excessive within the quantity of tokenized gold.

There may be presently round $2.4 billion value of tokenized gold on Ethereum, based on Token Terminal.

Associated: Ether celebration received’t cease as RWAs, TradFi cement it as the perfect institutional play

The tokenized gold provide has doubled year-to-date and is presently at an all-time excessive, it reported on Saturday.

RWA.zyx experiences that Ethereum has a 77% market dominance for tokenized commodities, and an excellent increased 97% share when the layer-2 Polygon community is included.

Ethereum additionally has greater than 70% market share of tokenized US Treasurys, which is the second largest asset to maneuver onto the blockchain behind personal credit score.

Ethereum’s RWA tokenization benefit

This RWA tokenization narrative has pushed Ether (ETH) costs over 200% since April to an all-time excessive just under $5,000 on Aug. 24.

It has additionally been bolstered by the fast accumulation of Ether by treasury firms, which have scooped up nearly 4% of your entire provide in simply 5 months.

Ethereum educator Anthony Sassano mentioned over the weekend that this is because of “credible neutrality,” which is prime to Ethereum.

“The one approach mass adoption of this expertise occurs is thru precise, credibly impartial, and permissionless techniques that aren’t owned by anybody and aren’t affiliated with any single entity.”

New funds tokenized on Ethereum

International monetary establishments are additionally racing to tokenize their merchandise, with many selecting Ethereum.

“Constancy, the third largest asset supervisor on this planet, launched a tokenized US Treasurys fund on Ethereum,” mentioned Sassano on Monday.

The Constancy Digital Curiosity Token (FDIT) seems to have launched onchain on Sept. 1 and presently has $203.6 million in whole asset worth, based on RWA.xyz.

Journal: Bitcoin might sink ‘beneath $50K’ in bear, Justin Solar’s WLFI saga: Hodler’s Digest