XRP jumped sharply in Monday’s session, climbing from $2.83 to $2.88 as a breakout push briefly examined $2.92 on six-fold common quantity. Bulls held agency above $2.86 assist, however repeated rejection at $2.90–$2.92 capped upside momentum. With Fed charge reduce bets close to 100% forward of the September 17 assembly, institutional inflows stay sturdy — leaving the token consolidating just below vital resistance.

Information Background

• Fed charge reduce expectations surged, with futures markets pricing a 99% likelihood of a 25-basis-point reduce on the September 17 FOMC assembly.

• Escalating U.S.-China commerce tensions stoked volatility and pushed danger flows into crypto.

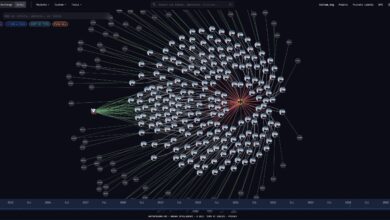

• Market analyst Dom flagged +10M XRP web purchase strain in quarter-hour in the course of the breakout window.

• Technical group cut up: bearish divergence flagged on weekly charts vs. bullish breakout projections towards $4.50 targets.

Value Motion Abstract

• XRP superior 3% within the September 7–8 window, buying and selling a $0.10 vary between $2.83–$2.92.

• Breakout sequence at 14:00 (Sept 7) lifted value from $2.85 to $2.92 on 231.25M quantity — 6x the 24h common.

• Bulls defended $2.86 assist throughout a number of retests.

• Resistance solidified at $2.90–$2.92, the place upside makes an attempt failed.

• Last hour pullback noticed XRP slide 1% from $2.88 to $2.87, with a pointy 2.1M quantity spike at 02:20 capping the rally.

Technical Evaluation

• Buying and selling vary: $0.10 (4% volatility) between $2.83–$2.92.

• Help: $2.86 stays the important thing flooring; repeated protection reveals accumulation.

• Resistance: $2.90–$2.92 has capped rallies throughout a number of checks.

• Indicators: RSI mid-50s = neutral-to-bullish bias.

• MACD histogram converging towards bullish crossover, confirming accumulation development.

• Sample: Descending triangle consolidation underneath $3.00; breakout above $3.30 might prolong targets to $4.00–$4.50.

What Merchants Are Watching

Whether or not XRP can submit sustained closes above $2.90 stays the instant focus. A confirmed break above this resistance might open room towards $3.00–$3.30, whereas repeated failures could reinforce the ceiling and invite renewed promoting strain.

• The Federal Reserve’s September 17 assembly looms massive, with markets pricing near-certainty of a 25-basis-point reduce. Any shock in charge path steerage will instantly have an effect on greenback liquidity, which merchants see as a key driver for near-term crypto flows.

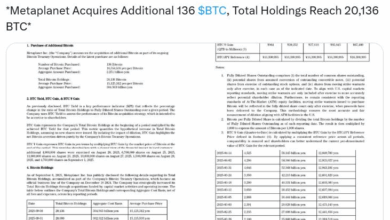

• Whale inflows stay intently tracked, with studies of 340 million XRP amassed in latest weeks. Continued large-scale shopping for might assist the consolidation flooring, whereas a slowdown in accumulation would weaken bullish conviction.

• The SEC’s October rulings on spot XRP ETF functions are the longer-term catalyst. Approval might set off structural inflows from institutional autos, whereas delays or rejections could dampen sentiment and cap momentum across the $3.00 stage.