Dogecoin posted a managed rise inside a decent intraday band, with consumers repeatedly defending the $0.213–$0.214 space and sellers leaning into the $0.220–$0.221 zone. Momentum improved on rebounds the place quantity rose above session norms, however late momentum fades stored worth pinned slightly below resistance into the shut.

Information Background

- No confirmed catalyst headlines drove the transfer. The session was dominated by order-flow dynamics round $0.21 assist and $0.22 resistance.

- Prior references to “all-time highs,” ETF filings, or treasury bulletins had been eliminated as a consequence of lack of verification. This readout focuses strictly on observable worth and quantity habits.

- Broader meme-coin flows had been combined, with rotation evident intraday however no sector-wide breakout confirmed by closing power.

Worth Motion Abstract

- Traded a ~$0.008–$0.010 vary, roughly 3–4% swing, with lows close to $0.213–$0.214 and highs probing $0.220–$0.221.

- The steepest leg decrease got here mid-session towards $0.213, the place shopping for stepped in rapidly, producing a V-style rebound.

- Rebound makes an attempt stalled beneath $0.22, with a number of rejections clustering within the $0.220–$0.221 band.

- Closing hour confirmed fading momentum, leaving worth stabilized slightly below resistance and preserving the intraday higher-low construction.

Technical Evaluation

- Assist: $0.213–$0.214 is the intraday demand zone. A sustained break under exposes $0.210–$0.212 after which $0.205.

- Resistance: $0.220–$0.221 stays the rapid ceiling. Above that, reference ranges sit at $0.224–$0.226 and $0.230.

- Momentum: RSI holding across the mid-50s displays a neutral-to-bullish bias with out overextension.

- MACD: Histogram is converging towards a possible bullish crossover, in step with accumulation on dips relatively than chase shopping for.

- Sample: Ongoing sideways consolidation below $0.22. A clear break and maintain above $0.221 on increasing quantity would affirm continuation; failure retains the chop intact.

- Quantity profile: Reversal bounces printed relative quantity outperformance, whereas assessments into resistance noticed participation fade, signaling the necessity for stronger sponsorship to interrupt by means of.

What Merchants Are Watching

- Can DOGE shut above $0.221 with quantity growth. A decisive every day shut by means of resistance would validate a shift from range-bound commerce to continuation, opening $0.224–$0.226 first, then $0.230. Repeated failures invite mean-reversion again towards $0.214.

- Depth and absorption at $0.213–$0.214. Persistent resting bids and fast reclaim habits assist the bull case. Thinner books or slower rebounds would warn that dip demand is weakening.

- High quality of the breakout if it happens. Merchants will search for larger highs and better lows on intraday frames, shrinking wicks at highs, and rising participation relatively than a single spike that reverses.

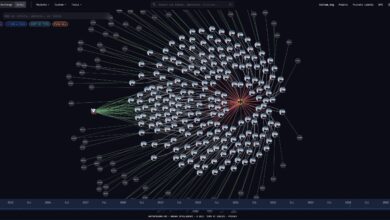

- Derivatives posture. Funding, open curiosity, and long-short skew ought to affirm spot power. Rising OI with steady funding is more healthy than a crowded lengthy construct with premium that invitations squeezes.

- Correlation to BTC and meme-sector breadth. A BTC push by means of close by resistance or broader meme-coin affirmation usually improves follow-through. Divergence would mood upside expectations.